LONDON – The current review focuses on cocoa price movements on the international markets during the month of November 2014.

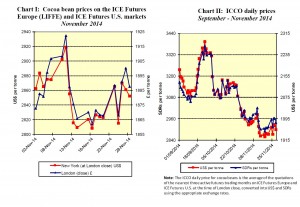

Chart I (click to enlarge) illustrates price movements on the London (ICE Futures Europe) and New York (ICE Futures U.S.) markets in November. Chart II shows the evolution of the ICCO daily price, quoted in U.S. dollars and in SDRs, from September to November 2014.

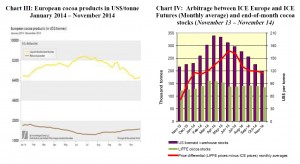

Chart III depicts the prices of European cocoa products from January 2014 to the present while Chart IV shows recent changes in warehouse stocks of cocoa beans and the price differential between the two cocoa futures markets.

Price movements

In November 2014, the ICCO daily price averaged US$2,909 per tonne, down by US$192 compared to the average price recorded in the previous month (US$3,101), and ranged between US$2,858 and US$2,983 per tonne.

During the first trading session of the month, as cocoa futures prices extended the price decline initiated at the end of the previous month, quotations hit a six-month low in London, at £1,873 per tonne and a ten-month low in New York, at US$2,863 per tonne.

Bearish fundamental factors resulting from weak cocoa demand, a rising United States dollar and relatively strong weekly arrivals of cocoa beans to ports in Côte d’Ivoire contributed to this fall.

However, moving onwards till the early part of the second week of the month, cocoa futures prices unexpectedly followed an upward trend despite the persisting aforementioned bearish factors which showed no signs of abating.

As seen in Chart I, cocoa futures attained their highest level for the month in both ICE Futures Europe and ICE Futures U.S., at £1,922 per tonne and at US$ 2,919 per tonne respectively.

Towards the middle of the month, the apparent disappearance of the threat of an Ebola outbreak which had disrupted cocoa harvesting and shipment in the top producing countries in West Africa, combined with good weather conditions and reports of a strong harvest for the region, led cocoa futures prices to decline sharply to their lowest levels in November.

Thus cocoa futures prices fell in both markets to £1,862 per tonne in London and to US$2,808 per tonne in New York. Thereafter, from the third week to the end of the month, cocoa prices showed no clear direction, amid expectations of weak fourth quarter European grindings data, combined with the publication of mixed reports from market players, some of which indicated a production deficit while others projected a surplus.

Certified warehouse stocks of cocoa beans

Compared to the previous month, both markets reported a fall in the volume of certified warehouse stocks.

In New York, volumes fell from 226,061 tonnes to 199,829 tonnes, while in London, they fell from 140,260 tonnes to 134,370 tonnes.

As shown in Chart IV, the arbitrage narrowed from an average of US$120 in October 2014 to US$116 in November 2014.

Supply & demand situation

According to news agency data, cocoa arrivals at ports in Côte d’Ivoire were around 532,000 tonnes by 7 December, compared with the start of the season on 1 October. This represented a fall of approximately 13% compared with 609,000 tonnes reported for the same period of the previous season.

In Ghana, cumulative cocoa purchases by the Ghana Cocoa Board reached 87,254 tonnes in the first three weeks of the season, as at 23 October 2014.

This was 62% lower compared with 228,043 tonnes reported for the first three weeks of the previous season, but only about 19% lower when compared to the level reached for the same period of the previous season.

However, it should be noted that the previous season opened two weeks later than the current season (3 October), thereby introducing a bias when analysing purchases figures.

With regard to demand, industry reports indicate that high prices in cocoa futures as well as large stocks of cocoa powder have quelled processing activities and consequently the price of cocoa butter and powder.

As seen in Chart III, prices of cocoa butter reached a 16-month low below $7,000, as a result of relatively weak demand in both emerging and traditional markets, which placed strong pressure on processing margins.