ABIDJAN, Côte d’Ivoire – Halfway through the 2022/23 main crop, the crop output in the two top world cocoa producers i.e., Côte d’Ivoire and Ghana, is higher than the levels recorded during the corresponding period of the previous season, says the International Cocoa Organization (ICCO) in its new Market Report. As at 08 January 2023, arrivals of cocoa beans at Côte d’Ivoire’s ports of exports were seen at 1.346 million tonnes, up by 11.6% year-on-year, says the International Cocoa Organization (ICCO) in its Cocoa Market Report for the month of December.

However, the country’s exports of cocoa beans during the first two months of the 2022/23 cocoa year were undercut by 47% year-over-year from 186,842 tonnes to 99,950 tonnes. The carriers’ strike action at the port of San Pedro back in November 2022 contributed to the reduction in the exports of cocoa beans during that period.

In Ghana, purchases of graded and sealed cocoa beans for the 2022/23 crop year reached 350,000 tonnes as at 15 December 2022, representing a 76% increase compared to 199,000 tonnes purchased at the corresponding period of the previous season.

Although the arrivals and purchases from the top producers show ample supplies, as at the time of writing the absence of rain raised concerns over the possibility of the dry weather having an adverse effect on the outlook for the April – September mid-crop.

Commercial traders (hedgers) net short futures positions

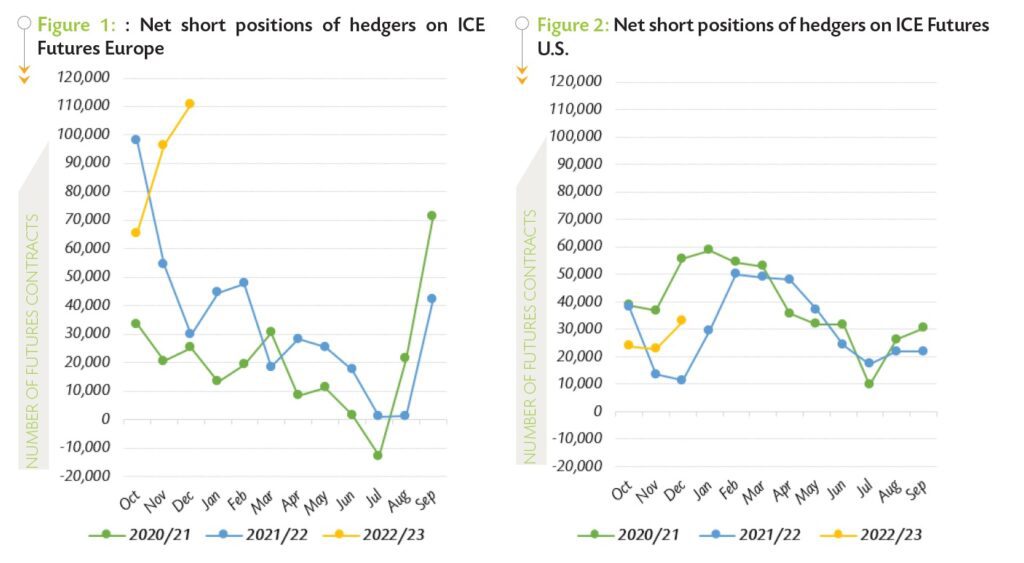

Figure 1 presents the net short positions of commercial traders in Europe over the period 2020/21 – 2022/23, while Figure 2 shows the same information in the United States, sourced from the weekly report on the Commitments of Traders.

The size of net short positions could be perceived as a demand for “insurance” against price drops, and its change over time can be viewed as the evolution of the risk perception of merchants and producers in the cocoa futures markets.

As opposed to the first three months of the 2021/22 crop year, cocoa merchants and producers increased their net short positions on both sides of the Atlantic over October – December 2022.

The behaviour of the above-mentioned category of market participants suggests that, while accounting for all cocoa futures contracts that are currently active, they perceive for now that cocoa prices are more likely to move downward in both Europe and the United States.

In the United States, average net short positions increased by 26% from an average of 21,050 contracts in October to 26,563 contracts in December. Meanwhile, in Europe, they went up by 50% from an average of 60,794 contracts to 90,897 contracts.

In December 2022, prices of the front-month cocoa futures contract averaged US$2,514 per tonne and ranged between US$2,392 and US$2,635 per tonne in London, while in New York the first position contract traded at an average price of US$2,515 per tonne and oscillated between US$2,432 and US$2,629 per tonne.

Back in December 2021, prices were lower and the average price of the front-month contract settled at US$2,185 per tonne and ranged between US$2,004 and US$2,308 per tonne in London. Meanwhile, prices of the first position of cocoa futures in New York averaged US$2,471 per tonne and oscillated between US$2,314 and US$2,625 per tonne over the same period.

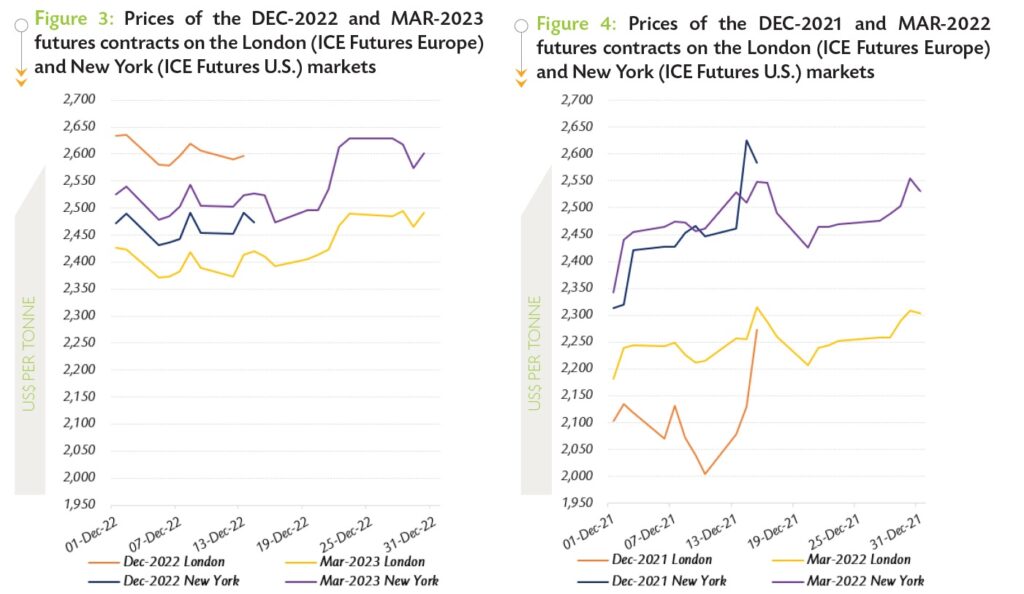

Figure 3 shows price movements of the first and second positions on the London and New York futures markets respectively at the London closing time in December 2022, while Figure 4 presents similar information for the previous year.

Futures price developments

Futures price developments

In December 2022, prices of the front-month cocoa futures contract averaged US$2,514 per tonne and ranged between US$2,392 and US$2,635 per tonne in London, while in New York the first position contract traded at an average price of US$2,515 per tonne and oscillated between US$2,432 and US$2,629 per tonne.

Back in December 2021, prices were lower and the average price of the front-month contract settled at US$2,185 per tonne and ranged between US$2,004 and US$2,308 per tonne in London.

Meanwhile, prices of the first position of cocoa futures in New York averaged US$2,471 per tonne and oscillated between US$2,314 and US$2,625 per tonne over the same period.

Figure 3 shows price movements of the first and second positions on the London and New York futures markets respectively at the London closing time in December 2022, while Figure 4 presents similar information for the previous year.

At the approach of the expiration date of the DEC-22 contract, the London market was in a strong backwardation while the New York one was in contango (Figure 3). Indeed, the DEC-22 contract was priced on average at US$207 per tonne above the MAR-23 contract.

On the contrary, in New York the DEC-22 contract traded on average at US$50 per tonne lower compared to MAR-23. The strong market tension observed in London was corroborated by the substantial delivery of 82,770 tonnes of cocoa at the expiration of DEC-22¹. It should be noted that this is the second-largest volume of cocoa deliveries recorded at the maturity of a futures contract on the London market since 2018.

Back in December 2021, a normal contango was observed in both London and New York with the DEC-21 contract being discounted by US$135 per tonne in London and by US$19 per tonne in New York vis-à-vis the MAR-22 contract.

Before reaching its expiration date, the DEC-22 contract traded slightly downward by 1%, moving from US$2,634 to US2,596 per tonne in London. In New York, it was priced on average at US$2,464 per tonne and ranged between US$2,432 and US$2,492 per tonne.

At the time, higher year-on-year arrivals of cocoa beans in Côte d’Ivoire and Ghana contributed to reducing prices.

Thereafter, in the course of the second half of the month under review, the nearby contract rolled over to MAR-23 and prices followed an upward trend on both sides of the Atlantic. On both markets, prices were reinvigorated by 3%, increasing from US$2,419 to US$2,491 per tonne and from US$2,523 to US$2,601 per tonne in London and New York respectively. During this time, the dry weather spell had commenced and concerns over its impact had started to make the headlines.

ICCO Market Report: Summary of 2022 price movements

At the end of 2022, the annual average price of the nearby contract in London had firmed by 7% compared to the previous calendar year as seen in Table 1. During the same period in New York, the average of the first position contract prices weakened by 1% year-on-year. Furthermore, the annual average of the US-denominated ICCO daily price stood at US$2,368 per tonne, down by 2% compared to the average price of the previous year.

On the contrary, the average of the Euro-denominated prices increased by 9% year-over-year, attaining €2,249 per tonne in 2022.

¹ https://www.theice.com/marketdata/publicdocs/liffe/cocoa/monthly_issuers_receivers/irrcocm221214.csv

¹ https://www.theice.com/marketdata/publicdocs/liffe/cocoa/monthly_issuers_receivers/irrcocm221214.csv