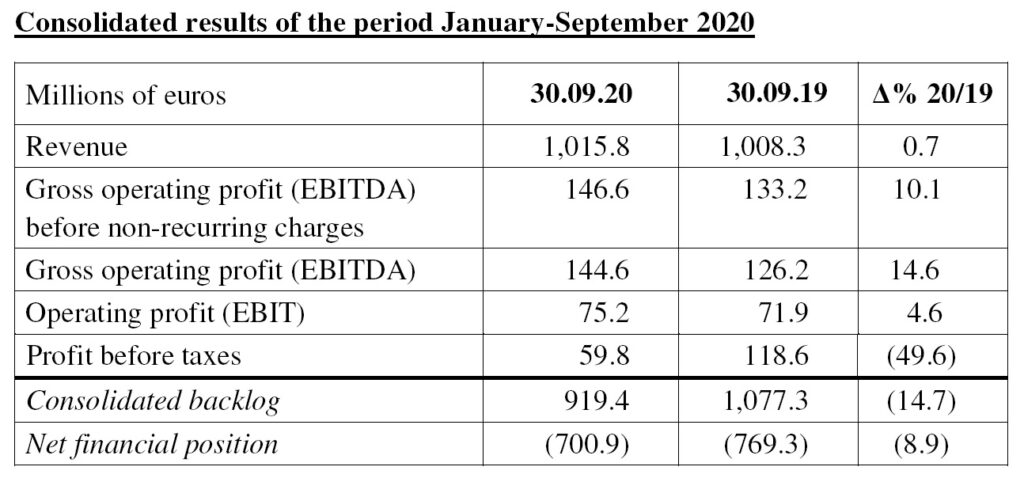

BOLOGNA, Italy – The IMA Group, a world leader in the production of automatic packaging machines, has closed the first nine months of 2020 with consolidated revenue of 1,015.8 million euros compared with 1,008.3 million euros at 30 September 2019. Gross operating profit (EBITDA) before non-recurring charges amounts to 146.6 million euros (133.2 million at 30 September 2019), gross operating profit (EBITDA) to 144.6 million euros (126.2 million at 30 September 2019), operating profit (EBIT) to 75.2 million euros (71.9 million at 30 September 2019) and profit before taxes to 59.8 million euros (118.6 million at 30 September 2019, which included 56.3 million on remeasurement of the fair value of the investment in Atop).

The consolidated backlog reached 919.4 million euros, -14.7% compared with 1,077.3 million euros at 30 September 2019.

The orders acquired in the first nine months of 2020 amount to 1,022.8 million euros, down by 7.1% compared with the same period of the previous year.

The IMA Group’s net debt at 30 September 2020 amounts to 700.9 million euros compared with 769.3 million euros at 30 September 2019.

IMA Group forecasts for fiscal year 2020

IMA Group forecasts for fiscal year 2020

The order trend in our reference sectors was again satisfactory in the third quarter despite the situation linked to the Covid-19 emergency, once again highlighting their resilience. The number of projects under negotiation is a positive sign despite the fact that the situation regarding the current health emergency is continuing to evolve, not only in Italy but also globally. However, the size of the backlog at 30 September is still considerably lower than at the same date last year.

“Based on the information currently available, we believe that Ima Group can achieve a result in line with what was previously announced: a reduction in EBITDA of about 10% compared with 2019” stated the company.

In commenting on the Group’s performance at 30 September 2020, Alberto Vacchi, IMA’s Chairman and CEO, declared: “The result achieved in the first nine months of 2020 reflects the backlog at the end of 2019, the order intake during the period and, above all, a different distribution of revenue compared with last year.

In fact, the third quarter was characterised by work that continued unabated even during the month of August and by the delivery of lines for surgical masks to the Civil Defence concentrated in the period of July-September. Our strong commitment to digitisation (IMA Digital) has allowed us to enhance and make accessible the entire range of digital products created by the Group to meet the needs of our customers all over the world, facilitating remote operations”.

Sofima shareholders have finalized the closing with BC Partners for the investment in IMA

The Board of Directors of IMA S.p.A. also announced that it had been informed by the shareholders of the parent company So.Fi.M.A. Società Finanziaria Macchine Automatiche S.p.A. (“Sofima”) that they had completed the closing relating to the sale of approximately 20% of their shares in SOFIMA to funds assisted by BC Partners LLP (“BC Partners”), a leading international investor.

IMA’s Chairman and CEO, Alberto Vacchi, has declared: “The deal is an excellent result for the company and its collaborators, who will benefit from the contribution of BC Partners as an important shareholder with considerable industrial experience with a view to commencing a period of development for IMA based entirely on innovation, and accelerating our global expansion in strategic sectors. In the process of finding the best possible partner for IMA and SOFIMA, it was important to find a counterparty that would allow IMA to remain independent, guaranteeing continuity to management and our partners, and to accelerate its strategy of growth as a global consolidator in the packaging machinery sector.

Personally, I am very happy to work on this great new project together with BC Partners. I believe it is useful for IMA to start this new phase from a position of strength, and designing products entirely from a digital point of view to satisfy next generation demand”.

Stefano Ferraresi, BC Partners’ partner, has declared: “IMA is an excellent example of an Italian company that has achieved a position of global leadership thanks to its engineering know-how, investment in research and the strength of the local production chain on which it can rely. IMA’s business has all the characteristics that BC Partners looks for in its investments: sector leadership, a strong management team and multiple levers for value creation. We are honoured to have been chosen as a partner by SOFIMA’s shareholders and enthusiastic about being able to support Alberto Vacchi and his excellent team of managers in the Group’s continuous expansion, both organically and through acquisitions”.

The shareholders of SOFIMA, BC Partners and the persons acting in concert with them – including IMA BidCo S.p.A. as bidder – will announce the mandatory public tender offer for all of the Company’s shares which follows completion of this investment through a separate press release that will be published as required by art. 102 of Legislative Decree 58/1998.