ABIDJAN, Côte d’Ivoire — This review of the cocoa market situation reports on the prices of the nearby futures contracts listed on ICE U.S. (New York) and ICE Europe (London) during the month of September 2018.

It aims to highlight key insights on expected market developments and the effect of the United States dollar exchange rates on cocoa prices.

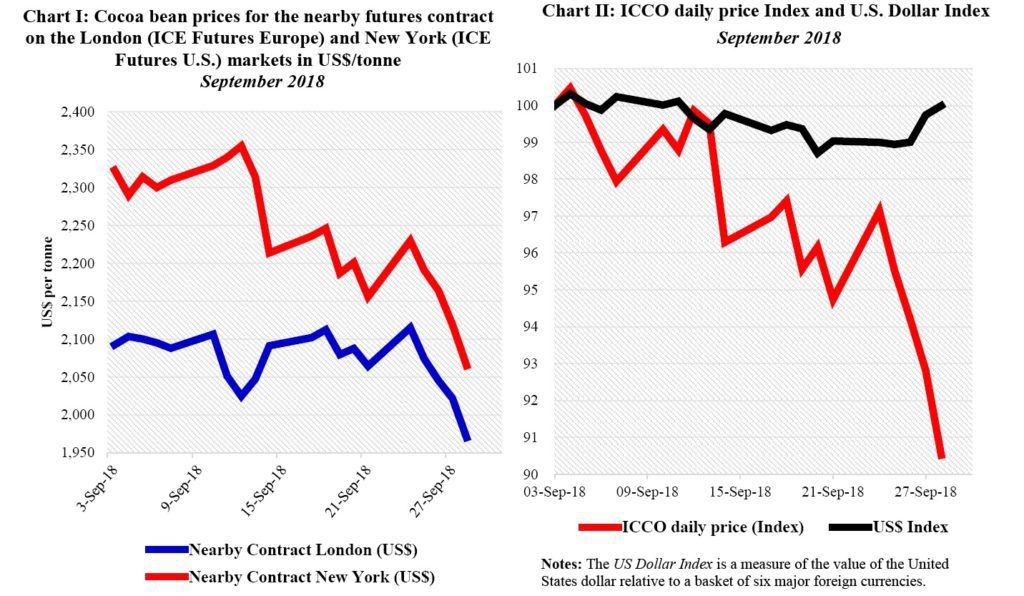

Chart I shows the development of futures prices on the London and New York markets at the London closing time. Both prices are expressed in US dollars. The London market is pricing at par African origins, whereas the New York market is pricing at par Southeast Asian origins.

Hence, under normal market conditions, the London futures prices should be higher than the New York ones.

Any departure from this price configuration provides indication on the relative, expected availability of cocoa beans at the delivery points, designated by the exchange, at contract expiration.

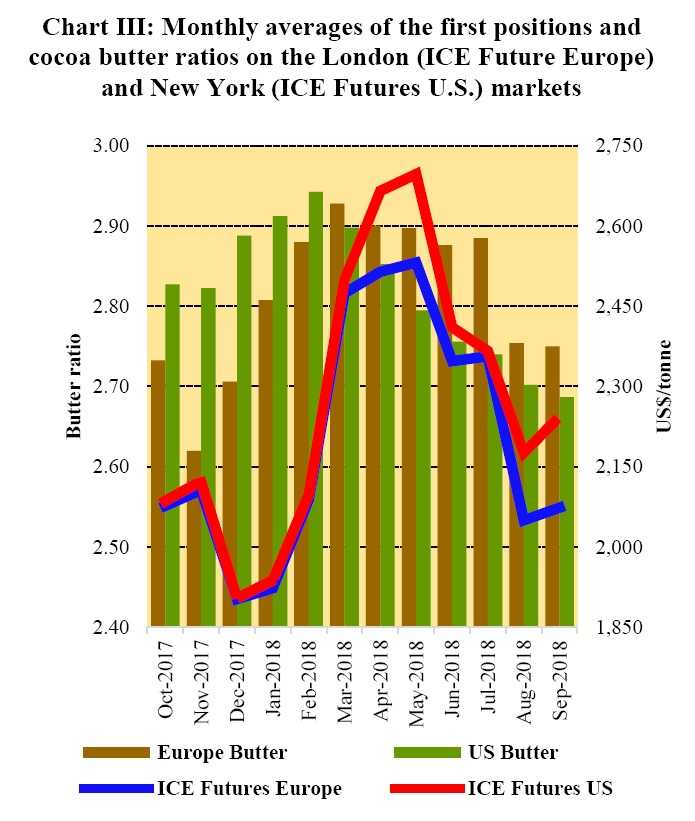

Chart II depicts the change in the ICCO daily price Index and the US dollar Index in September. By comparing these two developments, one can extricate the impact of the US dollar exchange rate on the development of the US dollar-denominated ICCO daily price index.

Finally, Chart III illustrates the monthly averages of the first positions and cocoa butter ratios on the London (ICE Future Europe) and New York (ICE Futures U.S.) markets during the 2017/18 cocoa year.

Price movements

The end of the 2017/18 crop season was marked by a downward trend in futures prices on both the London and New York markets (Chart I). This was in reaction to a correction on the cumulative arrivals of cocoa beans for the 2017/18 crop season in Côte d’Ivoire.

In addition, expectations of a strong output for the 2018/19 main crop contributed to prices weakening during September. Thus, the nearby contract traded at US$2,074/tonne and US$2,244/tonne in London and New York respectively.

Also, during the month under review, compared to its value spotted at the start of the month, the nearby contract declined by 6% in London and 11% in New York.

Thereafter, before expiry, the September 2018 contract was exchanged at US$2,079/tonne in London while it traded at US$ 2,319/tonne in New York.

Starting from 14 September onwards, the front-month contract, i.e. the December 2018 contract, descended further in response to anticipated favourable crop prospects for the 2018/19 main crop in West Africa.

Thereafter, prices plunged to reach their lowest value of the month on both markets settling at US$1,970/tonne in London and US$2,065/tonne in New York by the end of the month.

The strong likelihood of the occurrence of an El Niño event seems not to have had any influence on market participants’ expectations with regards to the upcoming crop outlook.

As shown in Chart II, the US dollar index remained stable in September while the ICCO daily price index retreated by 9% from its value displayed at the beginning of the month. The exchange rate market did not therefore play any role in this price development.

Throughout the 2017/18 crop season, the nearby contract was priced on average at US$2,205/tonne in London and US$2,268/tonne in New York.

Compared to their value recorded at the beginning of the crop year, prices by the end of September shrunk by 3% in London while they firmed slightly by 1% in New York during the 2017/18 crop season.

It is worth noting that, in the course of the 2017/18 crop season, the annualized volatility of the front-month contract prices reached 12% and 14% in London and New York respectively.

Concerning cocoa products, as seen in Chart III, butter ratios increased in Europe and the United States from October 2017 to February 2018 as a result of the increasing interest from new industries.

Moving on in the crop season, European processors saw their margins remain relatively steady between March and July 2018 before declining by the end of the season.

At the same time, profits drawn from processing activities in the United States dropped from March 2018 till the end of the crop year.

Supply and demand situation

Although the 2017/18 crop year is over, as at 1 October 2018, cocoa arrivals in Côte d’Ivoire are reported to have reached 1.938 million tonnes, down only by 2% from the level recorded for the same period last season.

In Ghana news indicated that, by 20 September 2018, purchases topped 900,000 tonnes, 50,000 tonnes higher than the Cocobod’s pre-season forecast.

During the 2017/18 cocoa year, the two top producers agreed to harmonize their marketing strategies in reaction to low international prices.

Hence, they jointly opened the 2018/19 crop year and simultaneously disclosed their farmgate prices. Indeed, compared to the previous year, the Conseil du Café-Cacao increased the farmgate price by 7% to 750 CFA/kg (1.34 US$/kg) of cocoa beans while the Cocobod maintained the Ghanaian farmgate price at the same level compared to the past crop year at 7,6 Cedis/kg (1.53 US$/kg).

On the demand side, the Netherlands and Côte d’Ivoire held the highest shares in processing activities during the 2017/18 crop season. The main regional cocoa associations will be releasing their grindings data for the third quarter of 2018 by mid-October.