ABIDJAN, Côte d’Ivoire – In the lead-up to the opening of the season, the general view from market participants was that the 2024/25 global production would increase above that of the past season and possibly lead to a limited surplus. Bearing in mind that Côte d’Ivoire accounts for over 40% of global production, it goes without saying that arrivals data from the country are very consequential not only for the trade balance but also price movements.

The season has now kicked off and considering the flow of cocoa arrivals amid an increase in producer prices, one would generally expect to see a continuous year-on-year rise in cocoa flows. However, for the month under review, there were divergent flows of arrivals in Côte d’Ivoire, and this contributed to the price movement of cocoa at the time.

Côte d’Ivoire’s cumulative arrivals during October see-sawed and consequently affected prices. This will be explained in the section on price movements.

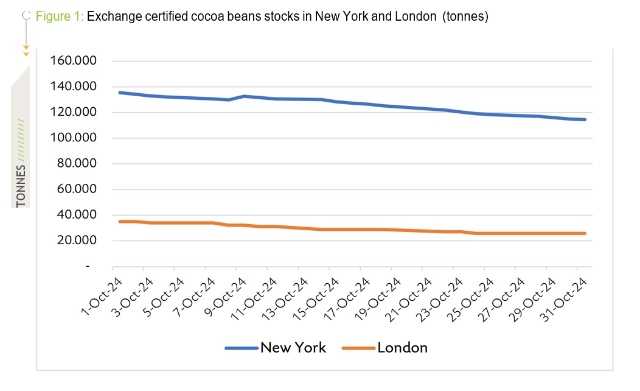

Depletion of exchange-certified stocks further heightened concerns about whether the market will be adequately supplied. The chart below shows the declining rate of exchange certified stocks during the month of October 2024.

In New York, cocoa stocks dropped to a 19-year low on 25 October 2024 when stocks fell to 118,230 tonnes. In London, total stocks as of 15 October 2024 were 29,020 tonnes compared to 150,520 tonnes for the same time of the previous season.

Future prices development

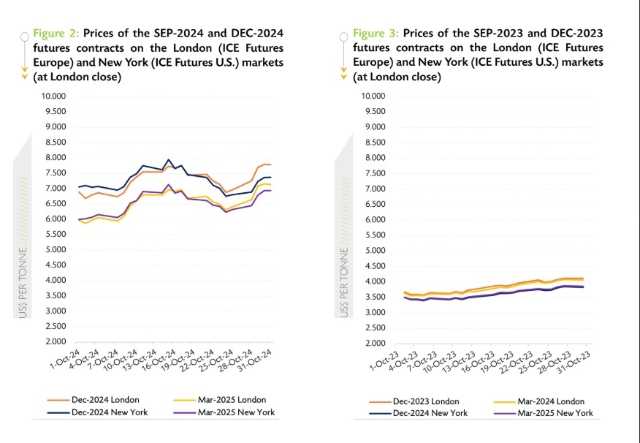

Cocoa prices developed upwards in the first two weeks of October as Côte d’Ivoire arrivals were reported at very low levels. As of 6 October, arrivals data were reported as 13,000 tonnes – down by 74% year-on-year. Then by 13 October, at 100,000 tonnes, arrivals data were still below that of last season by 12.3%.

The decline in arrivals during this period contributed to an increase in prices. By the middle of the month, compared to prices at the start of the season, the price of the nearby contract, i.e., DEC-24 in London had risen by 12% from US$6,896 per tonne to US$7,736 per tonne. For the same time frame in New York, prices rose by almost 13% from US$7,061 per tonne to US$7,950 per tonne.

Though the decline in arrivals supported prices, the decrease in arrivals may have been due to the slow pace of transportation of beans to the ports as heavy downpours during the period affected cocoa routes in Côte d’Ivoire. Furthermore, the situation was worsened by excess rainfall which hinders the proper fermentation and drying of beans, and consequently the quality of beans.

Prices may have also gained support from published grindings data during the month. Regarding grindings for the Q3.2024 quarter, whereas the National Confectioners Association and Cocoa Association of Asia posted year-on-year gains of 11.6% (109,264 tonnes) and 2.6% (216,998 tonnes) respectively, the European Cocoa Association published a drop of 3.3% (354,334 tonnes). With two of the three main regional associations posting positive grindings data, it raises the question whether the supply would be able to cater for the demand.

During the third week of the month, cocoa prices weakened as arrivals data improved. As at 20 October, Côte d’Ivoire arrivals were reported to be up year-on-year by almost 13% from 170,794 tonnes to 192,804 tonnes. By 24 October, prices had declined to US$6,881 per tonne in London and to US$6,754 per tonne in New York. The decline was short- lived, as reports on pod counting surveys for the main crop output were revised downwards as heavy rainfall led to a low survival rate of cherelles. Prices ended the month at US$7,785 per tonne in London and US$7,371 per tonne in New York.

With another eleven months to go, it is too early to provide concrete views on the season’s production. This report from Icco presented mixed sentiments regarding what holds for cocoa supply for the ongoing season.