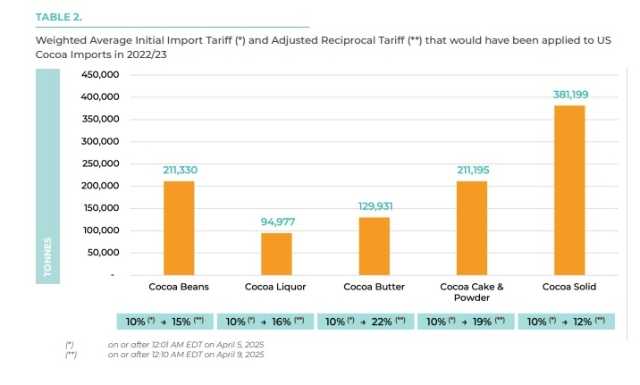

ABIDJAN, Côte d’Ivoire – Icco released the new cocoa market report for March 2025 as reported. As the 2024/25 main crop entered its last month i.e., March 2025, cocoa prices pulled back from the high prices and remained range bound. In London, at an average price of US$8,100 per tonne, the front month contract ranged between US$7,844 and US$8,326 per tonne and in New York it averaged US$8,055 per tonne and ranged between US$7,728 and US$8,415 per tonne (Figure 1).

As shown in Figure 1, the front month contract throughout the month under review generally traded at a discount as compared to the second month contract – an indication that supply tightness was not taking place.

A year ago, i.e., March 2024, the nearby contract was trading at an average premium of US$372 per tonne (Figure 2). Though the supply side of the market was less of a concern in March 2025, there were pessimistic views regarding the Ivorian mid- crop as reports indicated that more rains were needed at the time. It is worth pointing that as at the time of writing this report, rains in Côte d’Ivoire have started and the Secretariat would continue to monitor its impact on the country’s production.

Another aspect to consider too is that as production forecasts for other major producing countries are likely to be better than that of 2023/24 season, it is likely the output from the other countries may offset the losses envisaged from the Ivorian mid-crop. As such, prices at the time did not react significantly to the views of an expected poor mid-crop from Côte d’Ivoire.

The weakening of cocoa demand also played a role in the bearish developments observed in cocoa prices . By mid-April, the regional associations will publish their quarterly grindings data and this would further shed light on demand. Between 3 and 31 March 2025, cocoa beans stocks at ICE Futures London increased by 68% from 34,070 tonnes to 57,390 tonnes. At ICE Futures New York, for the same time frame, cocoa beans stocks rose by 25% from 1,463,836 bags to 1,833,665 bags.

As at March 2025, the United States tariffs had not yet been implemented but news of its advent caused jittering among market participants as it was envisaged to result in global macroeconomic uncertainty and a trade war on tariffs among countries was expected.

Recent changes in US trade policy on cocoa

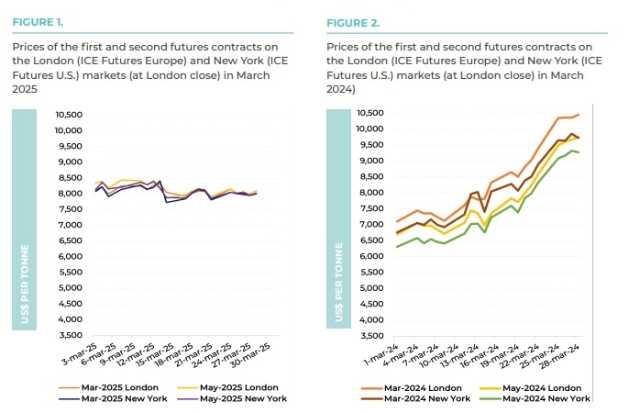

Eventually, as at the time of writing this report, the US tariffs have been implemented. Although a 90- days pause on all countries except China came into effect on 9 April 2025, a universal tariff of 10% applies on all exports to the United States. Nevertheless, the Secretariat has come up with some scenarios regarding the tariffs on cocoa. Despite the 90-days tariffs suspension, estimates made by the Secretariat in Table 1 below shows the expected tariffs on cocoa for some ICCO member countries.

Using trade data from the 2022/23 cocoa year, Table 2 illustrates a weighted average on the tariffs for cocoa beans and cocoa semi- finished products. The Secretariat will continue to monitor the situation and report accordingly.