ABIDJAN, Côte d’Ivoire – This review of the cocoa market situation from the ICCO reports on cocoa price movements on the international markets during the month of September 2017.

It aims to highlight key insights on expected market developments and the effect of the United States dollar exchange rates on cocoa prices.

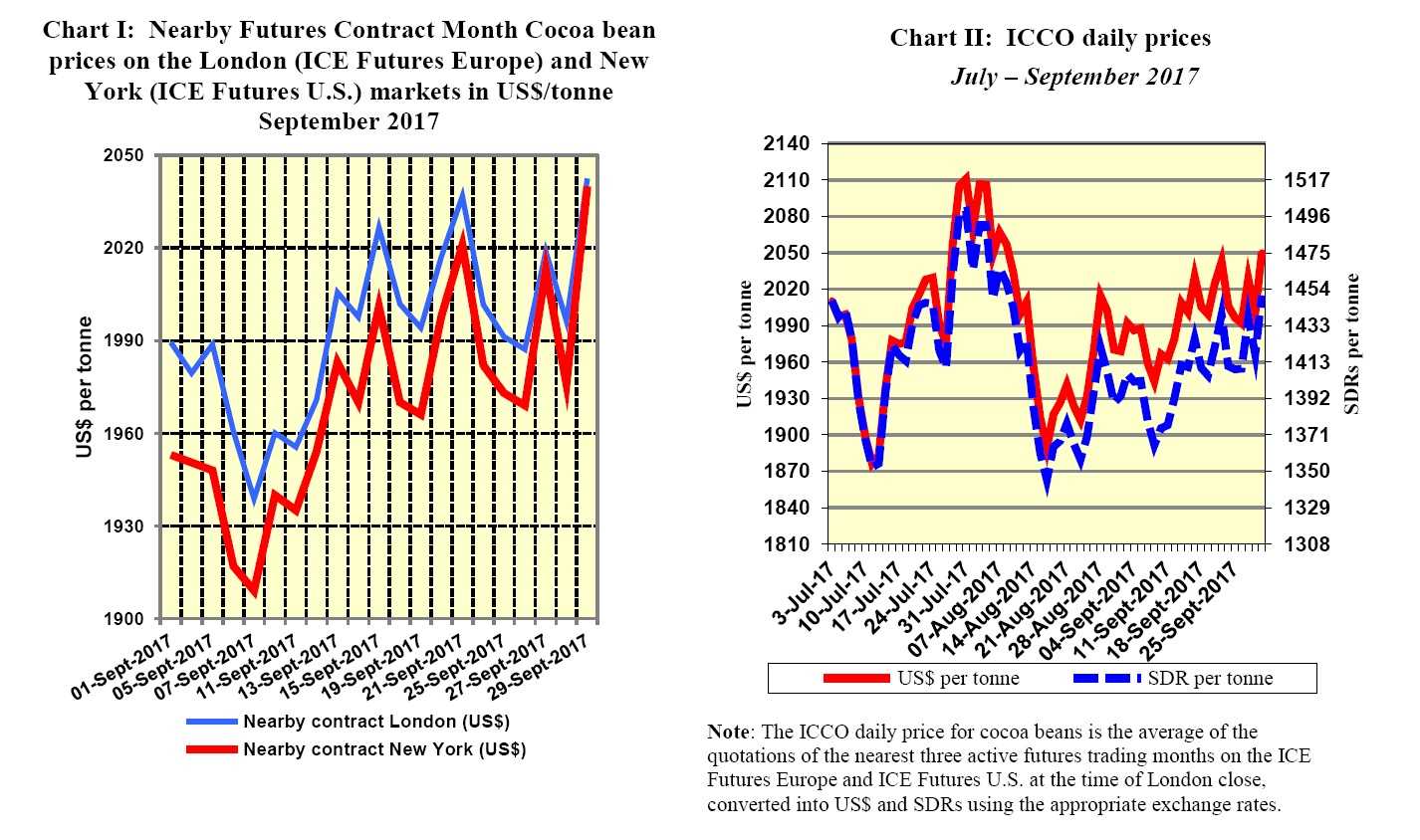

Chart I shows the London and New York prices of the nearby cocoa futures contracts, both expressed in United States dollars.

Since the London market is pricing at par African origins, and the New York market at par Southeast Asian origins, the London futures price is expected under the same market conditions to be higher than the New York one.

Nevertheless, the study of their price differences provides insights on the relative, expected availability of cocoa beans at these exchanges. Chart II distinguishes the impact of the United States dollar fluctuations on cocoa price.

Price movements

The month of September is a watershed for the calendar of the nearby cocoa futures contract.

At the expiry of the September contract on 14 September, the nearby position shifts its price discovery function from the final part of the 2016/2017 mid-season to the 2017/2018 main season, i.e. December contract.

The peculiarity in the market fundamental of the old crop, 2016/2017, and the new crop, 2017/2018, is clearly highlighted in the price developments shown in Chart I.

In the first two trading weeks of the month, the price of the nearby futures contracts (London and New York) declined by over 2% as a result of the latest report on the excess production from West Africa for the 2016/2017 mid-season period.

Thereafter, a bullish sentiment prevailed in both futures markets, following concerns about the current wet weather conditions in West Africa, which may cause the spread of black pod disease during the 2017/2018 season.

Chart I also shows a progressive narrowing of the arbitrage spread between the London and New York cocoa futures.

This is mainly due to the supply disruption in the US market caused by the discovery of itch grass in Ecuadorian cocoa shipments. (Itch grass is a toxic weed banned by the U.S. Agriculture Department’s Animal and Plant Health Inspection Service).

Chart II highlights the impact of the fluctuation of the United States dollar on the ICCO cocoa price. In particular, the upward drift of the dollar-denominated ICCO prices from the SDR-denominated price shows the impact of depreciation of the dollar against the basket of currencies making up the SDR (the IMF international asset reserve).

The United States dollar has generally lost ground against all major currencies, starting from 20 August 2017.

Supply & demand situation

On the supply side, news agency reports indicated that cumulative cocoa bean arrivals to ports in Côte d’Ivoire were 2.015 million tonnes at the end of the 2016/2017 crop year, up nearly by 30% from the 1.568 million tonnes produced in the same period of the previous season.

Ghana was expected to have recorded about 950,000 tonnes for the past season. As at the time of writing, news from Reuters reported that since the start of the 2017/2018 season, cocoa arrivals at ports in Côte d’Ivoire had reached around 67,000 tonnes as of 15 October 2017, down from 98,000 tonnes in the same period of the previous season.

Ghana opened the 2017/2018 cocoa season on 13 October 2017 with the decision to maintain the producer price at the 2016/2017 levels of 7,600 Ghana cedis (about US$1,735 a tonne) despite falling world prices, compared with about US$1,270 per tonne for the producer price in Côte d’Ivoire.

On the demand side, compared with the same period of the previous season, third quarter grindings data published by regional associations on processing activity indicated an increase in all regions.

European grindings data, published by the European Cocoa Association showed a three per cent increase to 353,544 tonnes.

Meanwhile, the National Confectioners Association published a 0.68% increase to 125,263 tonnes for North America, and the Cocoa Association of Asia published an increase of 12.92% to 189,407 tonnes. This underscores the consensus that there is a recovery in the global demand for cocoa beans.