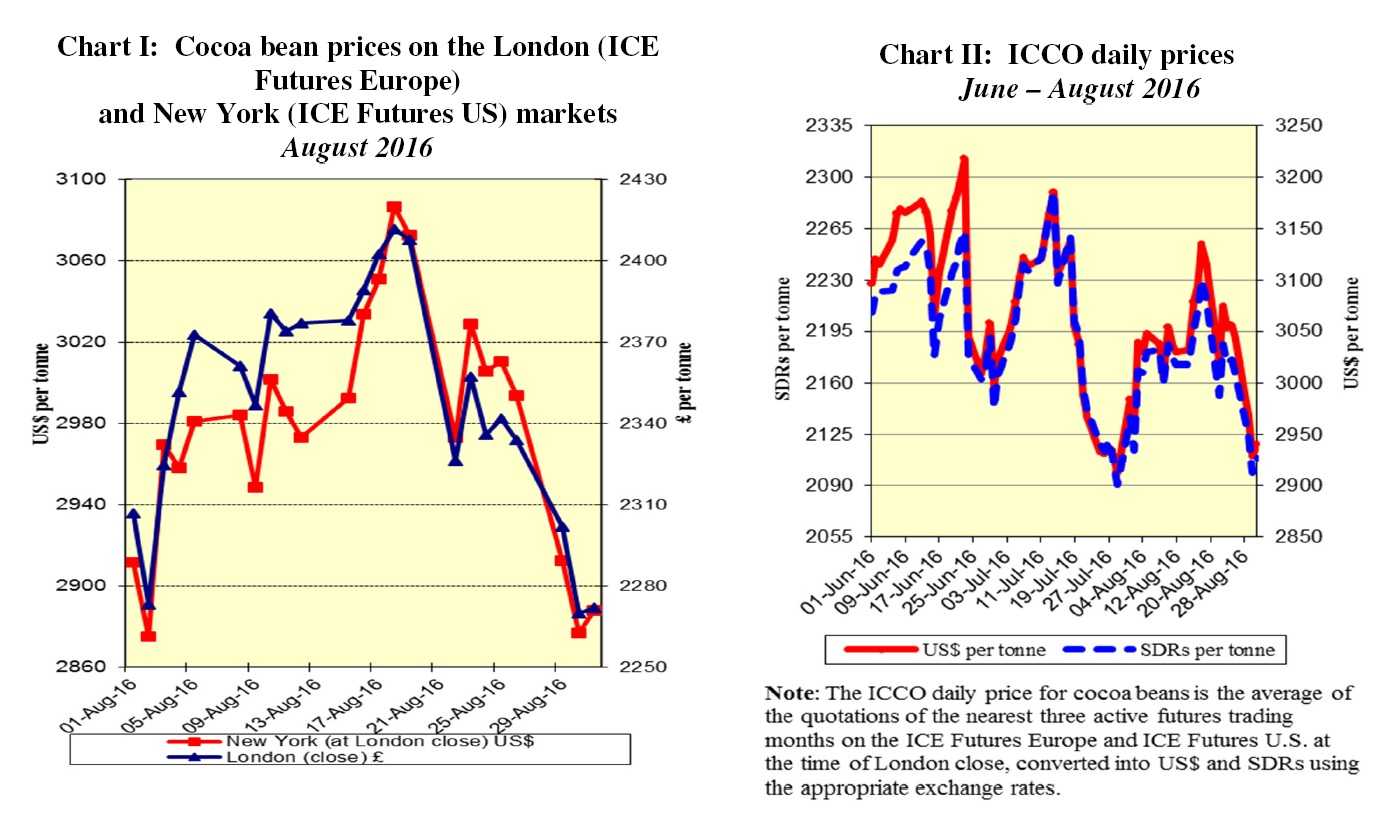

The current review reports on cocoa price movements on the international markets in August 2016. Chart I illustrates price movements on the London (ICE Futures Europe) and New York (ICE Futures U.S.) markets for the month under review.

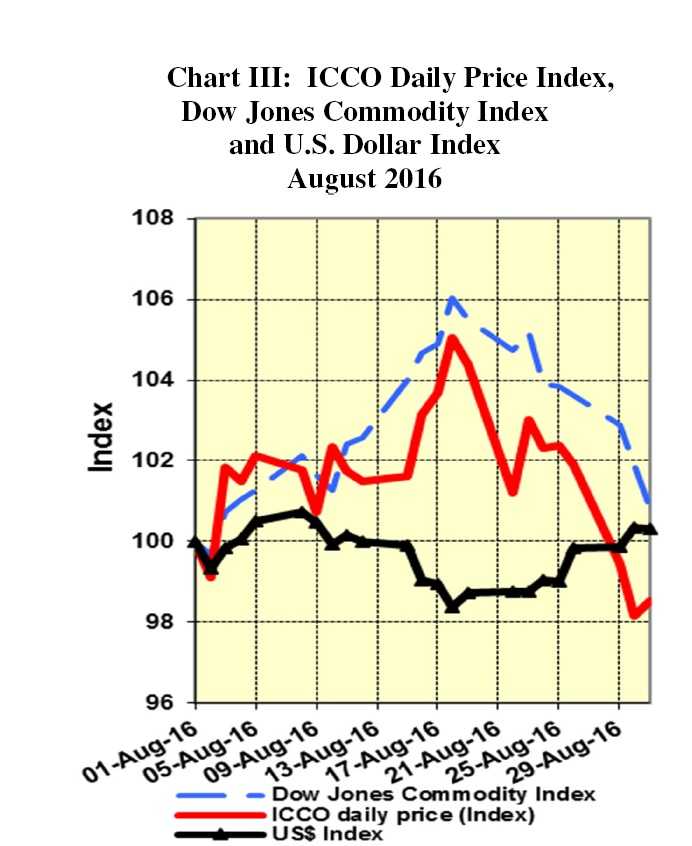

Chart II shows the evolution of the ICCO daily price, quoted in US dollars and in SDRs, from June to August 2016. Chart III depicts the change in the ICCO daily price Index, the Dow Jones Commodity Index and the US Dollar Index during the month.

Price movements

Price movements

In August, the ICCO daily price averaged US$3,033 per tonne, down by US$17 compared to the average price recorded in the previous month (US$3,350). Prices ranged between US$2,929 and US$3,135.

The decline of cocoa prices initiated in the middle of July continued at the start of the August, following expectations for improving cocoa production for the upcoming main crops (2016/2017) in West Africa.

Cocoa futures fell to their lowest level for the month under review, at US$2,875 per tonne in New York and attained £2,273 per tonne in London.

Thereafter, cocoa futures gradually rallied due to current crop arrivals drying up almost completely and amid speculation over the impact of dry weather conditions ahead of the new crop.

By the end of the third week of the month under review, cocoa futures in both markets hit their highest level of the month, at £2,411 per tonne in London and at US$3,135 per tonne in New York.

Thereafter, cocoa futures prices changed direction and generally followed a downward trend throughout until the end of the month in both markets amid reports of improving weather conditions towards the end of August in West Africa, thus bolstering market expectations of a return to a surplus for the upcoming 2016/17 cocoa season.

As a result, cocoa futures prices attained their lowest level of the month at £2,270 per tonne in London and also decreased to US$2,877 per tonne in New York.

Cocoa price movements during the month of August were also influenced by currency

movements, in particular reaching their peak when the US$ was the weakest against other

currencies and declining in the second half of the month when the US$ strengthened, as seen in Chart III.

Supply & demand situation

Data published by news agencies indicated that cumulative cocoa arrivals at ports in

Côte d’Ivoire reached approximately 1,458,000 tonnes by 4 September, as compared

with 1,732,000 tonnes recorded in the same period of the previous season (a 16% year-onyear decrease).

Although the season is not yet over, it is clear that cocoa production in Côte d’Ivoire will not reach the high levels attained during the previous two cocoa years.

The major contributory factors behind this relatively modest crop are the dry weather and severe harmattan conditions that have prevailed during the season.

The attention of most market participants has now turned towards next season’s main crop. While the lack of rainfall in some areas is posing challenges for the upcoming new season, the prospects look much more favourable than for the current 2015/2016 season.

In Ghana, the ICCO anticipates production for 2015/2016 to reach 820,000 tonnes and, as indicated in the previous report, this is set to confirm a significant improvement as compared to the previous season.

On the demand side, the ICCO expects world grindings of cocoa beans to be projected to be relatively flat in the 2015/2016 season compared to the previous season, reaching 4.160 million tonnes.

The positive growth in Europe, North America and Asia in the second quarter of 2016 has contributed to this development.

Nevertheless, it should be noted that grindings in these regions are reported to have increased on the back of the fall in cocoa production in West Africa which has suffered from lower availability to West African processors of quality beans.

This has led major processors to shift their grindings businesses to traditional processing regions which, on the other hand, have drawn on their stocks to remain operational.