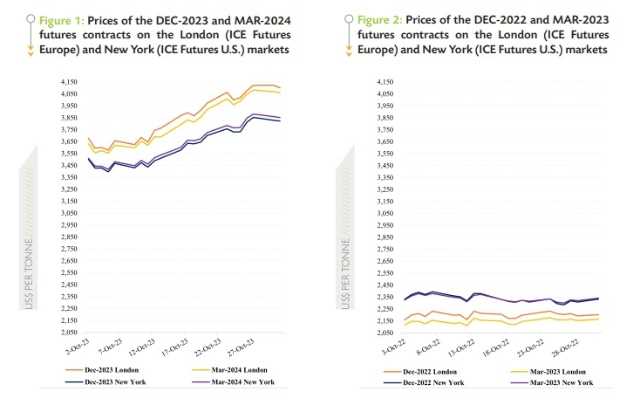

ABIDJAN, Côte d’Ivoire – On the heels of two consecutive years of deficit in conjunction with the expectation of another deficit for the current season, cocoa futures have continued to be bullish. From the beginning to the end of October 2023, based on the nearby cocoa futures (i.e., DEC-23 contract), prices increased by 12% in London from US$3,676 per tonne to US$4,102 per tonne.

Similarly, at the London closing time, cocoa futures prices in New York rose by 9% from US$3,500 per tonne to US$3,822 per tonne (Figure 1).

ICCO: does cocoa supply look set for another deficit?

Prior to the start of the 2023/24 season, carry-over of beans from the past season to the current season was reported as farmers looked forward to an increase in producer prices. As such, ample supplies were anticipated to be available for October 2023.

Indeed, compared to the previous season, Côte d’Ivoire increased its producer price from US$1,322.84 per tonne(1) to US$1,626.02 per tonne(2) , while in Ghana it went up from US$1248.78 per tonne(3) to US$1,837.11 per tonne(4).

But the producer price increase and carry-over beans have not currently mitigated the supply tightness. Arrivals in Côte d’Ivoire were reported as 227,000 tonnes by 29th October down 23.1% from the same period last season.

The downside to supply has emerged from several angles. Unseasonal heavy rains have prevented the drying of beans and led to degraded bean quality. Black pod diseases and swollen shoot virus due to the excess rains have been reported in cocoa regions.

Floods have also rendered major roads in some cocoa regions to be difficult to access. Should the weather revert to normal conditions for this time of the year, it is likely arrivals may improve as more beans may start to leave the farms for the ports.

As at the time of writing, Ghana is yet to release its graded and sealed purchases of beans. Ghana’s producer price is about US$211 tonnes above that of Côte d’Ivoire. As cross border trading is nothing new within West Africa, it is likely that beans are moving from Côte d’Ivoire to neighbouring countries.

This may be causing the current low levels of arrivals at ports in Côte d’Ivoire. Nevertheless, series of cumulative arrivals are needed for one to be in a better position to give a first estimate of the 2023/24 crop size.

Icco: futures price developments

During October 2023, prices of the nearby cocoa futures contract averaged US$3,844 per tonne and ranged between US$3,578 per tonne and US$4,122 per tonne in London. In New York, the nearby contract averaged US$3,604 per tonne and ranged between US $3,396 per tonne and US$3,853 per tonne (Figure 1).

These prices were way above the prices recorded in the same period of the previous season.

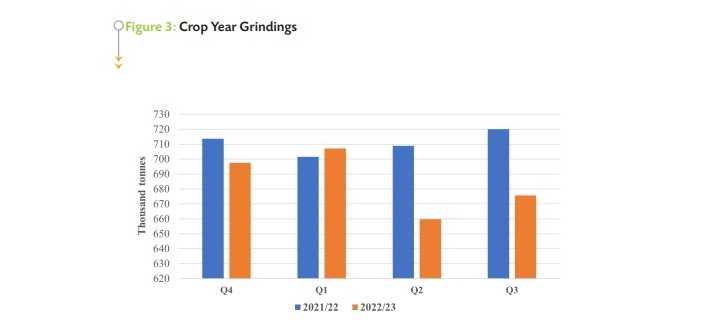

For October 2022, the nearby contract in London averaged US$2,200 per tonne and ranged between US$2,159 and US$2,232 per tonne.

In New York, prices ranged between US$2,283 per tonne and US$2,394 per tonne and averaged US$2,338 per tonne (Figure 2).

The price rallies seen in October 2023 mainly result from the much lower volume of beans available as compared to the quantities available in October 2022.

What about demand?

Based on published grindings data from the European Cocoa Association (ECA), National Confectioners Association (NCA) and the Cocoa Association of Asia (CAA), total grindings for the 2022/23 season dropped by almost 4% from 2,844,132 tonnes in the 2021/22 season to 2,739,982 tonnes.

It is worth pointing out that though Q3.23 grindings are lower than those recorded in Q3.22, the decline in the former was less than expected (Figure 3).

Yet still, it is too early to view how demand is faring amid cocoa price increases and slowdown in cocoa production. Uncertainty remains as high prices across the board (i.e., from raw materials to final products) may sap consumer spending and could bring winds of change to what seems like an improvement in demand.

The subsequent quarters’ grindings data publication will provide a better view of how cocoa demand unfolds.

Notes

- US$1 = 25 CFA as of 30 September 2022 – the Conseil du Café-Cacao announced the fixed farmgate price for 2022/23 season

- US$1 = 50 CFA as of 30 September 2023 – the Conseil du Café-Cacao announced the fixed farmgate price for 2023/24 season

- US$1 = 25 Ghana cedis as of 5 October 2022 – the Ghana Cocoa Board announced the fixed farmgate price for 2022/23 season

- US$1 = 40 Ghana cedis as of 9 September 2023 – the Ghana Cocoa Board announced the fixed farmgate price for 2023/24 season