ABIDJAN, Côte d’Ivoire — This review of the cocoa market situation reports on the prices of the nearby futures contracts listed on ICE Futures Europe (London) and ICE Futures U.S. (New York) during the month of August 2019. It aims to highlight key insights on expected market developments and the effect of the exchange rates on the US-denominated prices.

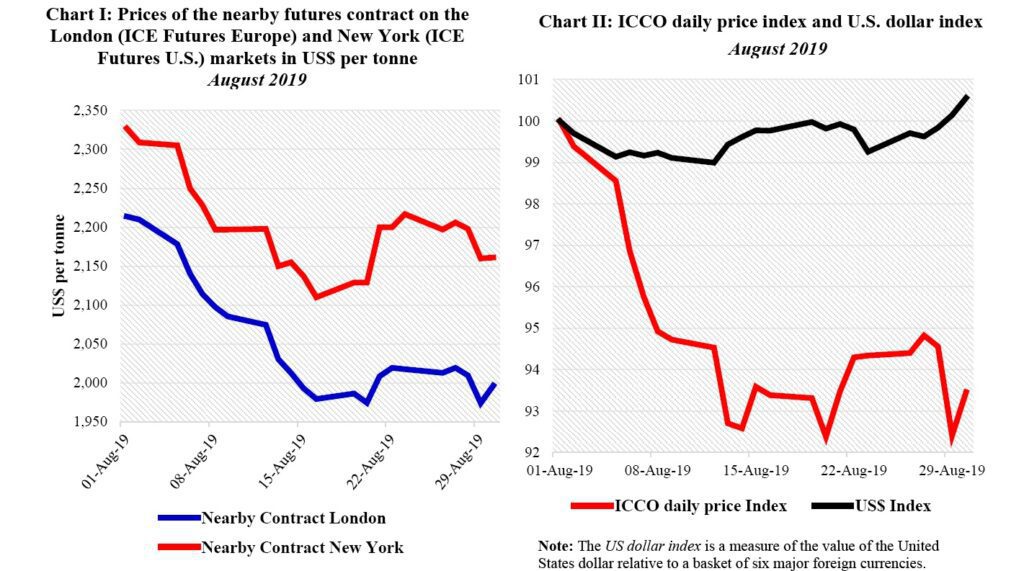

Chart I shows the development of the nearby futures prices on the London and New York markets at the London closing time. Both prices are expressed in US dollars. Chart II depicts the change in the ICCO daily price index and the US dollar index in August By comparing these two developments, one can disentangle the impact of the US dollar exchange rate on the development of the US dollar denominated ICCO daily price index.

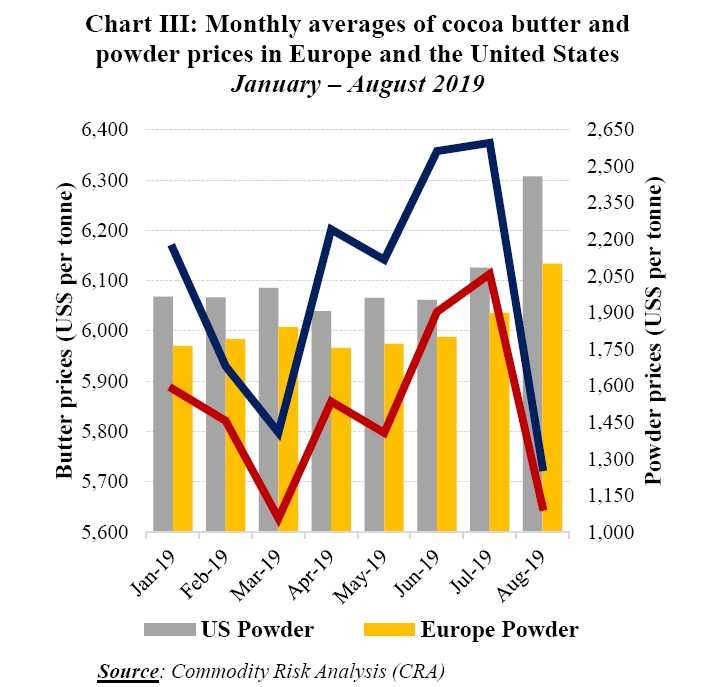

Finally, Chart III illustrates monthly averages of cocoa butter and powder prices in Europe and the United States since January 2019.

Price movements

As delineated in Chart I the front month cocoa futures contracts prices sagged considerably on both the London and New York markets during August This downward trend was an after effect of expectations that the global cocoa market is bracing itself for another supply excess for the current cocoa season.

Thereby in comparison to the ir settlement values recorded during the first trading day of the month, prices plunged by 10 from US$2,2 14 to US$ 1,996 per tonne in London whilst in New York, they abated by 7 from US$2, 327 to US$2, 161 per tonne by the end of August.

The dynamic of the nearby cocoa futures contract prices highlighted three major stages on both the London and New York markets during the month under review. Over the period 1-16 August prices followed a downward trend as the conducive meteorological conditions observed in Côte d’Ivoire’s major cocoa producing areas led market participants to reinforce their perception of a stronger global production.

Therefore prices substantially ebbed by 10 from US$2,2 14 to US$ 1 979 per tonne and by 9 from US$2, 327 to US$2, 110 per tonne, in London and New York respectively. Thereafter, prices recovered from their tumble during the period 16 23 August on both markets as market participants consolidated the losses incurred during the earlier mentioned time frame.

During this period, data posted by the Intercontinental Exchange (indicated that, certified stocks of cocoa beans in its licensed warehouses slightly reduced from 129,730 tonnes to 129,470 tonnes in Europe whereas in the United States, these stocks shrank from 266,090 tonnes to 263,083 tonnes.

Subsequently prices were reinvigorated by 2 from US$ 1 979 to US$ 2, 018 per tonne in London and by 5 from US$2, 110 to US$ 2, 2 17 per tonne in New York. However, this recovery in prices was short lived and from 2 3 August through to the end of the month, massive supplies of cocoa beans from Côte d’Ivoire and Cameroon undermined the preceding upward trend observed in prices.

Thereby, the first position of cocoa futures contracts traded lower on both markets during the last trading week of the month being reviewed In London, prices dwindled by 1 from US$2, 018 to US$ 1 996 per tonne whereas in New York they dropped by 3 from US$2, 217 to US$2, 16 1 per tonne.

The US dollar index remained broadly flat while the ICCO daily price index plummeted by 7 over the analysis period Chart II Therefore the deterioration seen in cocoa prices was mainly attributable to market fundamentals and other factors rather than currency fluctuations.

As exemplified in Chart III since the start of 2019 cocoa butter and powder have traded higher in the United States compared to Europe. Prices for cocoa butter deteriorated by 7 from US$ 6 164 to US$ 5 7 29 per tonne in the United States, whilst in Europe they dipped by 4 moving from US$5, 885 to US$ 5 650 per tonne.

Regarding cocoa powder, as compared to the levels attained at the start of the current calendar year, prices strengthened by 2 5 from US$ 1 965 to US$ 2 4 59 per tonne in the United States. At the same time in Europe, powder prices firmed by 19 from US$1, 764 to US$ 2,101 per tonne.

Additionally, since the start of 2019 the monthly average for the nearby cocoa futures contract prices regressed by 5% in both London and New York. Indeed, they subsided from US$2, 153 to US$2, 052 in London, while in New York they weakened from US$2, 303 to US$2, 198 per tonne.

Cocoa supply and demand situation

The 2018/19 cocoa year is drawing to a close with the prospect of another global supply excess. As at 21 August 2019, cumulative cocoa arrivals at Ivorian ports since the beginning of the season were estimated at 2.135 million tonnes, up by 12 from the 1. 9 13 million tonnes recorded during the same period of the previous season.

At the same time, data posted by the Ivoirian coffee and cocoa sect or regulator Conseil du Café Cacao showed that, during the period October 2018 June 2019, cocoa processing activities in the country expanded by 6 to 4 37 ,0 79 tonnes as compared to the 412,981 tonnes reached during the same period of the previous season.

Cameroon has witnessed an increase in both production and grindings with estimate s of 270 000 and 60,000 tonnes respectively anticipate d for the 2018/19 season. Additionally, Cameroonian officials announced on 14 August 2019 that grindings in the country are anticipated to double to 120,000 tonnes during the 2019/20 season due to recent and upcoming investments to expand the country’s processing capacities.

In the latest release of the Quarterly Bulletin of Cocoa Statistics the ICCO Secretariat published that world cocoa production for the current season is expected to increase by 4.3 to 4. 849 million tonnes, as compared with the previous season’s estimate of 4. 651 million tonnes. Regarding demand, a 4 .1 growth to 4. 783 million tonnes, in world grindings, is anticipated for the current season compared to the last crop year.