ABIDJAN, Côte d’Ivoire – Headlines continue to reiterate the current global supply shortfall and moreover, the ongoing seasonal intense Harmattan winds in West Africa are exacerbating the bullish prices situation. Since the start of the 2023/24 season, arrivals at Ivorian ports are estimated to be down by 34% year-on-year to 1.051 million tonnes as at 4 February 2024.

In Ghana, graded and sealed cocoa purchasess were down year-on-year by 35% to 351,000 tonnes.

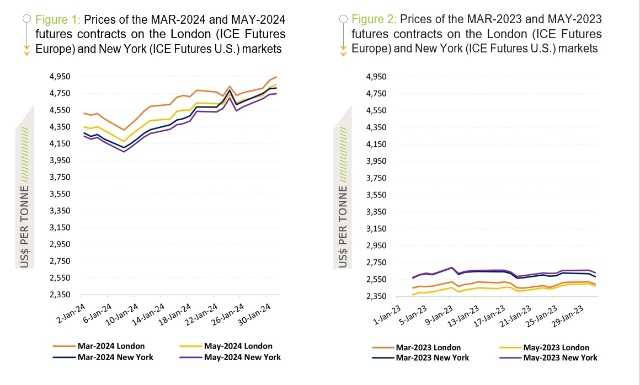

For the month under review, the nearby contract i.e., MAR-24 price in London and New York averaged US$4,540 per tonne and US$4382 per tonne, respectively. Compared to the nominal average price in January 2023, prices are up by 84% in London and 67% in New York.

ICCO releases Cocoa Market Review for January

With reference to Figure 1, the current backwardation structure of the cocoa market underscores the supply challenges and consequent high prices. In London and New York, the average price difference between the MAR-24 and MAY-24 contracts for January 2024 stood at US$134 per tonne and US$55 per tonne, respectively.

A year ago, in January 2023 the average price difference in London was US$50 per tonne, while in New York the market remained in contango i.e., less than US$19 per tonne (Figure 2).

Previous monthly reports have highlighted the issues which contributed to the challenges on the supply side in West Africa – the major outlet for global cocoa supplies. The Americas is the next main geographical area for global supplies. However, the region is currently not in a position and not an option to cater for the current shortfall, as the beans it produces attract a high premium and are expensive because of their fine flavour attributes.

Stocks inventories have also shown a reduction and this further heightens the current supply concerns. As per the ICCO European stocks survey results for the period ended 30 September 2023, identified European stocks were down by 8% from 842,000 tonnes in September 2022 to 771,000 tonnes in September 2023. For the same time frame in North America, ICE US inventories declined from 368,000 tonnes to 323,000 tonnes.

The breakdown of the survey results is available here.

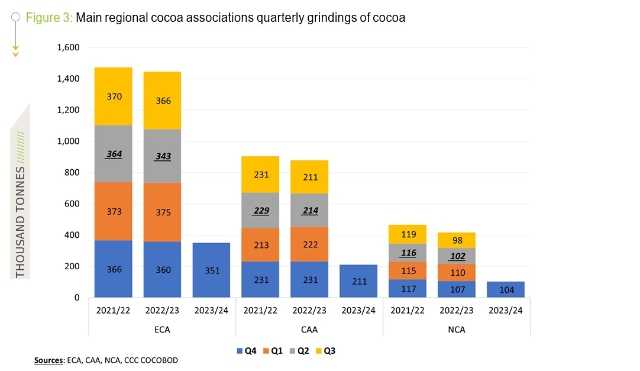

As shown in Figure 3, grindings data published by regional associations for Q4.2023 do not show significant changes compared to the Q4 period of the previous two cocoa years.

Whereas Europe’s Q4.2023 cocoa grindings as reported by the European Cocoa Association (ECA) fell by 2.5% from a year earlier to 350,739 tonnes, that of North America published by the National Confectioners Association (NCA) declined by 2.9% year-on-year to 103,971 tonnes.

ICCO: data from the Cocoa Association of Asia (CAA) revealed an 8.49% year-on-year drop to 211,202 tonnes.

With not much change in the volume of the beans processed for the Q4 period, does this depict that the traditional processing regions are drawing down on their stocks to maintain operations and can this be sustained given the current global supply scenario?

Origin processing has been promoted over the past years and Côte d’Ivoire is currently seen as the leading cocoa grinder in the world.

However, there is the likelihood of origin grindings being affected by the low availability of beans at major origin destinations. News agencies report that Ivorian cocoa grindings from the start of the 2023/24 season to the end of December 2023 stood at 169,953 tonnes of beans – down by 1.5 % compared with the same point last season.

Though it is nothing new in Ghana, some companies are reported to have imported cocoa beans from neighboring countries for their operations in the country.

As the leader in global supplies and processing, the Ivorian Le Conseil du Café-Cacao is reported to have taken steps to cater for the ongoing supply situation. These include a halt on the 2024/25 forward sales and a restriction on cocoa processors keeping stocks beyond the set limits.

There is a general view that the ongoing supply tightness originated from structural issues. In addition, concerns over the decline in supply could further deepen as the enforcement of the European Union regulation on deforestation draws closer.

With the leading producer taking certain strategic steps (including a suspending of the 2024/25 forward sales and a restriction on stocks limits), it would be beneficial if all major players reconsider the structural issues (aged trees, diseases, remunerative farm gate prices, climatic challenges, etc.) being faced by the cocoa sector.