LONDON, UK – The average of the ICO composite indicator in August rose by 10.7% to 114.78 US cents/lb. All group indicator prices rose in August 2020 for the second consecutive month with the largest increase occurring for Brazilian Naturals. In July 2020, world coffee exports fell by 11% to 10.61 million bags compared to July 2019, and Other Milds recorded the largest decrease.

In the first ten months of coffee year 2019/20, global exports reached 106.59 million bags, 5.3% lower than the same period in 2018/19.

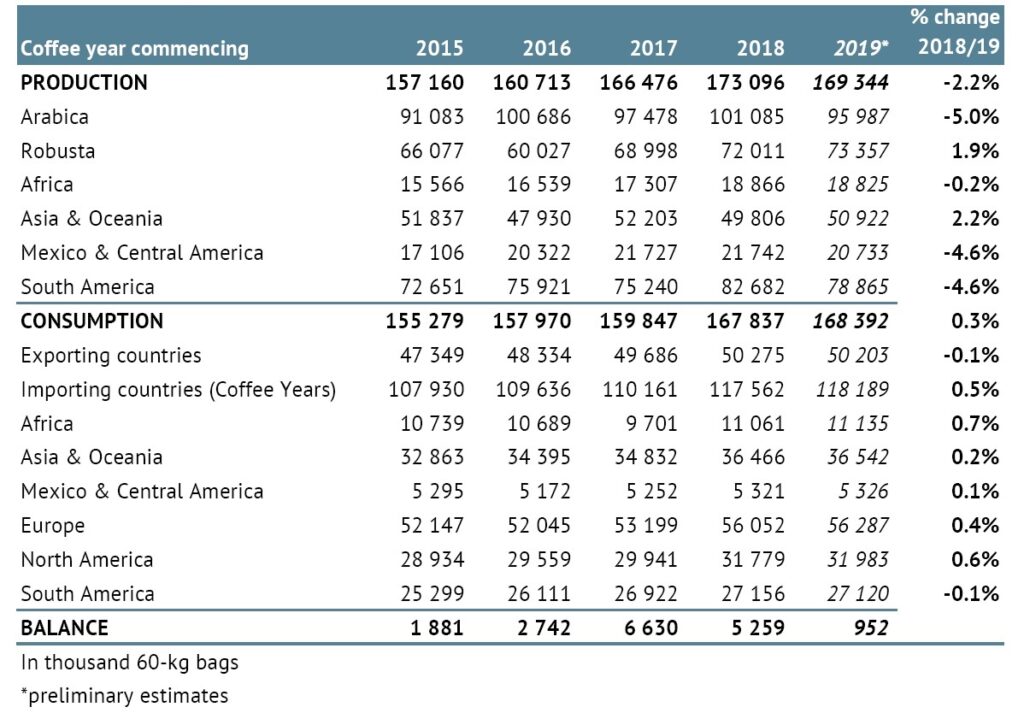

World coffee production is estimated at 169.34 million bags in 2019/20, 2.2% lower than last year while global consumption is estimated to rise by 0.3% to 168.39 million bags in 2019/20. As a result, there is an estimated surplus of 952,000 bags.

The monthly average of the ICO composite indicator rose by 10.7% to 114.78 US cents/lb in August 2020. This is an increase of 19.5% compared to August 2019 when the ICO composite indicator averaged 96.07 US cents/lb, the lowest average for August since 2006. While prices have increased, they remain low compared to the long-term average of 139.21 US cents/lb in the previous ten years.

The ICO daily composite indicator continued the upward trend at the end of July starting the month at 113.62 US cents/lb before reaching a low of 109.90 US cents/lb on 11 August. However, prices recovered over the rest of the month and reached a high of 121.31 US cents/lb on 31 August. Concerns over temporary tightness in supply, as evidenced by the lower output and exports in some countries, particularly producers of Mild Arabica, supported firm prices in August.

Prices for all group indicators rose in August 2020 for the second consecutive month. The largest increase occurred in the average price for Brazilian Naturals, which grew by 14.1% to 111.79 US cents/lb. Other Milds increased by 11.2% to 163.25 US cents/lb while Colombian Milds rose by 9% to 167.22 US cents/lb. As a result, the differential between Colombia Milds and Other Milds decreased by 39.8% to an average of 3.97 US cents/lb. The monthly average Robusta price increased by 7.4% to 72.68 US cents/lb.

The average arbitrage in August, as measured on the New York and London futures markets, rose by 20.3% to 58.09 US cents/lb. Certified stocks have also fallen in recent months. In August 2020, stocks of certified Arabica reached 1.54 million bags, the lowest volume since March 2017, and certified Robusta stocks amounted to 1.85 million bags, the lowest since November 2018.

Additionally, the volatility of the ICO composite indicator price increased by 1.3 percentage points to 8.9%. The volatility for Colombian Milds increased by 1.8 percentage points to 8.5%, and for Other Milds by 1.6 percentage points to 8.5%. Brazilian Naturals volatility rose by 2 percentage points to 13.5%, while the volatility for Robusta prices remained unchanged at 6.3%.

In July 2020, world coffee exports fell by 11% to 10.61 million bags compared to July 2019. Shipments of Arabica fell by 7.6% to 6.65 million bags, and Robusta exports decreased by 16.1% to 3.96 million bags. Other Milds recorded the largest decrease in July, falling by 19% to 2.24 million bags. Exports of Colombian Milds fell by 1.4% to 1.21 million bags, and Brazilian Naturals declined by 0.1% to 3.2 million bags. Among the five largest exporters in July, the shipments of Colombia, Ethiopia, and Indonesia grew while those of Brazil and Viet Nam declined.

Global exports in the first ten months of coffee year 2019/20 reached 106.59 million bags, 5.3% lower than the same period in 2018/19. Shipments of Other Milds shrank by 9.7% to 21.41 million bags in October 2019 to July 2020. Colombian Milds decreased by 6.6% to 11.74 million bags while Brazilian Naturals exports fell by 5.8% to 32.54 million bags in the first ten months of the coffee year. Robusta shipments reached 40.9 million bags, 2% lower than in October 2018 to July 2019.

World coffee production is estimated by the ICO at 169.34 million bags in 2019/20, 2.2% lower than in 2018/19. Arabica output is estimated to decrease by 5% to 95.99 million bags while Robusta output is expected to rise by 1.9% to 73.36 million bags. Production is expected to fall in all regions except for Asia & Oceania, where it is estimated to increase by 2.2% to 50.92 million bags. Africa is estimated to harvest 18.83 million bags, 0.2% less than in 2018/19. Production in Central America & Mexico is estimated to decline by 4.6% to 20.73 million bags and in South America by 4.6% to 78.87 million bags.

Viet Nam is the largest producer in Asia & Oceania and its output in 2019/20 is estimated to increase by 0.7% to 31.5 million bags. Viet Nam’s harvesting ended before the start of the global pandemic and benefited from the higher yields of newer trees as well as less favourable prices for competing crops like pepper. Indonesia’s production is estimated to increase by 16.5% to 11.2 million bags due to beneficial weather and firm prices for its Robusta crop.

Production in the next two largest producers of the region, India and Papua New Guinea, is expected to decrease by 2.5% to 5.85 million bags and by 19.2% to 752,000 bags, respectively. Regional exports in the first ten months of the coffee year reached 34.1 million bags, 4.2% lower than in the same period for 2018/19 due to strong competition on the international market.

Production is expected to rise in Africa’s two largest producers, Ethiopia and Uganda. Ethiopia’s harvest is estimated to increase by 2.1% to 7.7 million bags due to beneficial weather and improved agricultural extension services. Output from Uganda is estimated at 4.9 million bags, 4.2% higher than last year, which is the second year of increase.

Favourable weather and new trees reaching maturity have boosted yields in Uganda. However, output from Côte d’Ivoire is estimated to decrease by 10.2% to 2.2 million bags and from Tanzania by 23.4% to 900,000 bags. Exports from the region rose by 5.1% to 11.65 million bags in October 2019 to July 2020.

Production is projected to decrease in four of the five largest producers in Central America & Mexico. Honduras’ harvest is estimated to fall by 7.2% to 6.8 million bags, which is the second year of decline. Low prices and a limited labour supply have discouraged farmers from harvesting their coffee.

Production in Mexico is estimated to decrease by 5.8% to 4.1 million bags, in Guatemala by 1.2% to 3.96 million bags, and in Nicaragua by 3.7% to 2.7 million bags. However, Costa Rica’s harvest is estimated to increase by 5.1% to 1.5 million bags benefiting from beneficial weather and greater rainfall. Regional exports reached 14.2 million bags in the first ten months of 2019/20, 9.3% lower than in 2018/19.

Output from Brazil, both the world’s and South America’s largest producer, fell by 10.9% to 58 million bags in crop year 2019/20, which ended March 2020. Brazil’s Arabica output decreased by 17.4% to 37.12 million bags as it was an off-year of the biennial production cycle, but Robusta output rose by 3.4% to 20.88 million bags. The 2020/21 harvest has not been greatly affected by covid-19, with output anticipated to be similar to previous on-year crops. Colombia’s production is expected to grow by 1.7% to 14.1 million bags in 2019/20. Shipments from the region fell by 7.2% to 46.65 million bags in October 2019 to July 2020 due to lower output as well as transportation delays.

Global coffee consumption is estimated to rise by 0.3% to 168.39 million bags in 2019/20. The first half of the coffee year showed a strong trend following an increase in global demand of 5% to 167.84 million bags in 2018/19.

A surge in demand at the start of the global pandemic and increased at-home consumption helped to limit the fall in demand, but the latter half of the coffee year faces ongoing pressure from a global economic downturn and limited recovery in out-of-home consumption. As a result, the overall supply/demand balance is estimated by the ICO as a surplus of 952,000 bags.