The current review of the cocoa market situation reports on price movements on the international markets during the month of November 2016.

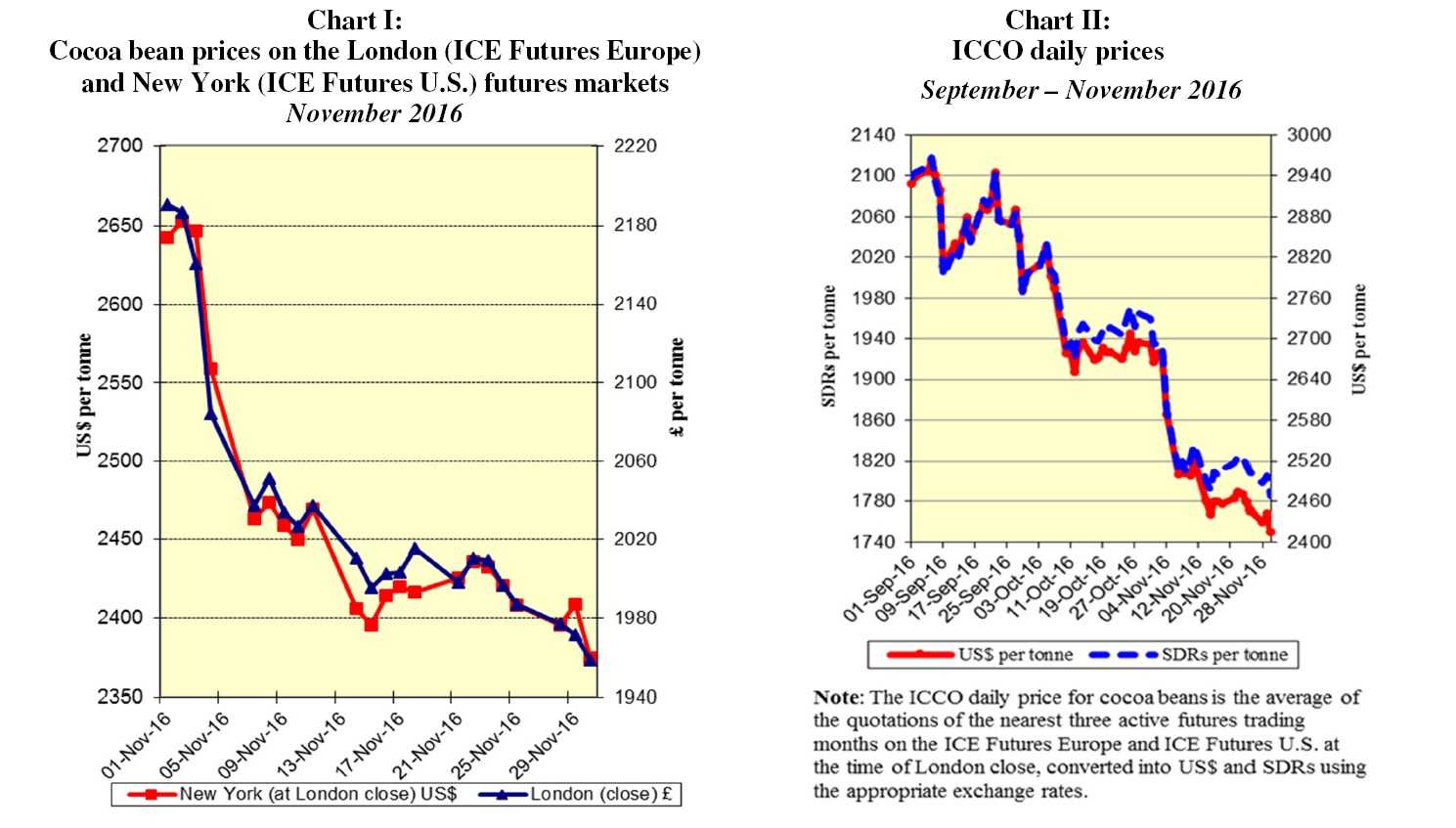

Chart I illustrates price movements on the London (ICE Futures Europe) and New York (ICE Futures US) markets in November.

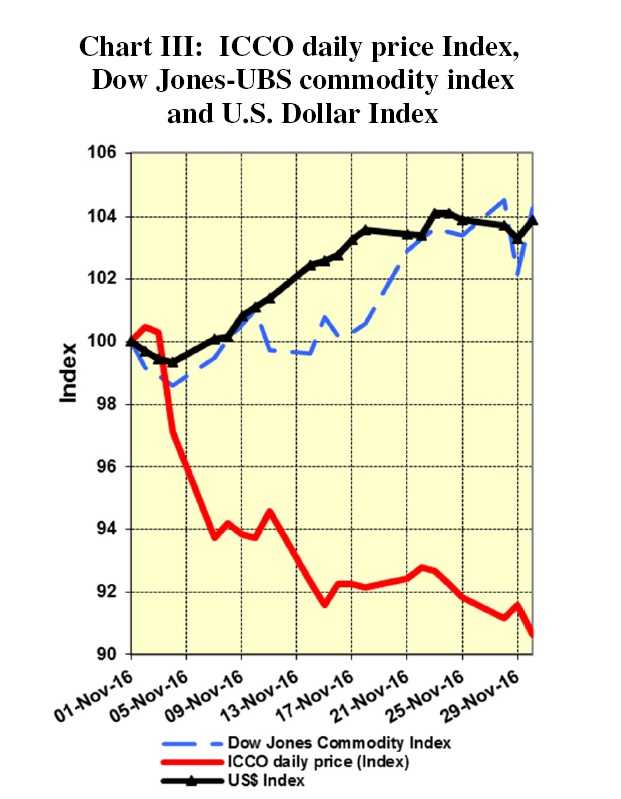

Chart II shows the evolution of the ICCO daily price, quoted in US dollars and in SDRs, from September to November 2016.

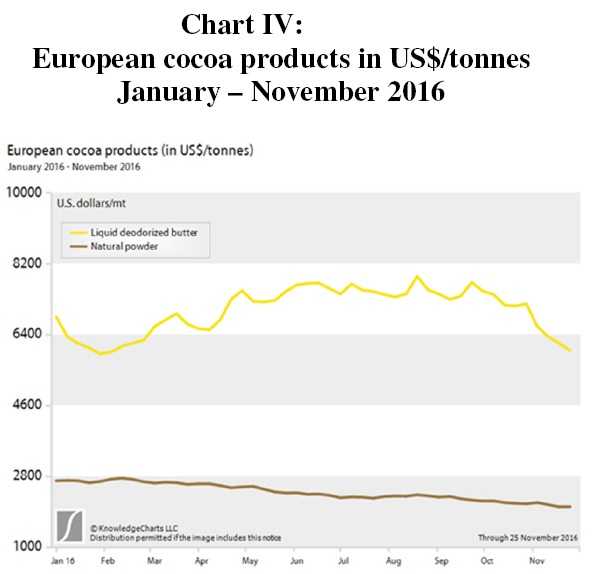

Chart III depicts the change in the ICCO daily price index, the Dow Jones Commodity Index and the US dollar Index during the month under review, while Chart IV presents the prices of European cocoa products since the beginning of the year.

Price movements

Price movements

In November, the ICCO daily price averaged US$2,500 per tonne, down by US$211 compared to the average price recorded in the previous month (US$2,711) and ranged between US$2,416 and US$2,678 per tonne.

The strong cocoa price deterioration, initiated in mid-August, continued during the beginning of the current cocoa season.

This was particularly the case during the month under review, as seen in Chart I.

Quotations hit their highest level of the month, at £2,191 per tonne in London and at US$2,653 per tonne in New York, during the very first trading sessions of November.

Moving ahead, the general market expectation of a production surplus for the ongoing 2016/17 cocoa season—mainly resulting from the prospect of a strong recovery in West African and Latin American production—has been the main factor behind the strong

cocoa price decline.

Thus, cocoa prices plummeted to a more than one-and-a-half year low, at £1,959 per

tonne in London, and to a more-than three-year low at US$2,375 per tonne in New York, losing 20% and 30% respectively from their peak values attained on 7th July 2016 and 7th December 2015.

Improving weekly figures related to port arrivals in Côte d’Ivoire also contributed in setting the bearish tone on both markets.

As seen in Chart III, the broader commodity complex outperformed cocoa futures prices.

Supply and demand situation

According to news agency data, cumulative arrivals since the beginning of the season at ports in Côte d’Ivoire reached around 548,000 tonnes by 4 December, as against 556,000 tonnes recorded during the same period of the previous season.

While cumulative arrivals are, at this point, slightly down, recent weekly arrivals have been

picking up strongly, in the light of very favourable weather conditions during October and the development of themain crop is expected to improve even further.

In Ghana, no new reports on purchases have been made available.

While rainfall levels have decreased in the past weeks, as is normally the case at this time of the season in West Africa, there are not yet any signs of a strong Harmattan on the way.

Indeed, Harmattan usually begins in December, and the last cocoa season reportedly

witnessed the strongest one in three decades, significantly affecting the quality of the main crop, as well as the size of mid-crop.

Market analysts are therefore closely monitoring this factor.

Unlike the drought that negatively affected the previous cocoa season, favourable weather conditions have been beneficial for the ongoing crop in Brazil, and a significant recovery is expected there.

In relation to demand, industry reports indicate that both cocoa butter and powder prices have continued to decrease, as illustrated in Chart IV.

Most market analysts expect butter prices to continue to decline in the coming months, amid a sustained decline in cocoa bean terminal prices.

Most market analysts expect butter prices to continue to decline in the coming months, amid a sustained decline in cocoa bean terminal prices.

The ICCO Secretariat’s revised estimates for the 2015/2016 cocoa year, published in the latest issue of the Quarterly Bulletin of Cocoa Statistics, show that the previous 2015/2016 season recorded a substantial deficit of 150,000 tonnes.

World cocoa bean production had declined by over five per cent (down by 217,000 tonnes) over the previous season, to 4.031 million tonnes while grindings are estimated to have contracted slightly, by 0.3 per cent to 4.141 million tonnes (down by 12,000 tonnes).

Global statistical stocks of cocoa beans, as at the end of the 2015/2016 cocoa year, are estimated at 1.447 million tonnes, equivalent to 34.9% of annual grindings.