ABIDJAN, Côte d’Ivoire – Cocoa futures prices are currently hovering above US$3,000 and £2,300 per tonne in New York and London respectively. Such prices, last seen in 2016, reflect approximately a 7-year high. Several factors are behind these price rallies, including global production shortfall, positive cocoa demand and adverse weather conditions amongst others.

As at 4 June 2023, cumulative arrivals of cocoa beans in Côte d’Ivoire were seen at 2.104 million tonnes, down by 4.8% (or -100,000 tonnes) compared to 2.204 million tonnes recorded during the corresponding period a year earlier.

Recent heavy downpours have been reported in major producing countries and have led to heightened fears of disease outbreaks as well as over the quality of the mid-crop cocoa beans. As at the time of writing, poor bean quality has been reported in Côte d’Ivoire , with cocoa bean counts averaging 120 for every 100 grams.

Exporters prefer counts of 80 to 100 for every 100 grams, with the best cocoa quality having the lowest bean count¹.

Furthermore, the growing concern over an El Niño climatic phenomenon developing later in the year has been making the headlines. In West Africa, El Niño is linked to dry weather conditions and depending on its severeness, can be detrimental to cocoa production. Moreover, inputs such as fertiliser prices continue to be impacted by the war in Ukraine.

As seen in Figure 1, though fertilizer prices are progressively declining, historically they are still significantly high and this could deter farmers from its usage, which could in turn affect cocoa production.

As much as supply concerns continue to support the rally seen in prices, the demand for cocoa beans could potentially pull the brakes on the price hikes.

As much as supply concerns continue to support the rally seen in prices, the demand for cocoa beans could potentially pull the brakes on the price hikes.

With prices of other ingredients like sugar rising² and inflation causing price increases in other areas of the supply chain, confectionery companies are likely to face hurdles in their operations and passing the cost of production increases to consumers cannot be ruled out.

Will such an occurrence affect the current optimism in cocoa demand and consequently reverse cocoa price rallies? Future reports from major companies on their chocolate confectionery sector and grindings data from regional cocoa associations may provide some insights on how cocoa demand will fare.

Futures Price Developments

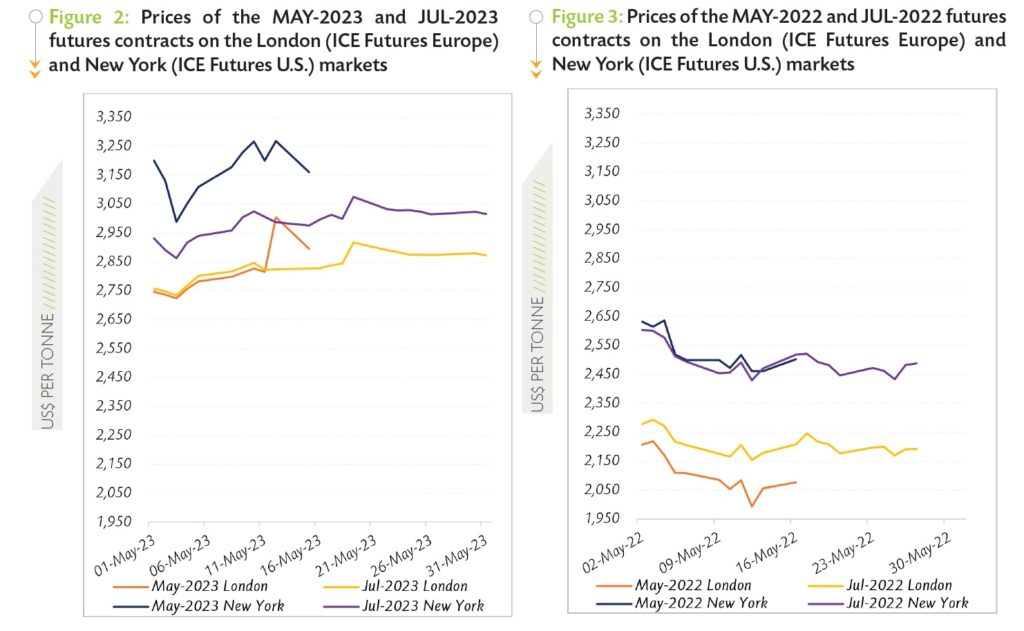

In May 2023, cocoa futures prices were higher on the international market compared to the situation seen back in May 2022. In London, prices of the first position of cocoa contracts averaged US$2,840 per tonne, up by 32% yearover-year compared to US$2,156 per tonne. Over the same period in New York, the average price of the front-month cocoa futures contract settled at US$3,092 per tonne, representing an increase of 23% from US$2,505 per tonne.

During the month under review, prices of the nearby cocoa contract ranged between US$2,723 and US$3,004 per tonne in London, while in New York they oscillated between US$2,988 and US$3,268 per tonne.

Figure 2 shows price movements of the first and second positions on the London and New York futures markets respectively at the London closing time in May 2023, while Figure 3 presents similar information for the previous year.

During May 2023, the global cocoa market was generally bullish, and this increasing momentum could be decomposed into two distinct sequences. At the approach of its maturity date on 15 May, prices of the MAY-23 contract developed upward in London while in New York they dropped slightly (Figure 2). Prices of the MAY-23 contract went up by 5% from US$2,747 to US$2,895 per tonne in London, while in New York they plunged by 1% from US$3,200 to US$3,160 per tonne.

Meanwhile, industry reports opined that market participants were envisaging a larger-than-expected supply deficit for the 2022/23 season due in part to firming demand for cocoa. Furthermore, the below-average rainfall that was recorded in the main cocoa-growing areas of Côte d’Ivoire raised concerns about the appropriateness of the soil moisture required for the good development of the crop.

At the expiry of the MAY-23 contract, the nearby cocoa futures contract rolled over to the JUL-23 contract during the second half of the month under review. Over this period, prices of the first position of cocoa futures contracts increased on both sides of the Atlantic as cumulative arrivals of cocoa beans at Ivorian ports since the beginning of the 2022/23 cocoa season continued to lag behind the level seen during the corresponding period of the previous season.

In London, futures prices rallied by 2% from US$2,829 to US$2,873 per tonne, while in New York prices of the first position of cocoa futures contracts were reinvigorated by 1% moving from US$2,997 to US$3,016 per tonne.

1 https://www.barchart.com/story/news/17042654/quality-concerns-of-the-ivory-coast-mid-crop-boosts-cocoa-prices#:~:text=Cocoa%20prices%20Friday%20rallied%20sharply,120%20

for%20every%20100%20grams

2 https://www.barchart.com/story/news/17566972/sugar-prices-surge-on-global-weather-concerns