ABIDJAN, Côte d’Ivoire — This review of the cocoa market situation reports on the prices of the nearby futures contracts listed on ICE Europe (London) and U.S. (New York) during the month of November 2018. It aims to highlight key insights on expected market developments and the effect of the exchange rates on cocoa prices.

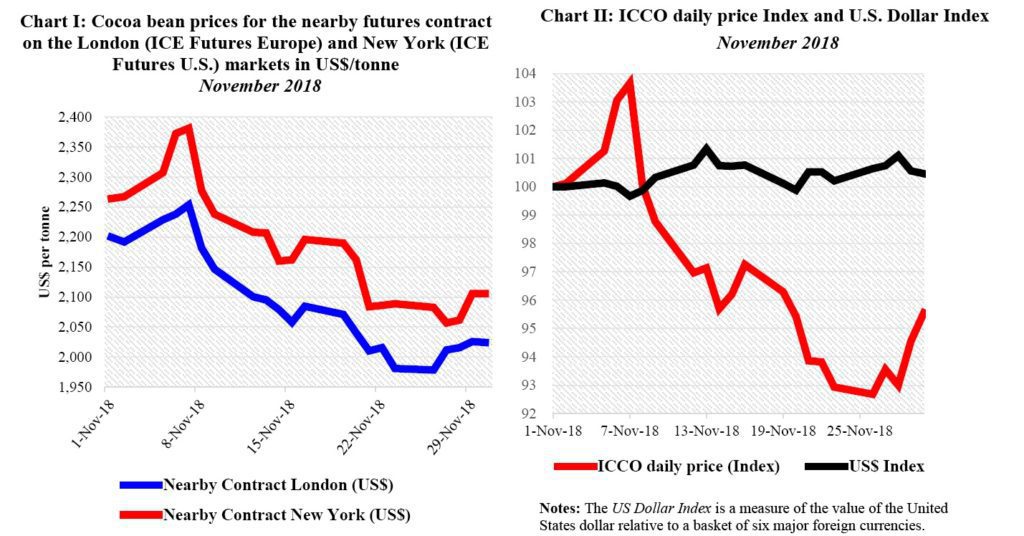

Chart I shows the development of the futures prices on the London and New York markets at the London closing time. Both prices are expressed in US dollars. The London market is pricing at par African origins, whereas the New York market is pricing at par Southeast Asian origins. Hence, under normal market conditions, the London prices should be higher than the New York ones.

Any departure from this price configuration provides indication on the relative, expected availability of cocoa beans at the delivery points, designated by the exchange, at contract

expiration. Chart II depicts the change in the ICCO daily price Index and the US dollar Index in November.

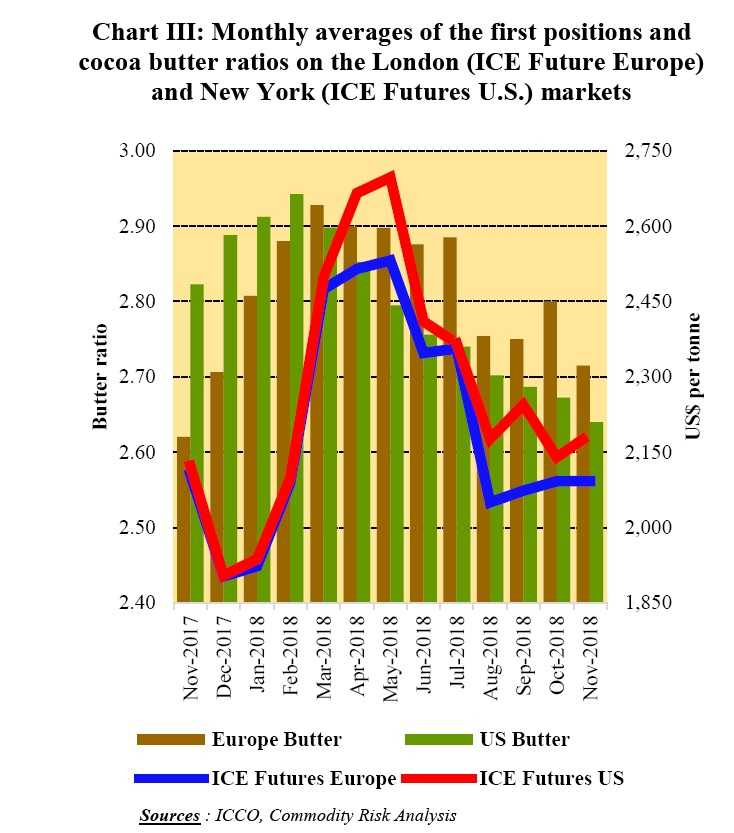

By comparing these two developments, one can extricate the impact of the US dollar exchange rate on the development of the US dollar-denominated ICCO daily price index. Finally, Chart III illustrates the year-on-year monthly averages of the first positions and cocoa butter ratios on the London (ICE Future Europe) and New York (ICE Futures U.S.)

markets.

Price movements

The bullish stance on prices observed during the first month of the 2018/19 crop year was not sustained in November. Indeed, as shown in Chart I, the front-month cocoa contract plummeted on news that ample arrivals and purchases of cocoa beans were recorded in Côte d’Ivoire and Ghana during the month under review.

Thus, compared to their values displayed at the beginning of November, the nearby contract prices weakened by 8% from US$2,200 to US$2,025/tonne in London by the end of the month. Concurrently, prices dipped by 7% in New York from US$2,264 to US$2,106/tonne during the last trading day of November.

The anticipated drawbacks of the abnormally heavy rains that occurred during October continued to play a supportive role in the nearby contract prices on both London and New York markets throughout the first week of November.

As an implication, the front-month contract traded on a positive note in the course of the first trading week of the period under review and reached its highest level of the month.

Compared to their values seen at the start of the month, on 7 November, prices strengthened by 2% and settled at US$2,254/tonne in London. At the same time, they firmed by 5% and reached US$2,381/tonne in New York.

However, this upward trend in prices was short-lived and thereafter a decline was observed on both markets following reports of large cocoa supplies recorded in West Africa. In addition, a mix of rain and sunshine and the fact that new plantings started to produce cocoa pods pressured down cocoa prices during the considered period.

Subsequently, from 8 November onwards, the first position contract retreated by 7% and averaged US$2,054/tonne in London. Similarly, on the New York market, the first position contract dropped by 8% and averaged US$2,146/tonne.

Contrary to normal market conditions, cocoa futures were priced with a premium in New York over London (Chart I). This was due to, on the one hand, an increase of 4% to 104,610 tonnes in certified stocks held in Europe. On the other hand, end-of-day reports from the Intercontinental Exchange (ICE) mentioned that, stocks reduced by 10% from 241,938 tonnes in the United States by the end of November.

The US dollar index firmed by nearly 1% from its value presented at the beginning of November while the ICCO daily price index contracted by 4 % from its value displayed at the start of the month (Chart II). The depreciation in the nearby contract prices is mainly supported by market fundamentals.

As shown in Chart III, the squeeze in the cocoa butter ratio and the first position prices which started in July 2018 continued during November in both Europe and the United States.

As shown in Chart III, the squeeze in the cocoa butter ratio and the first position prices which started in July 2018 continued during November in both Europe and the United States.

However, compared to November 2017, the nearby contract priced 1% lower during November 2018 in London whereas, on the contrary, it jumped by 3% in the United States. In addition, cocoa butter ratios increased by 4% in Europe and fell by 6% in the United States.

It is worth noting that, over the period under consideration, weekly reports from Commodity Risk Analysis (CRA) showed that cocoa butter prices rose in Europe from US$2,155/tonne to US$2,160/tonne.

Similarly, they increased in the United States moving from US$2,137/tonne to US$2,251/tonne.

The reduction in the nearby contract prices may have partly supported the improvement in processors’ margins in Europe. On the other hand, the increase in prices on the New York market could have contributed to pressuring down the profitability of processing

activities in the United States.

The burden of premiums proposed by the United States market is somehow weighting on manufacturers’ margins year-on-year.

Supply and demand situation

The 2018/19 crop year harvest started strongly in Côte d’Ivoire. Indeed, as at 2 December 2018, news indicated that, cumulative cocoa arrivals recorded at ports in the world top cocoa producer reached 689,000 tonnes, up by 35% from 510,000 tonnes seen in the same period last season.

On the demand side, revised estimates published by the ICCO Secretariat in its latest issue of the Quarterly Bulletin of Cocoa Statistics show an increase in world grindings of 3.9% during the last crop season.

Grindings reached a record 4.570 million tonnes, up by 173,000 tonnes. This new estimate reflects the unabated increase in demand which is especially reflected in the steady cocoa processing growth in origin countries.

Processing activities grew of 5.1% to 1.711 million tonnes in Europe and by 4.3% to 1.031 million tonnes in Asia and Oceania whereas Africa’s increase was by 5.7% to 951,000 tonnes.

In contrast, grindings in the Americas slightly regressed by 0.3% from the previous season to 877,000 tonnes.