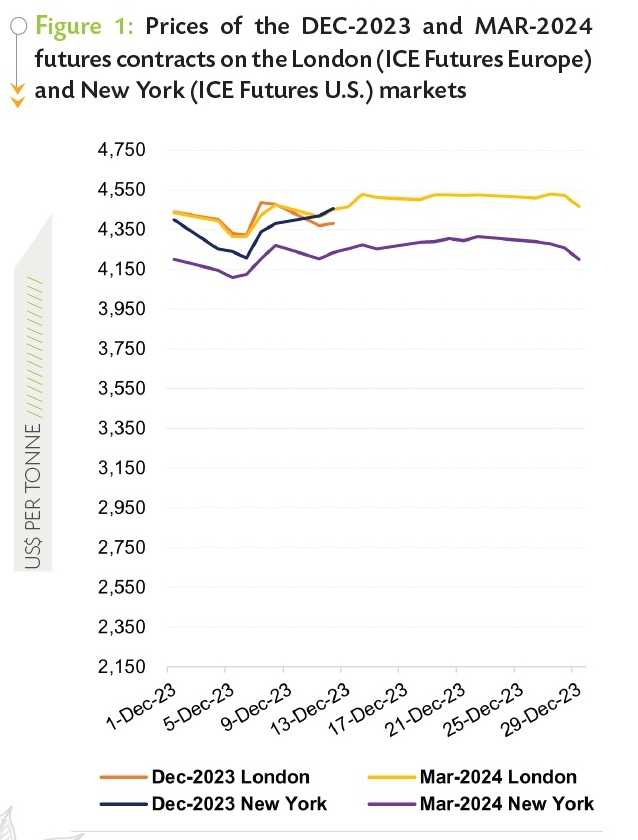

ABIDJAN, Côte d’Ivoire – During December, the nearby contract averaged US$4,467 per tonne and ranged between US$4,323 per tonne and US$4,529 per tonne in London. In New York, prices averaged US$4,300 per tonne and ranged between US$4,200 per tonne and US$4,456 per tonne (Figure 1).

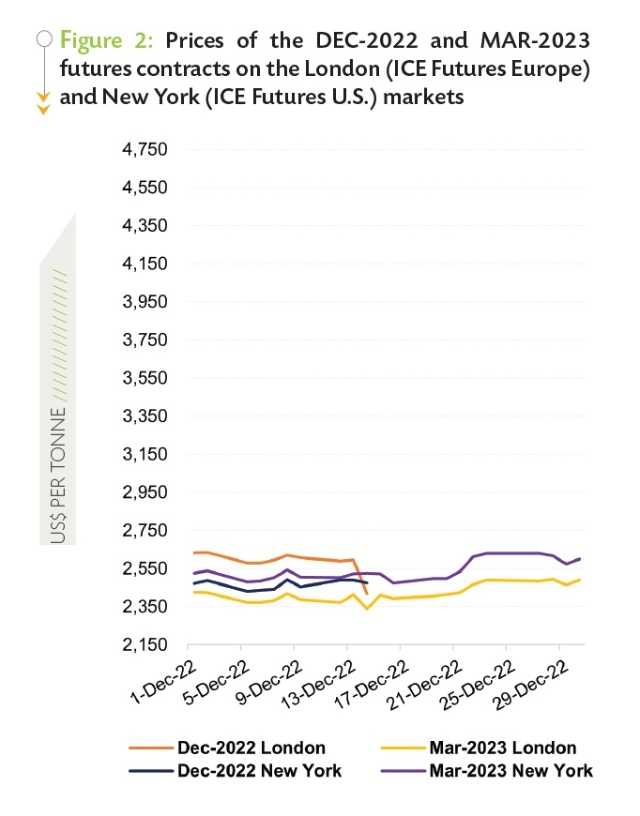

At the same time a year ago, the nearby contract for December 2022, averaged US$2,514 per tonne in London and ranged between US$2,392 per tonne and US$2,635 per tonne. In New York, the nearby contract averaged US$2,517 per tonne and oscillated between US$2,432 per tonne and US$2,629 per tonne (Figure 2).

During the calendar year 2023, supply was the major contributory factor that fueled bullish prices. From the onset of the year, i.e., January 2023, gross exports of cocoa beans from Côte d’Ivoire were lower as compared to the same period of the previous year.

Other factors that signaled supply deficits and elevated cocoa prices were unconducive weather conditions and diseases.

Floods caused delays to the mid-crop harvest. Moreover, black pod disease and swollen shoot virus due to the excess rains during the last quarter of 2023 heightened continued concerns of a shortfall in supply.

By the end of December 2023, the current 2023/24 season was also headed for an imminent deficit, as in the prior two years.

Indeed, the nearby contract price, at US$4,467 per tonne in London on the last trading day of December 2023, made a yearly gain of 79% when compared to its counterpart of December 2022 which was at US$2,491 per tonne.

For the same period in New York, the nearby contract price rose by 61% from US$2,601 per tonne to US$4,200 per tonne.

As at the time of writing, though rainfall in cocoa growing regions in Côte d’Ivoire is envisaged to bode well for the upcoming midcrop, supplies from the country are still below the previous season’s level.

According to news agency report, since the start of the season on 1 October 2023, main crop cocoa arrivals at Ivorian ports had reached 914,000 tonnes by 14 January 2024, down 36% from the same period last season.

With the recent surge in freight rates due to tensions in the Red Sea area, international trade is likely to be affected.

With already high cocoa prices, an additional cost resulting from high freight rates may be daunting for cocoa users and could affect demand. The Secretariat will monitor grindings trend as the season progresses.

Cocoa prices started the month under review on a moderate decline (Figure 1) as rain in cocoa growing areas was reported to be conducive and beneficial for the crops for that period of the year. In Côte d’Ivoire, average rains combined with sunshine were anticipated to lend support to the October – March main crop.

As such, by 6 December 2023, compared to the first trading day prices for December, the DEC-23 contract dropped by 3% from US$4,439 per tonne to US$4,323 per tonne in London, and by 4% in New York from US$4,399 per tonne to US$4,206 per tonne.

This downward trend was short-lived and prices resumed an upward path. Precisely by 8 December, prices in both markets had increased by 4% from the aforementioned lows to US$4,478 per tonne and US$4,381 per tonne in London and New York respectively.

Though both markets were in backwardation during the first half of the month, an observation from the price movement is that prior to the expiration of the DEC-23 contract, the price difference between the DEC-23 and Mar-24 contracts was much lower in London at an average of US$9 but showed significant values in the New York market at an average of US$141.

With the nearby contract trading higher than later contracts due to supply tightness and prices heading in backwardation, the lower price difference between the DEC-23 contract and MAR-24 contract in London as compared to New York can be attributed to the volume of beans reaching these two locations.

Since the two top producers’ bean supplies are normally destined for Europe, with low output expected from Côte d’Ivoire and Ghana for the ongoing season, there may have been less cocoa available to New York, thus resulting in a wider backwardation for New York cocoa futures.

As the year progresses, attention will be paid to price movements prior to expiration of contract months to determine whether the New York market price differences between the first and second trading months outpace that of price differences in London and what the underlying factor may be.

At the end of 2023, the annual average price of the nearby contract in London had firmed by 46% compared to the previous calendar year as seen in Table 1. During the same period in New York, the average of the first position contract prices strengthened by 35% year-on-year.

Furthermore, the annual average of the US-denominated ICCO daily price stood at US$3,261 per tonne, up by 38% compared to the average price of the previous year. The average of the Euro-denominated prices increased by 34% year-over-year, attaining €3,015 per tonne in 2023.