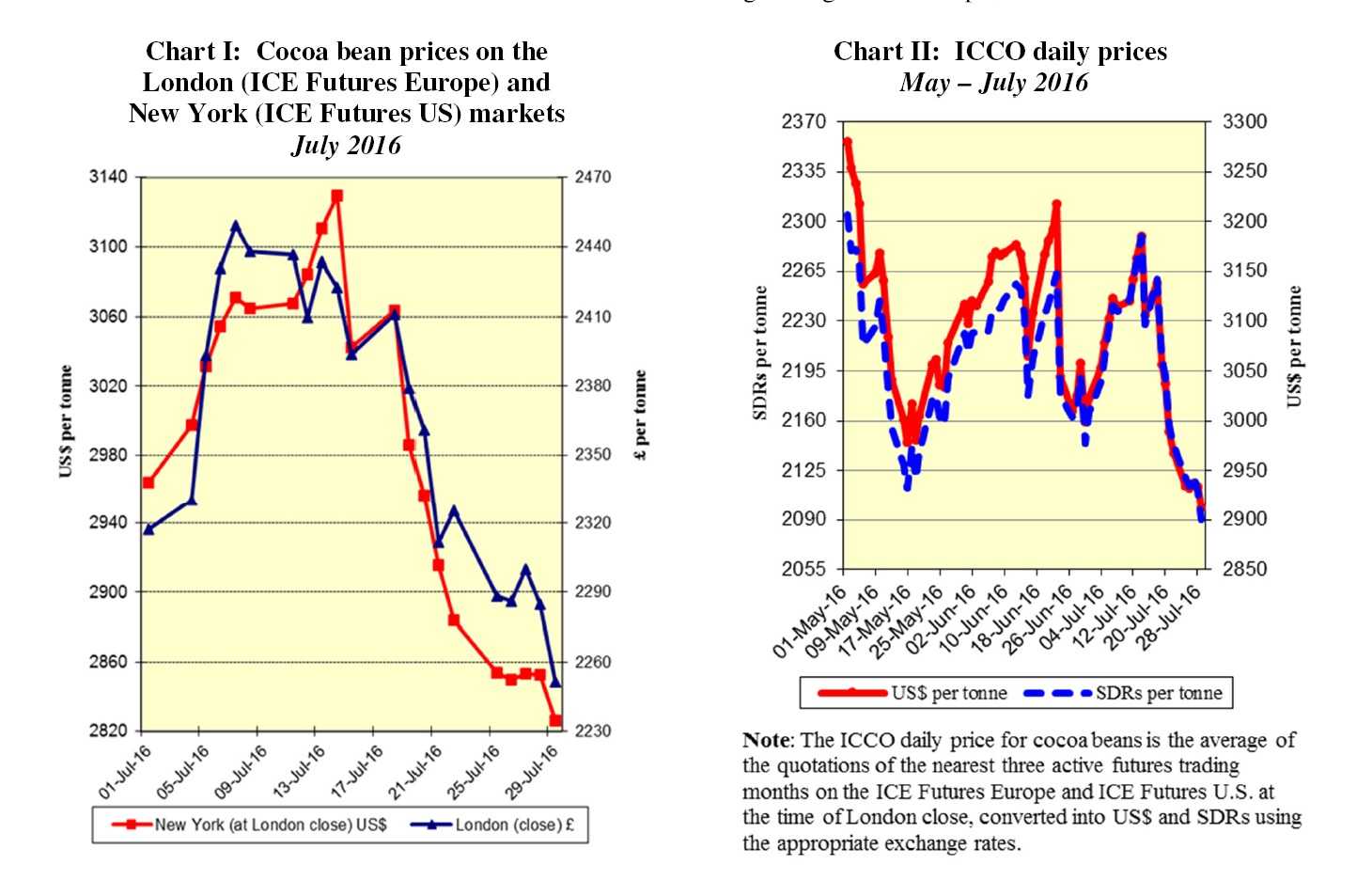

The current review reports on cocoa price movements on the international markets in July 2016. Chart I illustrates price movements on the London (ICE Futures Europe) and New York (ICE Futures U.S.) markets for the month under review.

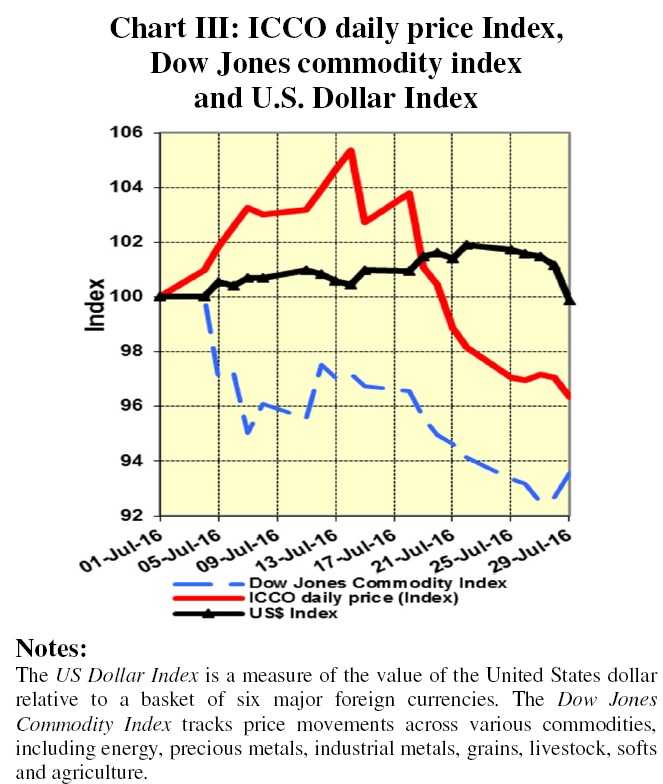

Chart II shows the evolution of the ICCO daily price, quoted in US dollars and in SDRs, from May to July 2016. Chart III depicts the change in the ICCO daily price Index, the Dow Jones Commodity Index and the US Dollar Index.

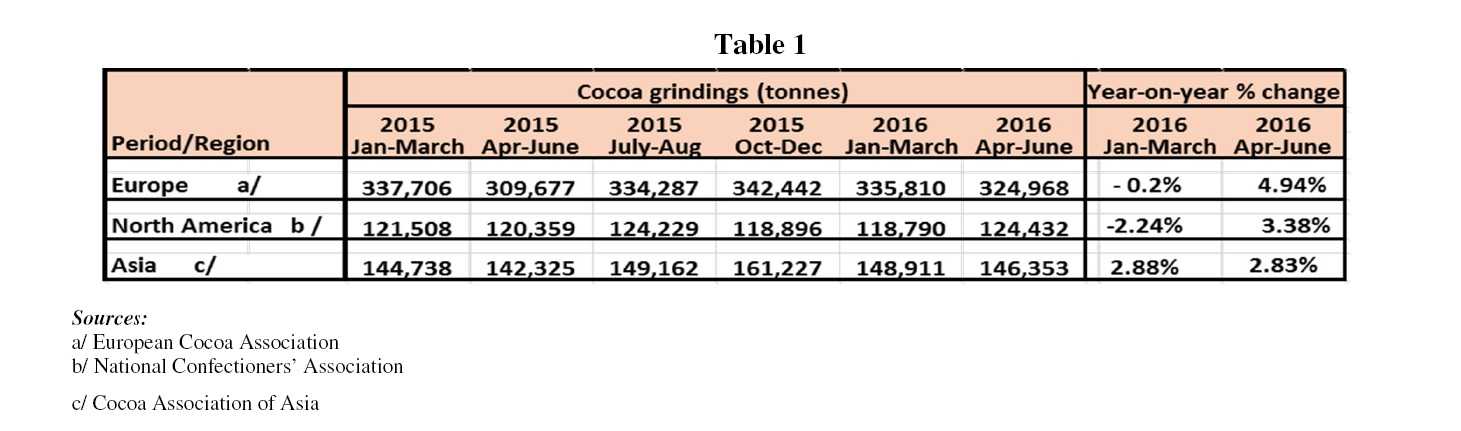

Table I summarizes cocoa bean grindings from Europe, North America and Asia.

Price movements

Price movements

In July, the ICCO daily price averaged US$3,050 per tonne, down by US$73 compared with the average price recorded in the previous month (US$3,123) and ranged between US$2,913 and US$3,186 per tonne.

At the beginning of July, cocoa futures prices on both the ICE futures Europe and the ICE futures U.S. markets reversed from the downward trend experienced during the very last trading sessions of the previous month.

Indeed, in the aftermath of the June 23 Brexit vote, the British Pound Sterling sank further to a 31-year low; thus, as seen in Chart I, pushing cocoa futures prices in London to a 39-year high at £2,449 per tonne at the end of the first week of July.

Across the pond on the other hand, a substantial projected deficit for the 2015/2016 season which resulted from the disappointing ongoing mid crops in West Africa, coupled with reports of unfavourable weather conditions for the June/July period also in West Africa led cocoa futures prices to reach their highest level of the month, at US$3,130 per tonne during the first half of July.

Thereafter, cocoa futures prices changed direction and generally followed a downward trend throughout until the end of the month in both markets, while the release of strong second quarter grindings data from Europe, North America and Asia broadly met market expectations.

Indeed, the likely effects of the strong grindings data on cocoa futures prices were offset by the recovering Pound Sterling in the light of improved sentiment among financial investors as Ms. Theresa May became the United Kingdom Prime Minister far earlier than anticipated.

Reports of expectations for improving cocoa production for the upcoming main crops (2016/2017) in West Africa also played a major role in this bearish momentum. This further pushed down cocoa futures prices to their lowest level of the month, at £2,252 per tonne in London. and to a four-month low, at U$ 2,826 per tonne in New York.

As reflected in Chart III, during the month under review, cocoa futures prices outperformed the general commodity complex in July.

Supply and demand

Supply and demand

On the supply side, according to news agency data, cumulative cocoa arrivals at ports in Côte d’Ivoire reached 1,434,000 tonnes by 31 July as compared with 1,645,000 tonnes in the same period of the previous season.

This represents a decline of twelve per cent. The earlier expectations of a relatively small Ivorian mid-crop following the harsh Harmattan were realized.

However, the current level of arrivals may underestimate actual production, as large quantities of beans have been rejected by exporters in the last few months mainly due to the small size of the beans.

There are reports that farmers are holding back significant quantities, which are likely to be mixed with the next main crop in October.

In Ghana, as at the time of writing, no new data on cocoa purchases are available but reports indicate that plans are underway by the Ghana Cocoa Board to achieve a crop recovery in the next season.

On the demand side, as shown in Table 1, data published for the second quarter of 2016 for Europe, North

America and Asia showed an increase in processing activity compared with the previous year. European cocoa grindings data were broadly in line with market expectations and registered an increase of almost five per cent.

North American grindings also rose by more than three per cent, the highest since the third quarter of 2014, following six straight quarters of declines.

Finally, Asian processing activity rose by almost three per cent, rising for the third consecutive quarter.

However, if the reported grindings total for Q2-2016 rose by 3.72%, portraying a positive picture of demand, analysts were of the view that overall demand has remained weak, affected by weak economic growth in Europe, the biggest cocoa consumer.

The IMF has recently downgraded its forecasts for economic growth in Europe.

At the end of August, the ICCO Secretariat will release its revised supply and demand forecasts for the current year in its Quarterly Bulletin of Cocoa Statistics.