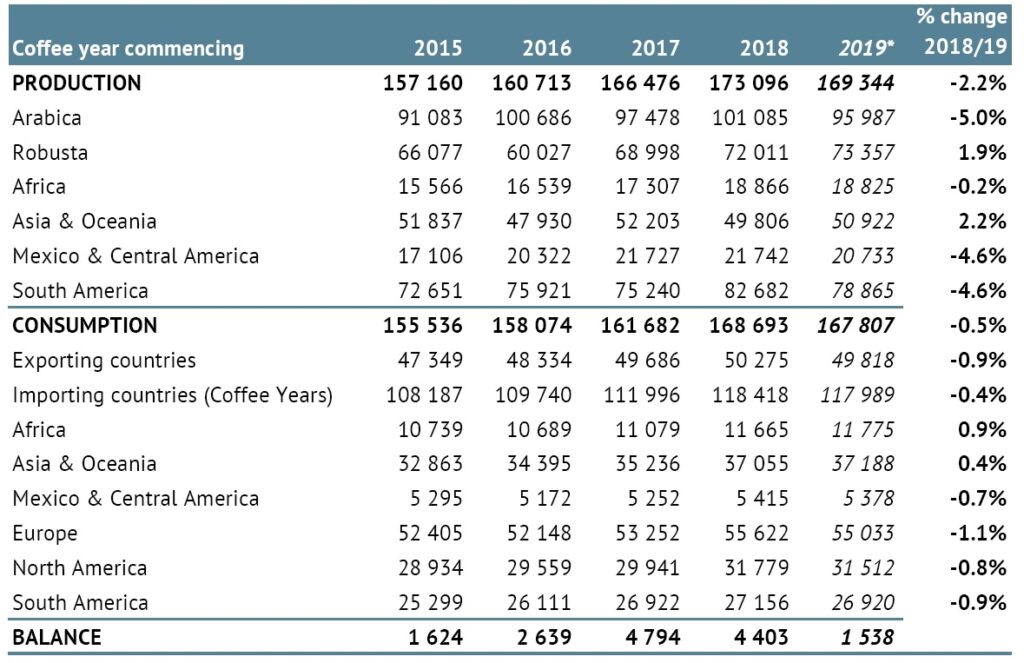

LONDON, UK – Global coffee production in 2019/20 is estimated at 169.34 million bags, 2.2% lower than last year, as output of Arabica decreased by 5% to 95.99 million bags, while that of Robusta rose by 1.9% to 73.36 million bags, says the ICO in its Market Report for September 2020.

World coffee consumption is expected to decrease by 0.5% to 167.81 million bags as the covid-19 pandemic continues to put pressure on the global economy and greatly limits out-of-home coffee consumption.

As a result, coffee year 2019/20 is seen ending in a surplus of 1.54 million bags. This compares to a surplus of 4.4 million bags in 2018/19. The two consecutive surpluses have limited a recovery in prices, which remain below the long-term average of 135.34 US cents/lb between 2007 and 2018.

The ICO composite indicator in September rose by 1.3% to 116.25 US cents/lb. It averaged 107.25 US cents/lb in coffee year 2019/20, 6.7% higher compared to 2018/19. All group indicator prices rose in September 2020 for the third consecutive month, with the largest increase occurring for Other Milds.

While prices have increased, they remain low compared to the long-term average of 135.34 US cents/lb between 2007 and 2018.

The daily composite indicator started on a high note, remaining above 120 US cents/lb until 14 September, when it fell to 116.97 US cents/lb. It continued to fall during the rest of the month, reaching a low of 108.09 US cents/lb on 29 September.

The Brazilian real also fell from mid- to late-September, erasing the gains made over the preceding three weeks.

Prices for all group indicators rose in September 2020 for the third consecutive month, though at a much slower rate compared to August. The largest increase occurred in the average price for Other Milds which grew by 2% to 166.56 US cents/lb.

Colombian Milds increased by 0.7% to 168.36 US cents/lb. As a result, the differential between Colombia Milds and Other Milds decreased by 54.7% to an average of 1.80 US cents/lb due to tightness in supply of Other Milds compared to Colombian Milds. Brazilian Naturals rose by 1.8% to 113.81 US cents/lb, and Robustas by 0.1% to 72.77 US cents/lb.

The average arbitrage in September, as measured on the New York and London futures markets, rose by 1.1% to 58.73 US cents/lb.

After falling for seven consecutive months, stocks of certified Arabica increased by 68.7% to 2.45 million bags in September 2020 compared to August 2020.

Certified Robusta stocks amounted to 1.85 million bags, unchanged from August 2020. Additionally, the volatility of the ICO composite indicator price decreased by 0.2 percentage points to 8.7%.

The volatility for Colombian Milds remained unchanged at 8.5%, but the volatility for Other Milds fell by 0.5 percentage points to 8%. Brazilian Naturals volatility declined by 1.2 percentage points to 12.3%, while the volatility for Robusta prices increased by 2.1 percentage points to 8.4%.

In August 2020, world coffee exports fell by 7.5% to 10.04 million bags compared to August 2019. This was the lowest volume of shipments in August since 2015 when exports totalled 9.14 million bags, and may indicate a decline in demand, particularly as prices have increased in recent months while the outlook for global economic growth remains bearish.

Shipments of Arabica fell by 6.7% to 6.35 million bags, and Robusta exports decreased by 9% to 3.69 million bags. Other Milds recorded the largest decrease in August, falling by 10.2% to 2 million bags. Exports of Colombian Milds fell by 8.4% to 1.19 million bags, and Brazilian Naturals declined by 3.6% to 3.16 million bags.

From October 2019 to August 2020, global coffee shipments fell by 5.6% to 116.54 million bags compared with the same period in coffee year 2018/19. In the first eleven months of coffee year 2019/20, Robusta exports recorded the smallest decrease, declining by 2.6% to 44.61 million bags. Shipments of Other Milds fell by 9.7% to 23.42 million bags, Colombian Milds by 6.8% to 12.93 million bags and Brazilian Naturals by 6% to 35.58 million bags.

Global output in 2019/20 is estimated at 169.34 million bags, 2.2% lower than in 2018/19. Arabica output is estimated to decrease by 5% to 95.99 million bags, while Robusta output is expected to rise by 1.9% to 73.36 million bags.

The decrease in output is attributed primarily to the reduction in Brazil, as this was an off-year for its Arabica production, as well as to the ongoing low prices. Harvesting in most countries had already concluded by the time the pandemic occurred.

Production in the five largest producing countries increased in 2019/20, except for Brazil, which accounts for around 35% of global output, says the ICO in the report. In 2019/20, Brazil’s Arabica crop was in the off year of its biennial cycle, and the total harvest is estimated at 58 million bags, 10.9% less than in 2018/19. Brazil’s Arabica output declined by 17.4% to 37 million bags while its Robusta output rose by 3.4% to 21 million bags. Viet Nam’s harvest is estimated at 31.5 million bags in 2019/20, 0.7% higher than last year.

Colombia’s total production in 2019/20 is estimated at 14.1 million bags, 1.7% higher than in 2018/19, as strong growth in the first three months of the coffee year was followed by falling prices and adverse weather.

After three years of decline, production in Indonesia is estimated to rise by 16.5% to an estimated 11.2 million bags in 2019/20 due to beneficial weather. Output in Ethiopia has grown steadily after falling by 19% to 5.56 million bags in 2010/11, and in 2019/20 is estimated to increase by 2.1% to 7.7 million bags due to beneficial weather and adequate rain.

Heading into 2019/20, global demand for coffee seemed strong following coffee year 2018/19 when world consumption grew by 4.3% to 168.7 million bags, which was well-above the long-term average of around 2%. However, in 2019/20, global coffee consumption is estimated by the ICO at 167.81 million bags, 0.5% lower than last year.

While there was a surge in demand at the start of the pandemic from panic-buying and stockpiling, consumption in the remaining months of the coffee year is estimated downwards due to ongoing pressure from a global economic downturn and limited recovery in out-of-home consumption, particularly as many countries are starting to experience a second wave of covid-19 at the end of the coffee year.

Compared to the previous year, demand in the top five consumers, which represent 63.7% of global consumption, slowed considerably in 2019/20. After two years of strong growth, consumption in the European Union is estimated at 45.04 million bags, 1.3% lower than last year.

In the United States, the world’s second largest consumer, demand is estimated to fall by 0.6% to 27.58 million bags while consumption in Brazil, the third largest, is estimated to decrease by 0.9% to 22 million bags. Demand in Japan is estimated at 7.5 million bags, 0.8% lower than in 2018/19, while consumption in Indonesia is estimated to fall by 1% to 4.75 million bags.

Although both production and consumption decreased, 2019/20 is seen in surplus, with global output exceeding consumption by 1.54 million bags. The ICO composite indicator reached 107.25 US cents/lb in coffee year 2019/20.

This compares to an average of 100.47 US cents/lb in 2018/19 when the surplus reached 4.4 million bags. This surplus, coupled with the majority of Brazil’s 2020/21 crop, an on-year in the biennial Arabica production cycle, reaching the market in the next few months, will limit further recovery in prices, concluded the Ico.

This compares to an average of 100.47 US cents/lb in 2018/19 when the surplus reached 4.4 million bags. This surplus, coupled with the majority of Brazil’s 2020/21 crop, an on-year in the biennial Arabica production cycle, reaching the market in the next few months, will limit further recovery in prices, concluded the Ico.