ABIDJAN, Côte d’Ivoire – Since the start of the season, cocoa prices have generally not gone through any noticeable movement although prices within the broader commodity market have witnessed significant ascending trends. It is well known that cocoa supply, demand and stocks are among the various factors driving cocoa prices. In this report, the current situation faced by these factors will be reviewed alongside cocoa prices.

By 4 June 2022, arrivals of cocoa beans at Ivorian ports were estimated at 1.926 million tonnes, lower by approximately 5.1% compared to the volume of 2.027 million tonnes recorded during the corresponding period of the 2020/21 cocoa season. In neighbouring Ghana, the 2021/22 crop is reported to witness a staggering drop to about 800,000 tonnes compared to the historic volume of 1.047 million tonnes recorded during the 2020/21 crop year.

Accounting for around 60% of global production, the shortfall in cocoa arrivals in Côte d’Ivoire and purchases in Ghana, coupled with an increase in global demand and resulting in a three-digit supply deficit¹ should normally have supported cocoa prices for the current season.

However, this is not the situation at the moment. Trends in stocks levels and grinding activities on both sides of the Atlantic will likely draw attention as the cocoa year progresses.

Level of cocoa bean stocks in exchange licensed warehouses

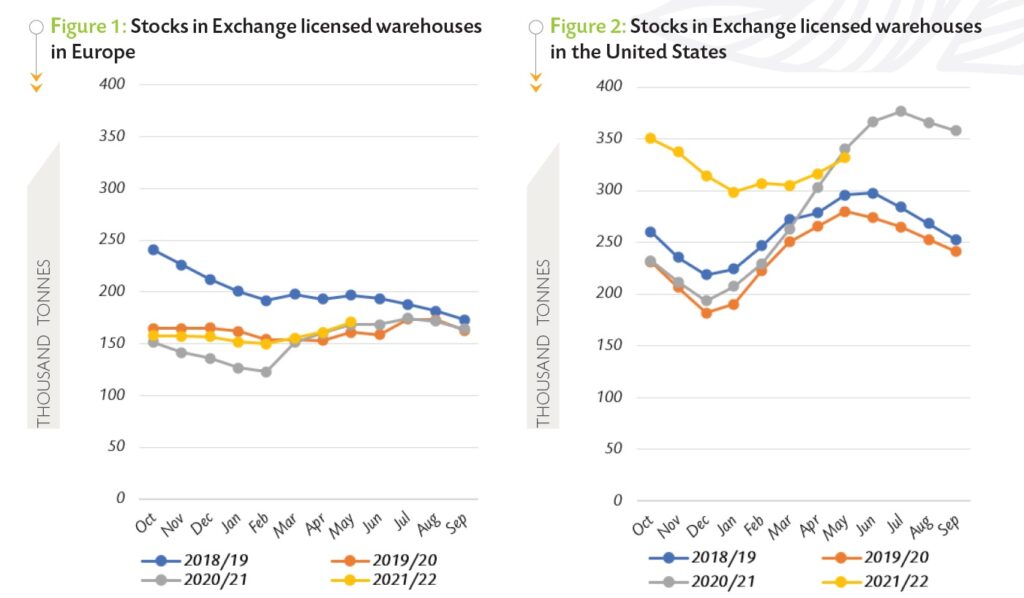

Notwithstanding the reduction in supply for the ongoing 2021/22 season, stocks of cocoa beans held in ICE Futures licensed warehouses in Europe and the United States are generally high compared to the past season.

This observation is partly due to the 2020/21 record production which contributed to the high level of carryover stocks held in warehouses on both sides of the Atlantic for the 2021/22 season. Hence, the reduction in cocoa production for the 2021/22 season does not seem at present to be reflected in the level of stocks held in the Exchange licensed warehouses.

As shown in Figure 1 and Figure 2 compared to the levels at the start of the season, cocoa bean stocks in Exchange licensed warehouses in Europe have increased by 8% from 157,556 tonnes to 170,690 tonnes.

Over the same time frame, in the United States, stocks of cocoa beans held in Exchange licensed warehouses have declined by 5% from 350,340 tonnes to 331,564 tonnes.

Price configuration and level of stocks

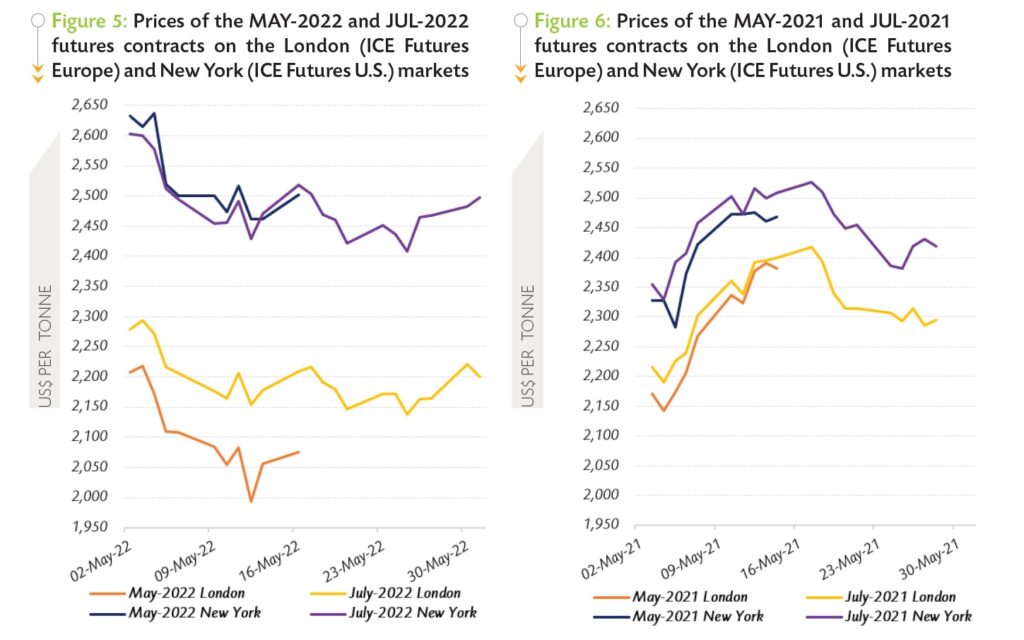

As shown in Figure 5, while London cocoa futures prices remained in contango in May – implying that there were no immediate supply bottlenecks, New York prices were in backwardation – reflecting that market participants might have been expecting an immediate relative shortage of cocoa beans.

At this stage, given the non-identical price configurations on both markets – which are also the traditional cocoa consuming regions, it is difficult to determine whether cocoa bean stocks movements observed in the United States were caused by the dwindling global cocoa production or higher withdrawals from stocks for processing in the United States compared to Europe, where high energy prices are currently being experienced as a result of the Russia-Ukraine war. Indeed, it is reported that Russia provides about 40% of the natural gas used in Europe².

Will the global inflationary pressure end up threatening demand for cocoa?

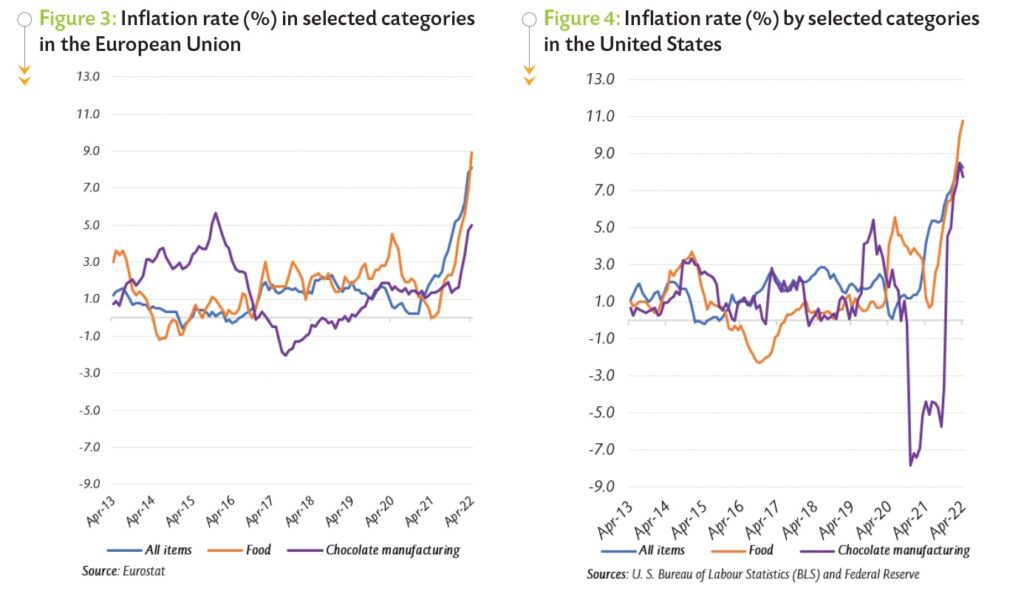

As shown in Figure 3 and Figure 4, at the end of April (which is the latest available data as at the time of writing), monthly inflation rates for all items were 8.1% and 8.3% in the European Union and the United States respectively, representing by far the highest level of monthly inflation rate reached over the last ten (10) years.

In addition, the industrial price index of manufactured chocolate products increased by 5.0% in the European Union and by 7.7% in the United States, making chocolate manufacturing more expensive compared to the past few years.

Some manufacturers like Mondelez International (owner of Cadbury Dairy Milk) indicated that the size of sharing bars will be reduced by 10% while maintaining the same price³, with others likely to follow suit or even increase the retail prices of their products. Inflation, which is reputed to weaken the purchasing power of consumers, could possibly constrain the consumption of non-essentials and luxury goods including cocoa products should the situation persist.

Futures prices developments for the cocoa season

During May, prices of the front-month cocoa futures contract followed a declining trend on both the London and New York markets with the MAY-22 contract prices settling at a nearly 2-year low at US$1,993 per tonne in London and almost a 5-month low at US$2,408 per tonne in New York. Figure 5 shows price movements of the first and second positions on the London and New York futures markets respectively at the London closing time in May 2022, while Figure 6 presents similar information for the previous year.

While approaching its maturity date on 16 May, prices of the MAY-22 contract developed downward (Figure 5), plummeting by 6% from US$2,207 to US$2,076 per tonne and by 5% from US$2,632 to US$2,502 per tonne in London and New York respectively.

At the time, the adequate climate conditions reported in the main cocoa areas of West Africa contributed to pressuring down cocoa futures prices. At the expiry of the MAY-22 contract, the nearby cocoa futures contract rolled over to the JUL-22 contract during the second half of the month under review.

Generally, the daily settlement prices of the JUL-22 did not demonstrate any significant trends on both markets and were range-bound. In London, the JUL-22 contract prices averaged US$2,179 per tonne and oscillated between US$2,138 and US$2,222 per tonne while in New York, the average price of the front-month contract was pegged at US$2,460 with minimum and maximum settlement values of US$2,408 per tonne and US$2,503 per tonne.

At the time, various driving forces were at play. On the one hand, the stocks in Exchange licensed warehouses were high year-on-year in both Europe and the United States. Furthermore, as mentioned by IHS Markit, reports on the chocolate industry indicated that over the 13-week period ending 15 May, sales of chocolate products had dropped by 6.3% in the United States while prices of chocolate products on the same market were inflated by 11%.

1 https://www.icco.org/may-2022-quarterly-bulletin-of-cocoa-statistics/

2 https://www.npr.org/2022/03/28/1089121238/the-u-s-will-ship-more-liquefied-natural-gas-to-europe-starting-next-winter

3 https://www.bbc.com/news/business-60902583/