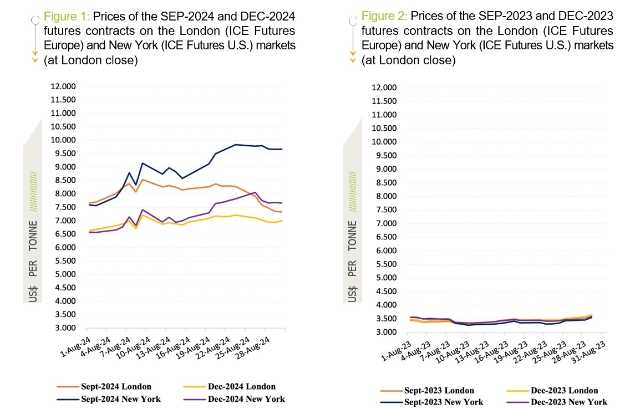

ABIDJAN, Côte d’Ivoire – In August, it appeared the cocoa market entered a new phase characterized by “relatively low” cocoa prices. At the end of August, the monthly average cocoa price in London represented a six-month low at US$8,047 per tonne, while in New York, it was a one-month low at US$8,992 per tonne. These prices can be interpreted as ‘relatively low’ as they are about 133% and 163% above the average price recorded for August 2023 in London and in New York, respectively (Figure 1 and 2).

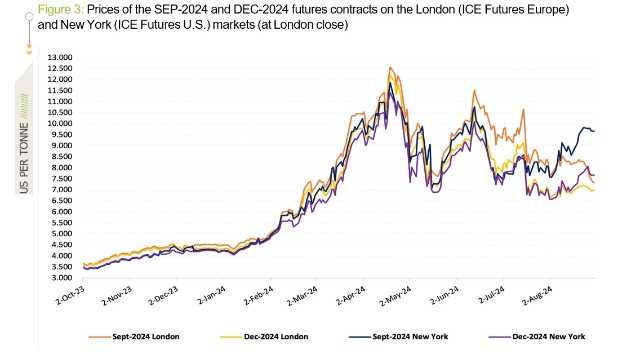

As shown in Figure 1, during the month under review, it was observed that the nearby contract (SEPT-24) in New York followed an upward trend, while it declined in London. It is worth noting that, since the start of the 2023/24 season, the price for the SEPT-24 contract for London has been above that of New York until August 2024 (Figure 3). Moreover, during the month, the difference between the SEPT-24 and DEC-24 contracts widened in New York, while it narrowed in London (Figure 1).

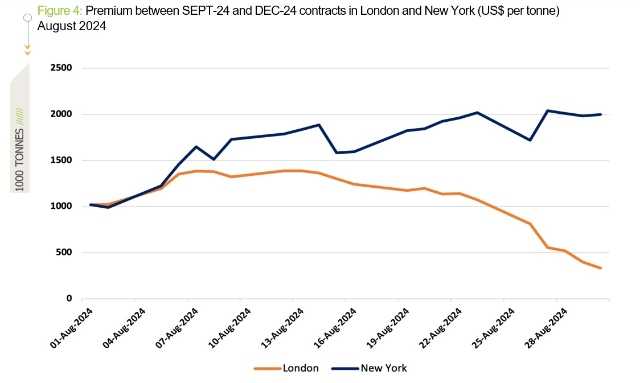

In August, between the SEPT-24 and DEC-24 contracts, the monthly average premium in New York was at US$1,710 per tonne and rose throughout the month, while in London it was at US$1,078 per tonne and tumbled (Figure 4).

The high prices in New York may be associated with the differences in either the level of stocks between New York and London or their rate of decline.

As West Africa feeds the London market, expectations for better supplies from the region, especially from Côte d’Ivoire and Ghana for the upcoming 2024/25 season may be reflecting in the low prices seen in London. On the other hand, to make profit, traders in London may be taking a short position to sell now and later buy these contracts at a lower price.

Reports of conducive weather conditions, which is expected to bolster the 2024/25 main crop especially across the West African cocoa belt, were the main factor that provided the relief in prices.

The fall in prices signaled easing concerns about the availability of cocoa beans. As the market is approaching the end of the season, it is expected that origin selling in the coming weeks for the 2024/25 crop may further pressure prices downward. As at the time of publishing this report, Ghana has announced the opening of its 2024/25 season and informed the public of the expectation of a better production for the new season.

However, with the market still in backwardation, can we anticipate further price declines and improved availability of supplies? There has been a postponement of bean delivery from the current season to the 2024/25 season. Would upcoming supplies be enough to immediately satisfy the market?

As mentioned in previous reports, price increases which are expected to support farm investment will not lead to an immediate increase in supply due to the time lag effect. As a perennial tree, it can take three to four years for new cocoa trees to begin producing beans. Moreover, issues including diseases especially CSSVD and climate change persist and compound the problems faced by cocoa farmers.