LONDON – The current review of the cocoa market situation reports on price movements on the international markets during the month of October 2014. Chart I (click to enlarge) illustrates price movements on the London (ICE Futures Europe) and New York (ICE Futures US) markets for the month under review.

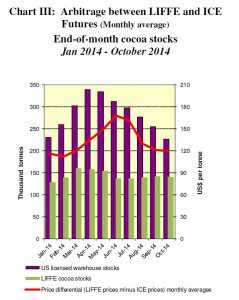

Chart II shows the evolution of the ICCO daily price, quoted in US dollars and in SDRs, from August to October 2014. Chart III illustrates the end-of-month stocks in licensed warehouses in Europe and in the United States, including the arbitrage spread between the two cocoa futures markets.

Price evolution

In October, the ICCO daily price averaged US$3,101 per tonne, down by US$120 compared to the average price recorded in the previous month (US$3,221) and ranged between US$2,958 and US$3,197 per tonne.

At the start of the month under review, cocoa futures continued the downward trend initiated at the end of the previous month and fell to £1,956 per tonne in London and to US$3,021 per tonne in New York. Bearish fundamentals such as favourable weather conditions along with positive expectations for the 2014/2015 main crop from West Africa contributed to this development. However, by the second week through to the middle of October, cocoa futures prices moved sideways. While concerns over the potential impact of Ebola on West

African supplies continued to provide some support to cocoa prices, the release of a 1.1% fall in grindings data from Europe for the third quarter of 2014 pressured cocoa prices downwards. Nevertheless, with the publication of stronger-than-expected North America grindings data, cocoa futures increased thereafter and attained their highest level for the month in London, at £2,033, whereas in New York, it rose to US$3,110.

However, as illustrated in Chart I, the gains could not be sustained and, from the third week to the end of October, the strengthening of the US dollar, in the light of positive macroeconomic news from the United States coupled with strong arrivals data from West Africa, set a bearish tone on both the London and New York markets. Thus, cocoa futures decreased to a five-month low, to £1,886 per tonne and to US$ 2,891 per tonne in London and New York respectively.

Certified warehouse stocks of cocoa beans

Chart III depicts the level of stocks held in licensed warehouses in both London and in the United States. Compared to the previous month, volumes fell from 255,244 tonnes to 226,061 in New York while they remained at almost the same level in London, declining only from 141,570 tonnes to 140,260 tonnes.

Nevertheless, the arbitrage spread (difference in price) between LIFFE and ICE cocoa futures markets remained quite unchanged, from an average of US$ 121 in September 2014 to US$ 120 in October 2014.

Supply and demand

On the supply side, total cocoa arrivals at Ivorian ports as at 2 November 2014 reached approximately 216,000 tonnes according to data published by Reuters. This was about 4,000 tonnes higher than the corresponding period of the previous year.

In Ghana, although at the end of the 2013/2014 cocoa year, cocoa purchases for the light crop which started in July were only just over 20,000 tonnes, suffering from the low price paid to cocoa farmers compared to those in neighbouring countries, the main crop outlook for the current season is expected to benefit from the increase in producer prices in addition to favourable weather conditions. No data have yet been made available on purchases made at this stage for the new season.

In Indonesia, one news agency reported a reduction in exports of cocoa beans from the country’s main growing island of Sulawesi during the month of October. Compared to the same period for the previous cocoa season, cocoa beans exports were approximately 5,275 tonnes as against 3,376 tonnes. Pest infestation and reports of farmers switching from cocoa production to coffee which is less vulnerable to plant disease have resulted in the fall in production.

On the demand side, while North American grindings rose to 4.59% in the third quarter of 2014, at 138,027 tonnes, European grindings data on the other hand showed a fall of 1.1% compared with the same period for the previous year, dropping to 327,866 tonnes. In Asia, compared with the previous year, industry data showed a 5.9% drop to 151,643 tonnes for the third quarter of 2014.

At the end of November, the ICCO Secretariat will release its revised supply and demand estimates for the 2013/2014 cocoa year in its Quarterly Bulletin of Cocoa Statistics.