The current review of the cocoa market situation reports on price movements on the international markets during the month of October 2016.

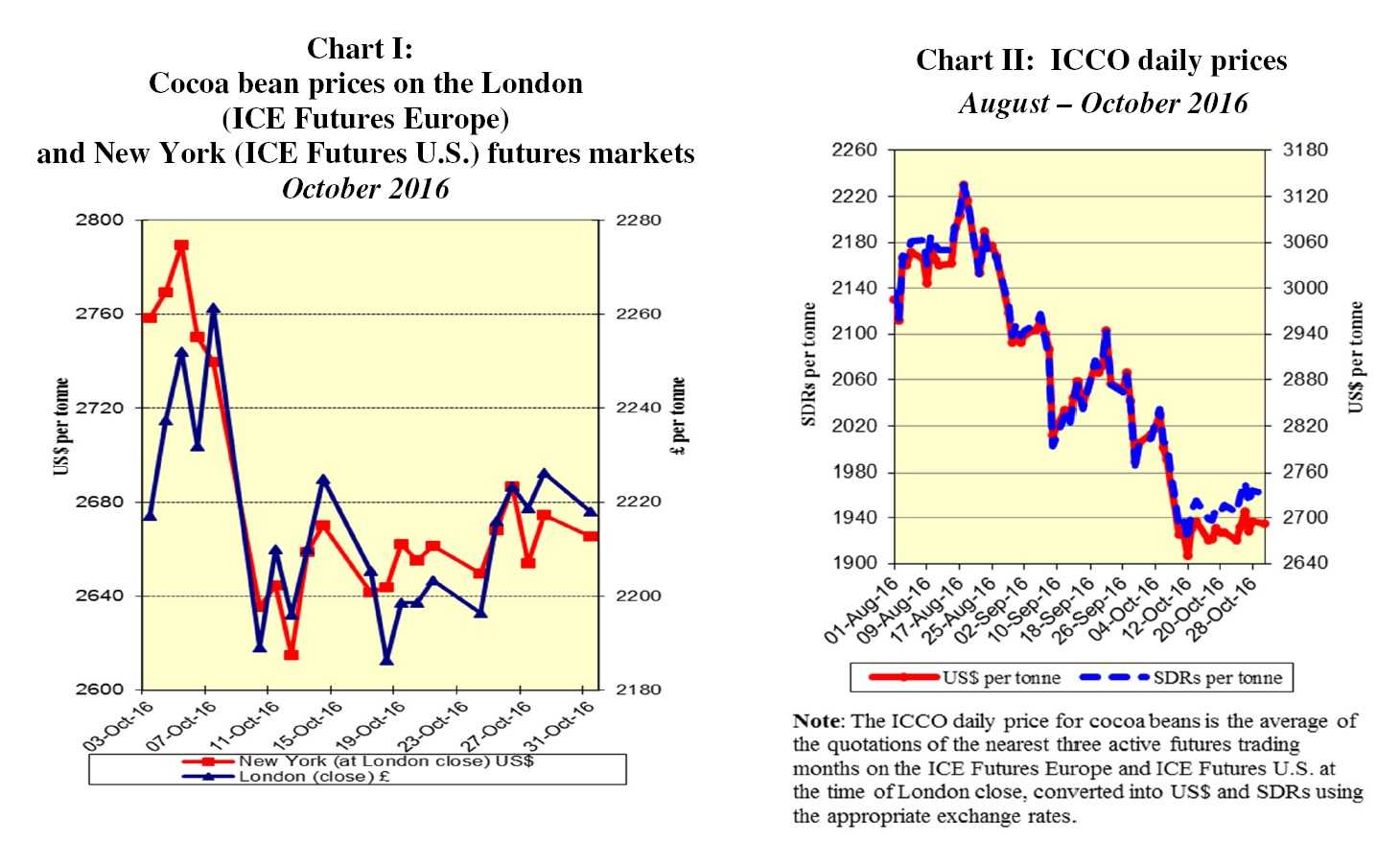

Chart I illustrates price movements on the London (ICE Futures Europe) and New York (ICE Futures US) markets in October.

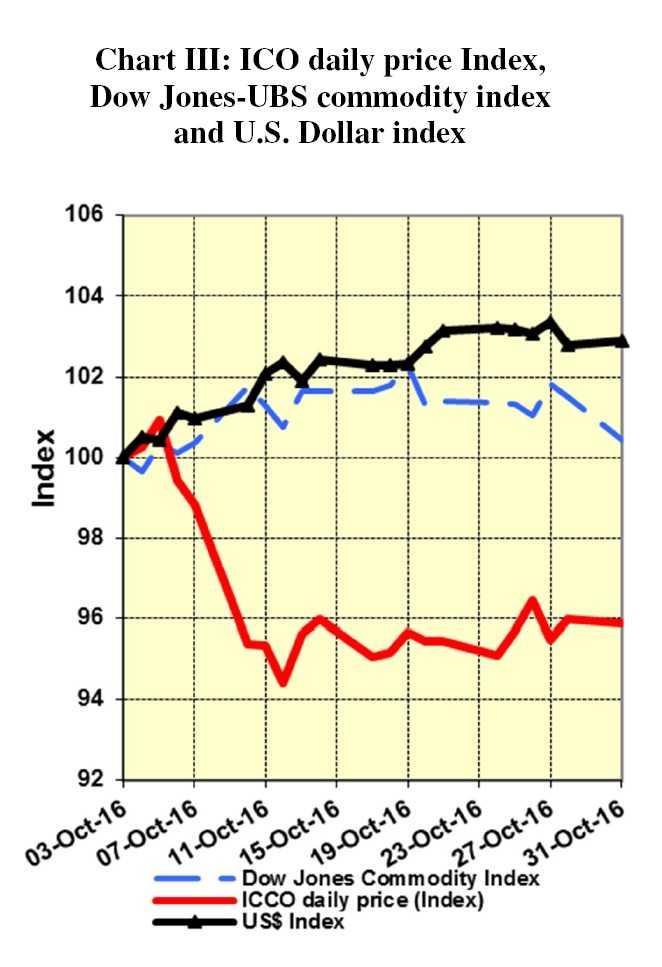

Chart II shows the evolution of the ICCO daily price, quoted in US dollars and in SDRs, from August to October 2016, while Chart III depicts the trend in the ICCO daily price Index, the Dow Jones Commodity index and the US dollar Index.

Price movements

Price movements

In October, the ICCO daily price averaged US$2,711 per tonne, down by US$170 compared with the average price recorded in the previous month (US$2,881) and ranged between US$2,651 and US$2,835 per tonne.

During the first week of October, cocoa futures markets surged to their highest level for the month and settled at £2,261 per tonne in London and at US$2,790 per tonne in New York.

This increase was spurred by a weakening Pound Sterling following concerns over the state of the UK’s economy which had re-surfaced following the announcement by the British Prime Minister that formal negotiations for Britain to leave the EU will start by March 2017.

However, as shown in Chart I, the rise in cocoa prices was short-lived, and cocoa futures prices declined in the second week of the month, reaching their lowest level for the month by the end of the third week, at £2,186 per tonne in London and at US$ 2,615 per tonne in New York.

The general market expectation of a surplus for the ongoing 2016/2017 cocoa season was the main factor that led to downward pressure on cocoa prices, despite reports of excessive rainfalls in some cocoa producing areas in Côte d’Ivoire, thus raising the threat of crop disease.

Towards the end of the month under review, cocoa futures moved sideways, with the release of grindings data from Europe, Asia and North America, which was mostly in line with market expectations and the publication of weak weekly arrivals at ports in Côte d’Ivoire, being the main market fundamentals influencing prices.

As shown in Chart III, the cocoa market was globally outperformed by the broader commodity complex which remained strong despite the strengthening of the US dollar. The general market expectation of rising global output in 2016/2017 was the main market

fundamental in maintaining a downward pressure on cocoa futures prices in October.

Supply and demand situation

Supply and demand situation

The 2016/2017 cocoa harvest started slowly in West Africa, as expected, as the crop development was delayed due to dry weather conditions.

Indeed, as at 6 November 2016, total cocoa arrivals at Ivorian ports had reached 252,000 tonnes since the start of the ongoing season; representing an approximate 30% decrease from 362,000 tonnes in the same period of the previous season.

However, as weather conditions have been favourable in recent months for crop development, in particular in light of conducive rainfall in September, the flow of cocoa beans reaching the Ivorian ports is expected to pick up in the coming weeks.

In Ghana, cocoa purchases recorded by the Ghana Cocoa Board amounted to approximately 200,000 tonnes as at the end of October, according to government officials.

On the demand side, while European and Asian grindings rose in line with market

expectations in the third quarter of 2016, by 2.9% and 12.45% to 343,935 tonnes and 167,637 tonnes respectively, North American grindings on the other hand, increased slightly, at a rate below market expectation, by 0.5% to 124,412 tonnes.

Nevertheless, this general rise in regional grindings data should not necessarily be interpreted with optimism in relation to global demand.

Indeed, grindings data from Côte d’Ivoire for the 2015/2016 cocoa season shows a substantial decrease, as compared to the previous cocoa season.

Market participants are therefore of the view that the general rise in grindings figures for the third quarter of 2016 could partially be attributed to the production fall in Côte d’Ivoire for the past cocoa season.

At the end of November, the ICCO Secretariat will release its revised supply and demand

estimates for the 2015/2016 cocoa year in its Quarterly Bulletin of Cocoa Statistics.