ABIDJAN, Côte d’Ivoire – A deficit of around 100,000 tonnes is currently estimated for the 2022/23 season which just ended, states the Cocoa Market Report for the month of September of the International Cocoa Organization (ICCO).

At this point last year, market participants had predicted a balanced situation for the season. But adverse weather conditions in Côte d’Ivoire and Ghana soon led to a change in these expectations.

As cumulative port arrivals indicated that the market was heading towards a supply deficit, cocoa prices in real terms surpassed the levels recorded during the 2021/22 season (Figure 1).

This, coupled with the news of an expected El Niño weather phenomenon, supported the rally of cocoa prices. So far, so good for some farmers and exporters, but not most of them.

This, coupled with the news of an expected El Niño weather phenomenon, supported the rally of cocoa prices. So far, so good for some farmers and exporters, but not most of them.

The Ivorian and Ghanaian pricing mechanisms provide a guaranteed price paid to farmers. In both Côte d’Ivoire and Ghana, the guaranteed price ended up being relatively lower than the farm gate prices in neighbouring countries, which had become more attractive. Indeed, cross-border flows of cocoa beans have been reported.

At present, however, it is not possible to assess the extent of this geographical arbitrage as the 2023.Q3 official trade statistics will become available in 2024.Q1 only, says the ICCO.

Furthermore, hoarding of cocoa beans was observed in Côte d’Ivoire and Ghana during the latter part of the 2022/23 mid-crop. This was fueled by expectations of a higher farm gate price for the 2023/24 season.

The incidence of bean hoarding is reported to be one of the disruptions that led Ghana to open the 2023/24 season earlier on 8 September 2023 instead of the start of October 2023.

If farmers hoarded cocoa, does this really reflect that the volume of production for the just ended 2022/23 may be higher than actual arrivals and purchases for the season?

As part of the 2022/23 crop will be tallied as inclusive of the 2023/24 harvest, the estimated deficit of 100,000 tonnes could be over-estimated.

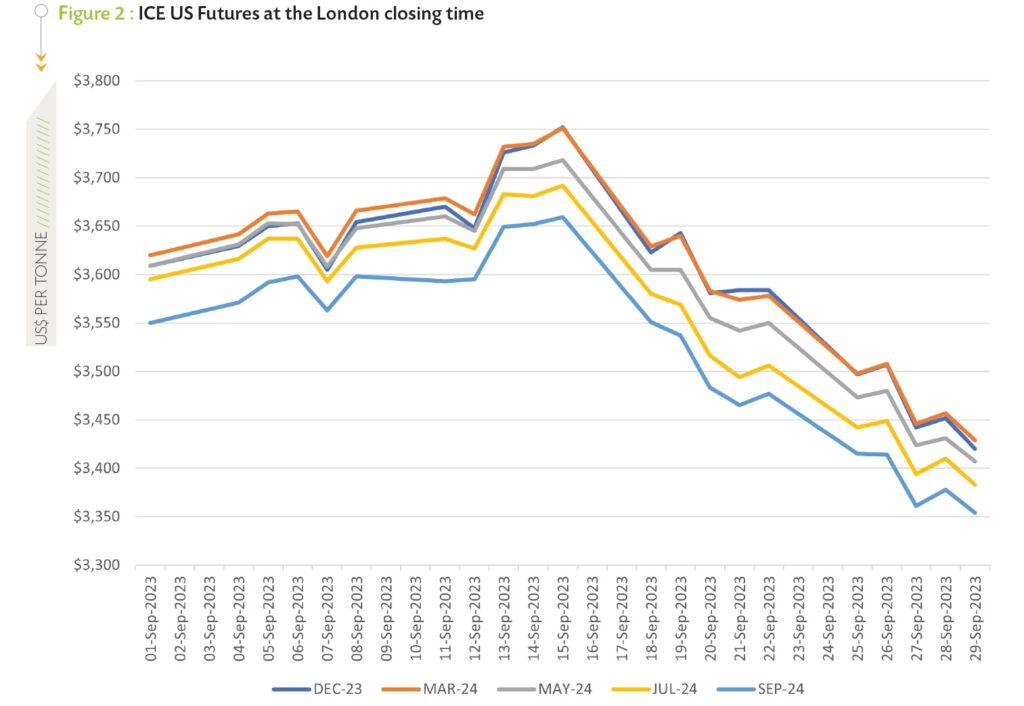

While a backwardation was reported on the cocoa futures market during the month of September (Figure 2), the market is anticipating an ease on supply “tightness”, i.e., intertemporal arbitrage. However, it is too early to assess the 2023/24 crop development.

Reports of pod counting for the main crop season are not favourable; and data on port arrivals are also limited. Moreover, it is unclear how El Nino will play out during the current season.

Reports of pod counting for the main crop season are not favourable; and data on port arrivals are also limited. Moreover, it is unclear how El Nino will play out during the current season.

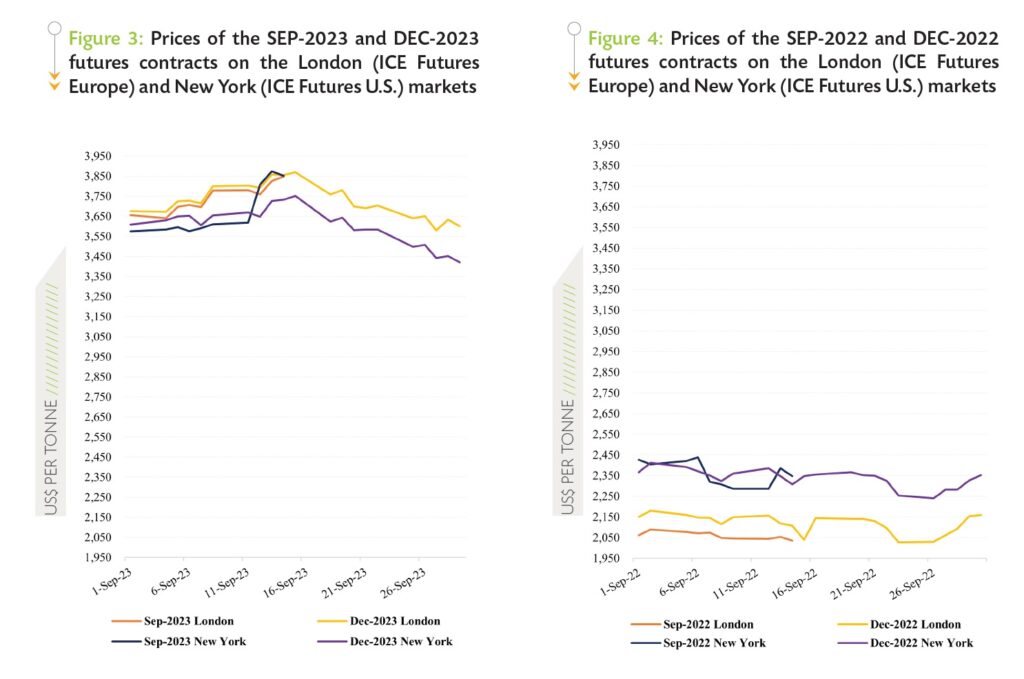

Overall, compared to the same period a year ago, cocoa prices remained significantly high for the last month of the 2022/23 season.

For September 2023, cocoa prices averaged US$3,739 per tonne and ranged between US$3,580 per tonne and US$3,848 per tonne in London. In New York, they averaged US$3,669 per tonne and ranged between US$3,575 per tonne and US$3,874 per tonne (Figure 3).

A year ago, cocoa prices in September 2022 averaged US$2,083 per tonne and ranged between US$2,027 per tonne and US$2,160 per tonne in London; meanwhile in New York they averaged US$2,339 per tonne and ranged between US$2,240 per tonne and US$2,438 per tonne (Figure 4), concludes the ICCO.