ABIDJAN, Côte d’Ivoire – This review of the cocoa market situation focuses on the prices of the July-2020 (JUL-20) and September-2020 (SEP20) futures contracts listed on ICE Futures Europe (London) and ICE Futures U.S. (New York) during the month of July 2020. It aims to highlight key insights on expected market developments and the effect of the exchange rate on the US-denominated prices of the said contracts.

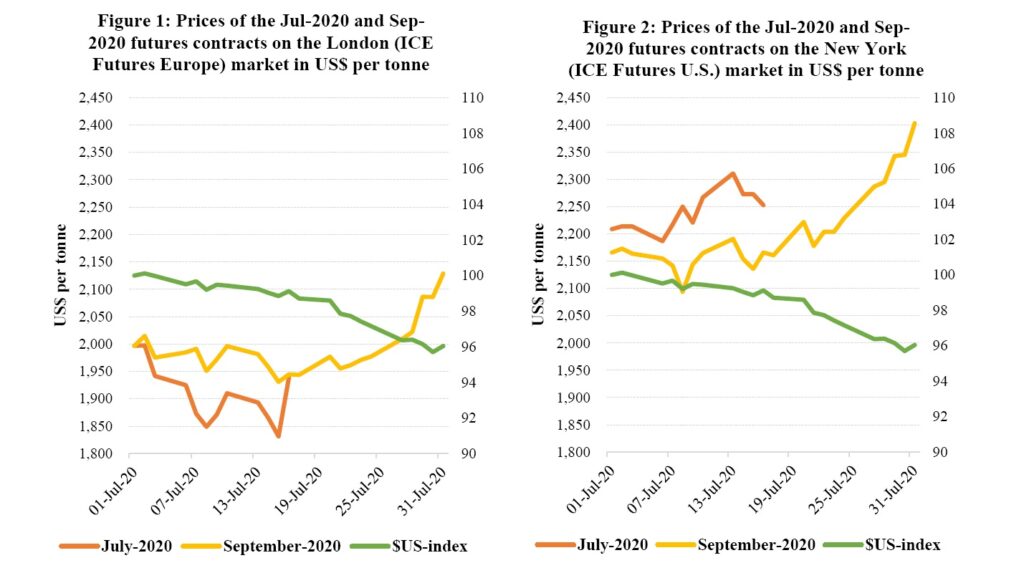

Figure 1 shows the development of the aforementioned futures contracts prices on the London market whilst Figure 2 depicts the evolution of prices for the same futures contracts on the New York market at the London closing time.

Hence, by monitoring the development of the US dollar index in July, one can determine the impact of the US dollar exchange rate on the development of the futures prices – denominated in US dollar – during the period under review.

Finally, Figure 3 presents monthly averages of cocoa butter and powder prices in Europe and the United States since the start of the 2019/20 crop year

Movements in cocoa prices

While approaching the maturity date (16 July 2020) of the JUL-20 contract, the London market was in contango whereas New York was in backwardation. Indeed, the JUL-20 contract priced with an average discount of US$67 per tonne over the SEP-20 contract in London while in New York, a premium of US$87 per tonne was established between prices of these futures contacts.

Regarding cocoa futures price movements (Figure 1 and 2) over the month of July, the SEP-20 cocoa futures contract prices perked up by 7% from US$1,997 to US$2,129 per tonne in London and by 9% from US$2,209 to US$2,403 per tonne in New York.

The recorded rise in prices was driven by various factors. On the one hand, there was a 4% depreciation of the US dollar. As a result, the US-dollar denominated cocoa prices were expected to increase by this same magnitude ceteris paribus.

On the other hand, as compared to last season levels, tighter arrivals were recorded in Côte d’Ivoire, Ghana and Nigeria. Moreover, in the course of the investigated month, certified stocks of cocoa beans in European warehouses declined by 14% year-on-year to 117,453 tonnes.

At the same time in the United States, certified stocks of cocoa beans drastically collapsed by 41% to 6,961 tonnes.

It should be noted that cocoa futures and cocoa butter price movements are positively correlated, whereas cocoa powder prices are inversely correlated to that of cocoa futures.

Figure 3 shows that compared with the average prices recorded at the start of the 2019/20 cocoa year, prices for cocoa butter ebbed during July in both Europe and the United States. Indeed, pricesfor cocoa butter declined by 17% from US$6,331 to US$5,257 per tonne in the United States, while in Europe they shrank by 18%, moving from US$6,260 to US$5,128 per tonne.

On the contrary, compared to the levels reached in October 2019, prices for cocoa powder considerably boomed on both markets, spiking by 33% from US$2,261 to US$3,018 per tonne in the United States. During the same time frame in Europe, powder prices soared by 43% from US$2,003 to US$2,873 per tonne.

In addition, compared to their average values recorded at the start of the 2019/20 cocoa year, the nearby cocoa futures contract prices plummeted by 19% from US$2,423 to US$1,957 in London at the end of July 2020. Similarly, in New York, the frontmonth contract prices tumbled by 9% from US$2,467 to US$2,250 per tonne over the same period.

Cocoa supply and demand situation

At the end of July, cocoa arrivals in Côte d’Ivoire and Ghana remained lower compared to levels attained one year ago. Indeed, as at 3 August 2020, cumulative cocoa arrivals at Ivorian ports, since the 2019/20 season started, were established at 2.043 million tonnes, down by 5.4% from the 2.160 million tonnes reached during the same period in the previous season.

In Ghana, the Ghana Cocoa Board (COCOBOD) reported that during the period 1 October 2019 – 4 June 2020, cocoa purchases amounted to 742,725 tonnes. This represents a 4.3% drop from the volumes bought over the same period of the previous season.

On the demand side, a bearish stance was seen in the second quarter of 2020 grindings figures published by the main regional cocoa associations. Indeed, the European Cocoa Association (ECA) released data showing a year-on-year decrease of 8.9% to 314,108 tonnes in grindings while the Cocoa Association of Asia (CAA) announced a decline of almost 6% to 202,674 tonnes year-on-year.

In the same vein, processing activities weakened in North America during the second quarter of 2020 with the National Confectioners’ Association (NCA) reporting a 10.7% reduction to 110,776 tonnes of cocoa beans grinded.

At the end of August, the ICCO Secretariat will release its revised crop and grindings forecasts for the current cocoa year in its Quarterly Bulletin of Cocoa Statistics.