ABIDJAN, Côte d’Ivoire – This review of the cocoa market situation reports on the prices of the nearby futures contracts listed on ICE Futures Europe (London) and ICE Futures U.S. (New York) during the month of November 2019. It aims to highlight key insights on expected market developments and the effect of the exchange rates on the US-denominated prices.

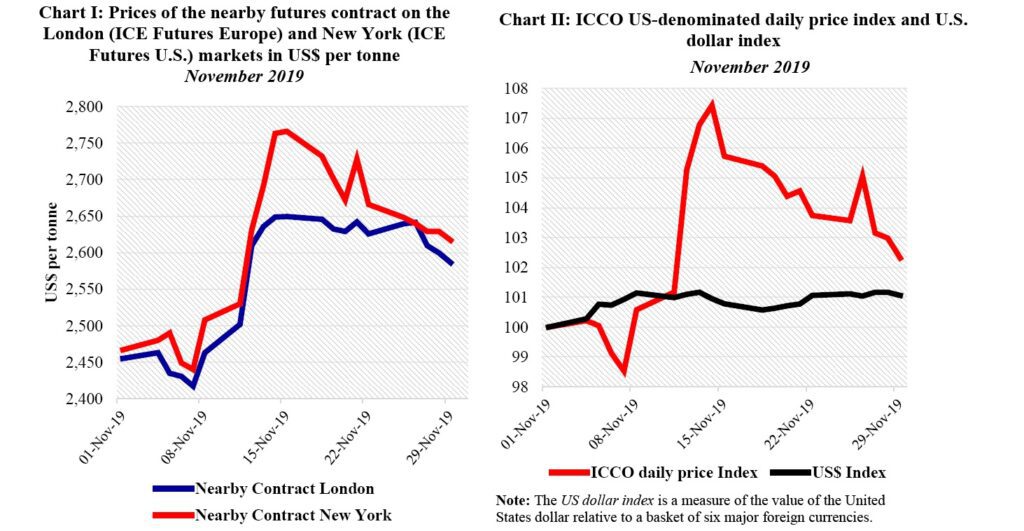

Chart I shows the development of the nearby futures prices on the London and New York markets at the London closing time. Both prices are expressed in US dollars.

Chart II depicts the change in the US denominated ICCO daily price index and the US dollar index in November.

By comparing these two developments, one can determine the impact of the US dollar exchange rate on the development of the US dollar denominated ICCO daily price index.

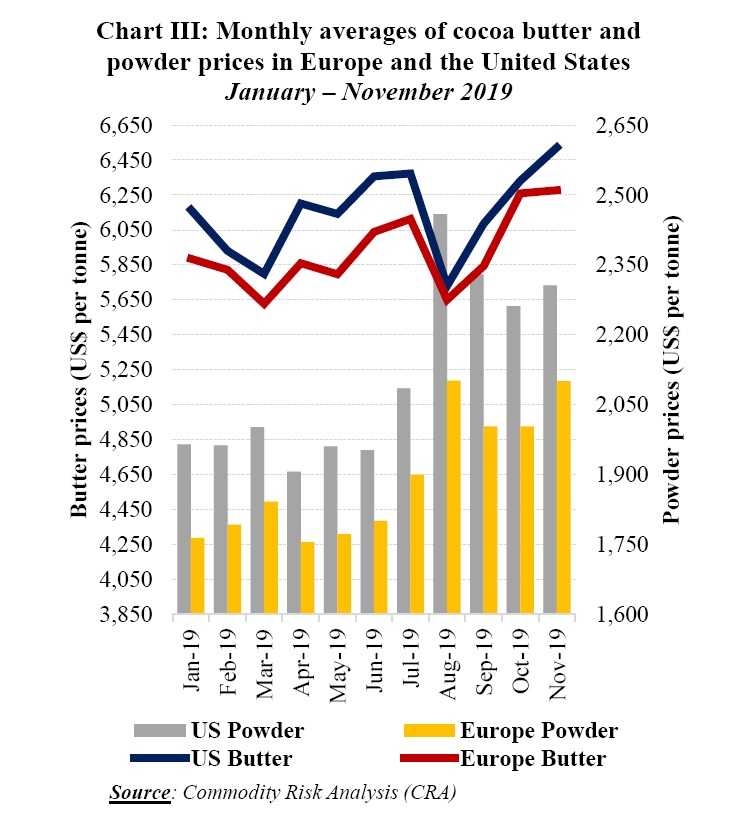

Chart III presents monthly average cocoa butter and powder prices in Europe and the United States since the start of 2019

Price movements

As illustrated in Chart I the nearby futures contract i.e. December 2019 (DEC 19) traded strongly on both the London and New York markets during November 2019. Compared to their values recorded during the first trading session of the month, prices ameliorated at the end of November by 5% from US$2,455 to US$2,586 per tonne and by 6% from US$2,467 to US$2,617 per tonne in London and New York respectively.

This increase was fuelled by prospects of a tight size for the ongoing crop combined with episodes of inappropriate meteorological conditions prevailing in the cocoa cultivation areas of the two premier producers (Côte d’Ivoire and Ghana).

On both the London and New York markets, three distinct stages were seen in the evolution of the front month contract prices. Although initial expectations indicated a relatively smaller output for the 2019/20 crop compared the level attained a year earlier during the timeframe 1-7 November, cocoa arrivals in Côte d’Ivoire and purchases in Ghana surpassed levels reached a year ago.

Thus prices first retreated by 2% from US$2,455 to US$ 2,417 per tonne and by 1% from US$2,467 to US$2,440 per tonne in London and New York respectively.

However, this decline in prices was brief and during the period 8-15 November, prices reverted from their plunge in response to increasing grindings and detrimental above average showers recorded in West Africa

In addition, concerns about the spread of black pod disease stemming from wetter weather conditions amplified the bullish trend seen in prices.

Subsequently, prices were boosted by 8% from US$2,463 to US$2,649 per tonne in London and by 10% from US$2,508 to US$2,766 per tonne in New York.

Finally, in the course of the second half of the month (16-29 November) prices halted their spike and shrank by 2% from US$2,646 to US$2,586 per tonne and by 4% from US$2,732 to US$2,617 per tonne in London and New York respectively as improved climate conditions were observed across West African producing countries.

In the course of November, the spread between the New York and London cocoa futures prices reduced drastically except over the period 13 25 November At the time, the volume of certified cocoa stocks dwindled year on year by 31% from 29,135 tonnes to 19,988 tonnes on ICE US Futures, whereas they spiked by 9% from 102,044 tonnes to 111,328 tonnes on ICE Europe Futures.

Chart II indicates that the US dollar appreciated by 1% during the analysis period while the ICCO daily price index strengthened by nearly 2% compared to its value at the beginning of November 2019. Hence, the amelioration in the US dollar weighed on cocoa prices.

The dynamics in cocoa butter and powder prices in Europe and the United States as outlined in Chart III indicate that, between January and November 2019 prices for cocoa butter and powder generally followed an upward trend on both of the world’s largest cocoa consuming markets.

Indeed, prices for cocoa butter improved by 6 from US$ 6,164 to US$6,522 per tonne in the United States, while in Europe they climbed by 7% moving from US$5,885 to US$ 6,278 per tonne.

Regarding cocoa powder, as compared to the levels reached at the start of 2019 prices increased by 17% from US$1,965 to US$2,306 per tonne in the United States.

At the same time in Europe, powder prices rose by 19% from US$1,764 to US$2,101 per tonne. Furthermore, compared to their average values recorded in January 201 9 the front month cocoa futures contract prices progressed by 19% and 13% in London and New York respectively at the end of November 2019. They rose sharply from US$2,153 to US$2,570 in London, while in New York they soared from US$2,303 to US$2,613 per tonne.

Cocoa supply and demand situation

At the end of the second month of the 2019/20 crop year, arrivals in both Côte d’Ivoire and Ghana were established at levels lower than the volumes reached a year ago. Indeed, as at 1 December 2019, cumulative arrivals of cocoa beans at Ivorian ports were reported at 694,000 tonnes, down by 2% from 708,000 tonnes attained during the same period during the 2018/19 season.

Over the period 25 November – 1 December, 40,000 tonnes of cocoa beans were delivered to Abidjan port, whilst 47,000 tonnes were recorded at the San Pedro port.

In Ghana, arrivals of graded and sealed cocoa were seen at 208,000 tonnes by 1 4 November 2019, down by 1 from 210,000 tonnes reached a year earlier.

The revised estimates published by the ICCO Secretariat in its latest issue of the Quarterly Bulletin of Cocoa Statistics show an increase in world grindings of 4.6% during the last season. Grindings reached 4.807 million tonnes, up by 211,000 tonnes.

This new estimate is evidence of the expansion in demand, which is especially reflected in the steady growth of cocoa processing in Asia and Oceania as well as origins countries. Processing activities are estimated to have grown by 14 3% to 1.201 million tonnes in Asia and Oceania and by 2.9% to 991,000 tonnes in Africa, whereas the Americas increase was of 2.8% to 897,000 tonnes.

Grindings in Europe slightly progressed by 0.5% from the previous season to 1.719 million tonnes.