LONDON, UK – ICO indicator prices fell slightly across all groups but the decline was most pronounced for Robustas. The controversy concerning the need for Brazil to import Robusta to alleviate supply shortages in Brazil continued when an envisaged import quota was suspended.

Meanwhile increasing inventory levels and a favourable outlook for the 2017/18 crop, especially in Brazil somewhat eased supply concerns. Finally, our initial estimate of the value of world coffee exports shows an increase of almost 6% for 2015/16 compared to the year before.

Coffee prices in February decreased slightly with the monthly average of the ICO composite indicator down by 1.0% to 137.68 US cents/lb compared to 139.07 US cents/lb in January.

The composite price varied within a range of almost 10 US cents/lb around the mean, from a high of 142.09 US cents/lb on 1 February to a low of 133.02 US cents/lb on 27 February.

The price increase noted in January came to a halt as a result of increased stock levels and a positive outlook for the upcoming crop in Brazil.

Among all groups, the monthly average prices of the Robusta group recorded the most pronounced decline, down by 1.7% from 108.32 US cents/lb to 106.49 US cents/lb.

However, the daily prices declined throughout the month to a low of 103.54 US cents/lb before ending the month on 105.33 US cents/lb. Hence, the positive price trend for Robusta has reversed in February after reaching a 5 ½ year high last month.

The Arabica group indicators also fell slightly with Colombian Milds, Other Milds noted lower by 0.8%, 1.3%; Brazilian Naturals remained almost unchanged just 0.1% lower compared to January.

The arbitrage between the London and New York futures markets has decreased by 3.5% from 52 US cents/lb to 50.18 US cents/lb.

The evolution of prices in February comes against the backdrop of a dispute in Brazil about whether or not to allow imports of Robusta in order to buffer supply shortages resulting from the poor Conillon harvest.

This has led to an increase in the Brazilian domestic Robusta price and as a result, the Brazilian soluble industry has had to substitute the use of Robusta with lower grade Arabicas.

While processors of soluble argued in favour of importing a limited amount of Robusta, farmers claimed that domestic supply was sufficient and that imports would be detrimental for local production.

On 22 February the Brazilian President suspended the approval of the envisaged import quota of 1 million bags in order to allow for further analysis of the matter.

Meanwhile Vietnam, the major Robusta producing country, is estimated to have exported 11.9% more coffee in the first four month of coffee year 2016/17 compared to the previous year.

Certified stocks on the New York and London futures markets have increased further by 3.1% (from 1.45 to 1.49 million bags) and 2.5% (from 2.73 to 2.80 million bags) respectively.

Weather conditions in Brazil remain largely positive despite below average rainfall in Espírito Santo, the main Conillon producing region, somewhat alleviating supply concerns.

Preliminary data on the value of exports by all exporting countries in coffee year 2015/16 are now available, coming to an estimated US$ 20.1 billion for a volume of 104.8 million bags.

This value is 5.9% higher than 2014/15 despite a 1.4% lower total export volume, reflecting the increase in prices recorded over the last year.

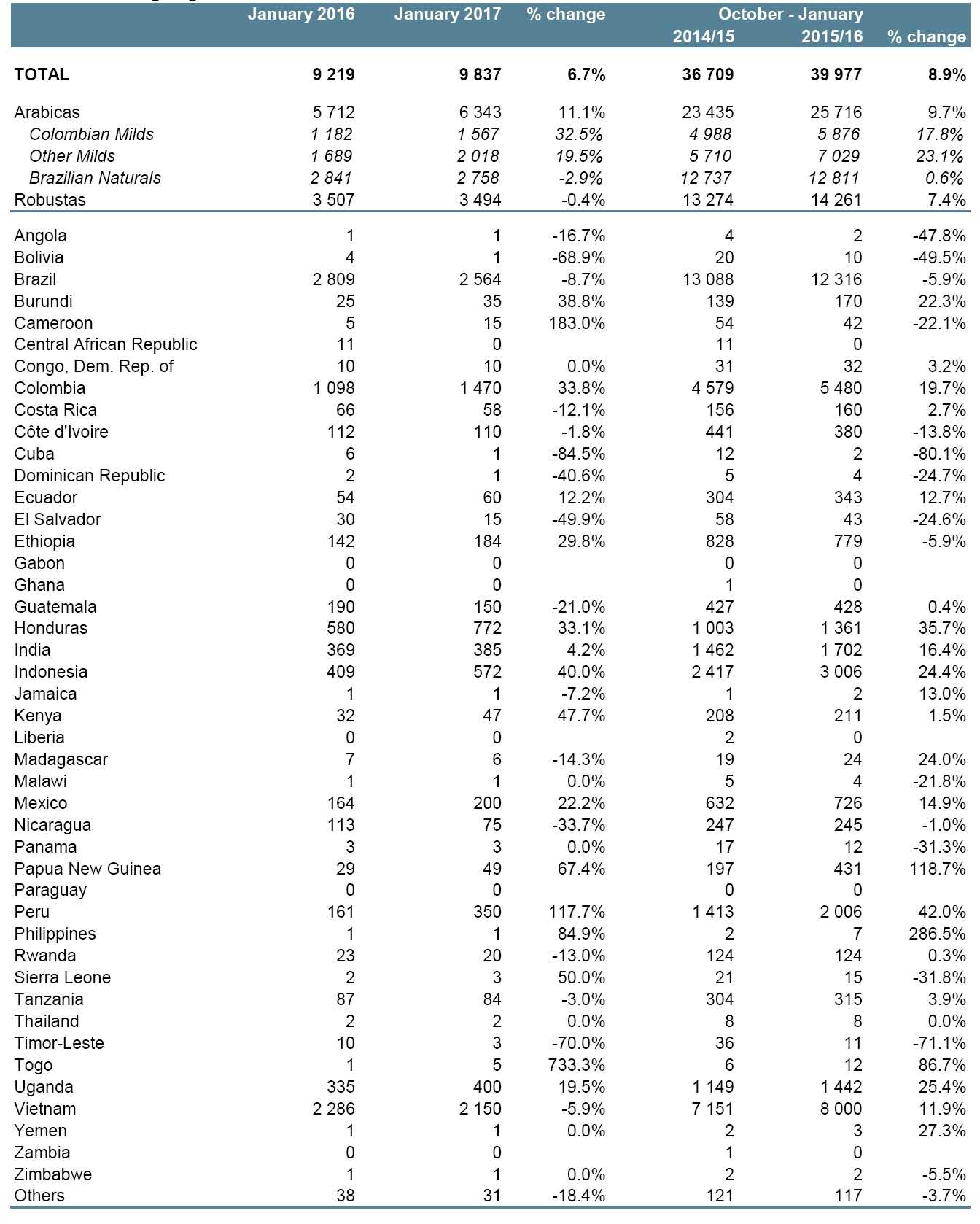

Shipments by all exporting countries during January 2017 totalled 9.8 million bags, bringing the cumulative total for coffee year 2016/17 (October 2016 to January 2017) to 39.9 million bags against 36.7 million for the same period in coffee year 2015/16, an increase of 8.9%.

Shipments by all exporting countries during January 2017 totalled 9.8 million bags, bringing the cumulative total for coffee year 2016/17 (October 2016 to January 2017) to 39.9 million bags against 36.7 million for the same period in coffee year 2015/16, an increase of 8.9%.

During this period, exports of Robusta and Arabica increased by 7.4% and 9.7% respectively.

The report can be found at this link.