LONDON, UK – In February 2020, the ICO composite indicator continued its downward trend, averaging 102 US cents/lb as prices for all group indicators fell. However, the differential between Colombian Milds and Other Milds more than doubled to 10.93 US cents/lb.

Global exports in January 2020 totalled 10.29 million bags, compared with 11.14 million bags in January 2019, and shipments in the first four months of coffee year 2019/20 decreased by 5.8% to 39.53 million bags. Exports from the world’s two largest coffee-producing regions declined in the period October 2019 to January 2020.

Shipments from South America decreased by 9.8% to 19.86 million bags and from Asia & Oceania by 5.4% to 12.21 million bags.

However, exports from Africa grew by 9.5% to 4.38 million bags, as shipments from the region’s three largest producers all increased, and shipments from Central America & Mexico rose by 1.7% to 3.07 million bags. In 2019/20, world coffee consumption is estimated to exceed global output by 0.48 million bags, but Covid-19 presents considerable downside risk to global coffee consumption.

The ICO composite indicator fell again in February, averaging 102 US cents/lb, 4.6% lower than in January. The daily price of the ICO Composite ranged between 97.73 US cents/lb on 4 February and 106.34 US cents/lb on 28 February.

Fears over the effect Covid-19 might have on demand, particularly for out-of-home consumption, as well as ample supplies for the remainder of the year, given that Brazil’s 2020/21 crop is in the on-year of its biennial Arabica cycle, exerted downward pressure on the market.

There was a similar downward trend for prices for all group indicators in February 2020, although this was relatively more marked in the case of Brazilian Naturals, which decreased by 7.3% to 102.62 US cents/lb. Other Milds fell by 4.7% to 135.5 US cents/lb, while Colombian Milds decreased 0.7% to 146.43 US cents/lb.

As a result, the differential between Colombian Milds and Other Milds widened in February 2020, more than doubling to 10.93 US cents/lb.

While sufficient coffee exists to meet existing levels of demand, concern has been growing about the immediate availability of quality Arabica. Prices for Robustas decreased by 3.5% month-on-month to 68.07 US cents/lb

The New York Arabica futures market fell by 8.9% to an average of 106.69 US cents/lb in February 2020, while the London Robusta futures market declined by 3.3% to 59.02 US cents/lb.

As a result, the spread between Arabica and Robusta coffees, as measured on the New York and London futures markets, decreased to 47.67 US cents/lb, for the second consecutive month. Certified Arabica stocks decreased by 0.5% month-on-month to 2.47 million bags while certified Robusta stocks rose by 4.6% to 2.57 million bags in January 2020.

The volatility of the ICO composite indicator decreased by 2.8 percentage points to 7.8% over the past month. The volatility of all indicators fell in February 2020. Among the Arabica group indicators, Brazilian Naturals fell by 3.3 percentage points to 10.5%, Other Milds by 3.1 percentage points to 8% and Colombian Milds by 2.2 percentage points to 8.5%. The Robustas group indicator volatility was 6.8%, a decrease of 1.3 percentage points from January 2020.

Global exports in January 2020 totalled 10.29 million bags, compared with 11.14 million bags in January 2019. Exports in the first four months of coffee year 2019/20 decreased by 5.8% to 39.53 million bags compared to 41.95 million bags in 2018/19.

During this period, shipments of Brazilian Naturals declined by 11.8% to 13.28 million bags and Other Milds decreased by 6.6% to 6.46 million bags. However, exports of Colombian Milds have increased by 0.6% to 5.27 million bags in October 2019 to January 2020. Robusta shipments fell 1.4% to 14.51 million bags.

Exports from Africa in the first four months of coffee year 2019/20 increased 9.5% to 4.38 million bags as shipments from the region’s three largest producers all increased. Uganda was the largest regional exporter, shipping 1.62 million bags, an increase of 10% on the first four months of coffee year 2018/19 due to higher prices in December and the greater availability of coffee this season.

Uganda’s output in 2019/20 increased due to new trees planted several years ago coming into production and favourable weather. Shipments from Ethiopia grew by 18.2% to 1.17 million bags, and from Côte d’Ivoire by 5.6% to 558,000 bags, as improvements in productivity were reported for both countries. However, Tanzania’s exports decreased by 1.6% to 393,000 bags.

Asia & Oceania’s coffee exports declined by 5.4% to 12.21 million bags in October 2019 to January 2020. Viet Nam’s exports during this period declined by 14.6% to 8.35 million bags, as low coffee prices discouraged farmers from selling their coffee, particularly with abundant supply from other Robusta producers.

India’s exports declined 8.4% to 1.41 million bags with green exports falling by 22.6% to 726,000 bags, however, its shipments of higher-valued soluble coffee during this period have increased by 13.9% to 687,000 bags. Indonesia’s shipments increased 86.8% to 1.99 million bags as its production recovered 16.8% from the previous year when output fell by 13.2% to 9.42 million bags.

Compared to the first four months of coffee year 2018/19, exports from Mexico & Central America rose by 1.7% to 3.07 million bags. This growth was led by Honduras where shipments grew by 2.6% to 1.22 million bags. Higher prices in December 2019 and January 2020 boosted exports from Honduras in January, which rose by 12.6% to 694,000 bags, offsetting lower shipments in October to December.

In contrast, Mexico’s exports between October 2019 and January 2020 have declined by 13.1% to 652,000 bags, partially in response to low prices, but also due to rising domestic consumption that reduces the availability of coffee for export.

Both Nicaragua and Guatemala recorded increases in exports of 63.5% to 525,000 bags and 1.6% to 507,000 bags, respectively. The recent rise in prices as well as higher production than initially estimated may have boosted exports from these two countries.

In October 2019 to January 2020, South America’s exports declined by 9.8% to 19.86 million bags. During this period, shipments from Brazil fell by 12.7% to 13.16 million bags.

Brazil is nearing the end of its 2019/20 crop year, which was an off-year for its Arabica production. Brazil’s exports of Arabica decreased by 17% to 10.74 million bags, but its Robusta shipments grew by 22.4% to 1.13 million bags.

Exports from Colombia rose by 1.5% 4.83 million bags while its output, as estimated by the National Federation of Coffee Growers of Colombia, has increased 12.9% to around 5.61 million bags. In February, Colombia launched the Coffee Price Stabilization Fund to protect farmers against price fluctuations.

The goal of this new fund is to further improve the quality of Colombian coffee over time, but the full impact will likely be seen in the medium term.

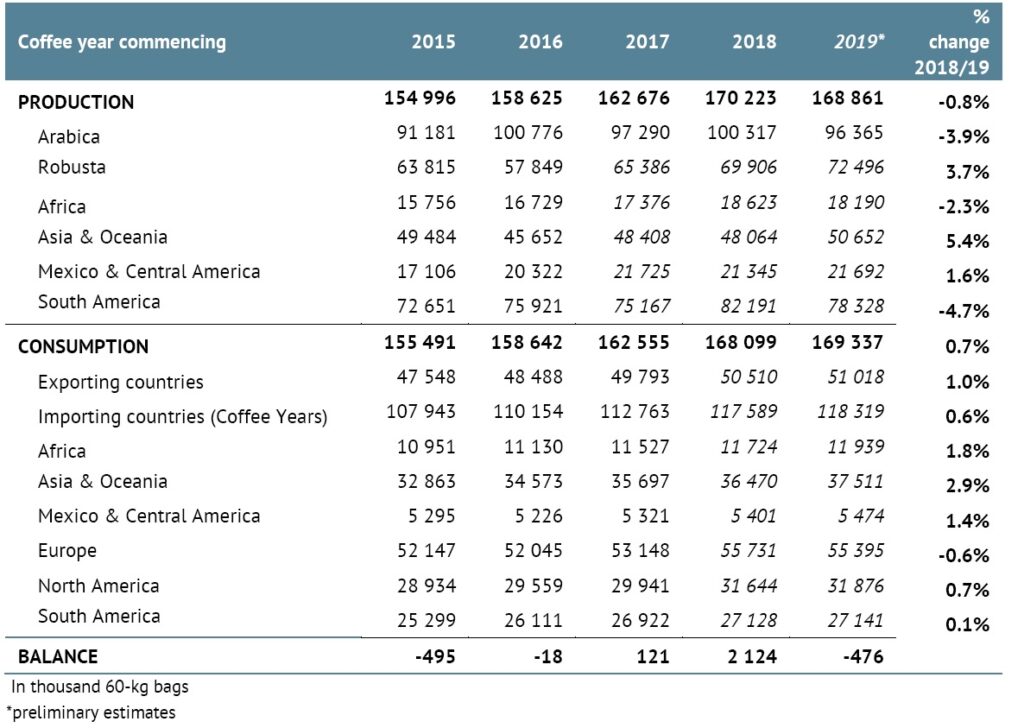

In 2019/20 world coffee production is estimated by the ICO at 168.86 million bags, a decrease of 0.8% on 2018/19. Arabica production is estimated 3.9% lower at 96.37 million bags while Robusta output is estimated 3.7% higher at 72.5 million bags.

World coffee consumption is estimated by the ICO at 169.34 million bags, 0.7% greater than in 2018/19, following a year of exceptional consumption growth in Europe and North America. In coffee year 2019/20, a deficit of 0.48 million bags is currently estimated, however Covid-19 presents considerable downside risk to global coffee consumption.