ABIDJAN, Côte d’Ivoire — This review of the cocoa market situation reports on the prices of the nearby futures contracts listed on ICE Europe (London) and U.S. (New York) during the month of January 2019. It aims to highlight key insights on expected market developments and the effect of the exchange rates on cocoa prices.

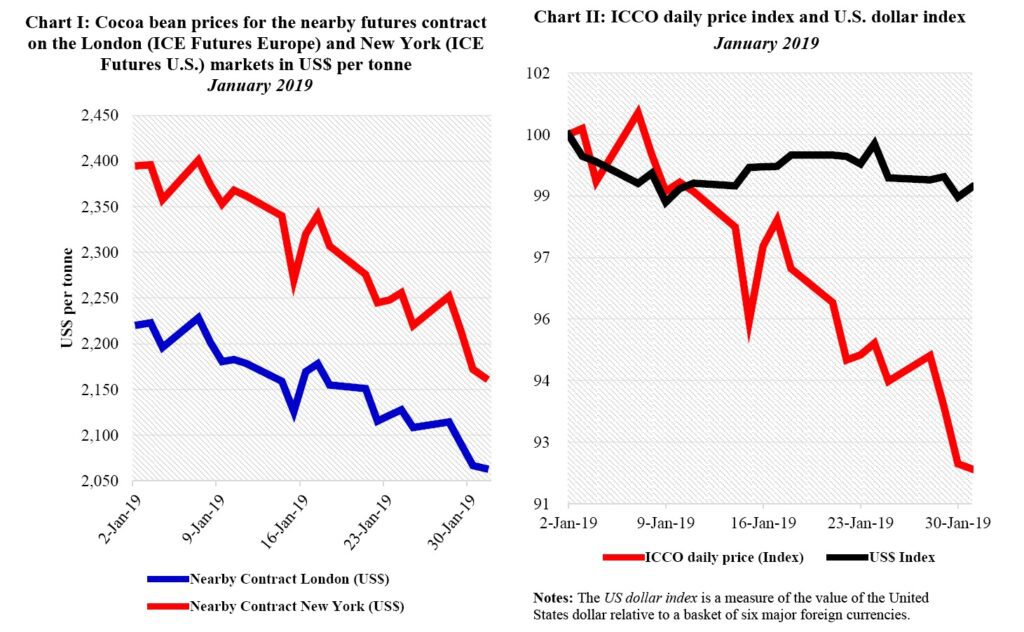

Chart I shows the development of the futures prices on the London and New York markets at the London closing time.

Both prices are expressed in US dollars. The London market is pricing at par African origins, whereas New York prices at par Southeast Asian origins. Hence, under the same conditions, one would expect the futures prices in London to be higher than in New York.

Nevertheless, in May 2017, changes in the grading rules for ICE Europe led to a substantial increase in both the share of Bulk Delivery Units (BDUs), which are more expensive to grade/re-grade, and less sought cocoa bean origins. These factors have discounted London prices vis-à-vis the New York market.

This unusual price configuration has been possible because a physical arbitrage between the two futures markets is prevented to some extent by the presence of idiosyncratic SPS measures (i.e. on itch grass and metalaxyl) and grading rules across the Atlantic.

The ICCO Secretariat foresees that such a price configuration will persist in the months (or even years!) to come until these differences disappear. Chart II depicts the change in the ICCO daily price index and the US dollar index in January. By comparing these two developments, one can extricate the impact of the US dollar exchange rate on the development of the US dollar-denominated ICCO daily price index.

Price movements

The front-month (March-2019) cocoa contract prices sunk during the month of January as a result of the strong supply of cocoa beans mainly from West Africa in addition to the favourable climate conditions which prevailed in this region’s main cocoa growing countries (Chart I). They declined overall by 7% in London and 10% in New York.

During the first two weeks of January, the prices of the nearby futures contract dropped by 4% to US$2,126 per tonne in London and by 5% to US$2,270 per tonne in New York. This bearish stance on prices was mainly the results of the higher-than-expected cocoa arrivals recorded in Ivorian ports.

From 16 January 2019 onwards, the futures prices continued to deteriorate on both markets as a result of favourable meteorological conditions. Indeed, news of the drastically reduced likelihood of an El-Niño event coupled with the very weak Harmattan winds witnessed in West Africa led cocoa prices to further weaken. By the end of the month, the March-2019 cocoa futures contract was exchanged at US$2,064 per tonne in London and US$2,163 per tonne in New York.

Finally, it is worth noting that the depreciation of the US dollar – by nearly 1% – during the month of January had a negligible impact on the observed decline in the US-denominated cocoa price (Chart II).

Cocoa supply and demand situation

Cocoa production is anticipated to further increase during the 2018/19 crop year with Africa contributing two-third of the global crop. As at 24 February 2019, cumulative arrivals of cocoa beans in ports of exports in Côte d’Ivoire reached 1.469 million tonnes against the 1.343 million tonnes recorded during the same period of the previous season.

Over the period 18-24 February 2019, a total of 27,000 tonnes of cocoa beans were delivered to Ivorian ports, up from 22,000 tonnes delivered in the country for the same week last season.

In Ghana, cocoa bean purchases reached 674,735 tonnes by 31 January 2019, up from the 611,853 tonnes sold during the same period last season. In Cameroon, news indicated that, as at 16 November 2018, cocoa bean arrivals to the port of Douala were seen at 109,410 tonnes, 11% higher than the cumulative volumes recorded for the same period last year in the country.

On the demand side, processing at origins continued its upward pace. At the time of writing, news indicated that, as at 31 December 2018, total grindings in Côte d’Ivoire reached 135,000 tonnes, up from the 124,000 tonnes recorded at the same period of the previous season. Moreover, the exports of semi-finished cocoa products from Côte d’Ivoire have grown by 1.1% and attained 114,386 tonnes since the start of the 2018/19 cocoa year.

In its next issue of the Quarterly Bulletin of Cocoa Statistics which will be released at the end of the month of February, the ICCO Secretariat will provide further details on recent trends in the cocoa beans supply and demand situation as well as in the international trade of cocoa beans and cocoa semi-finished products