MILAN, Italy – Emerging from a global pandemic and facing an unpredictable and challenging economic climate, consumers today are struggling with huge financial pressures, and in many cases are adopting behaviours similar to their parents and grandparents from the ‘70s and ‘80s.

They are having to adapt as inflationary pressures force supermarket prices up. Combined with higher energy prices, slow wage growth and supply-side shortages, shoppers are making difficult choices in their day-to-day spending. Many are relying on personal savings to survive.

Low consumer confidence

The result is low consumer confidence and less disposable income. For many, it is also a return to the kind of austerity shopping behaviours that we saw decades ago. We are seeing new coping behaviours as a result of ‘inflation fatigue’ with consumers taking control and making decisions about where and how they shop, what they buy, and how they consume.

As prices continue to rise, consumers are making difficult trade-offs in their shopping baskets, focusing on essentials. Resilient categories like Chilled & Fresh, Ambient, Beverages and Personal Care are being offset by value sales declines in Alcohol and Household Care.

Fewer promotions post-pandemic are making way for the return of everyday low pricing as retailers try to mitigate the impact of food price inflation.

All of this at a time when retail has never been more disrupted with the continued growth of the discounters, new innovations in retail media and as quick commerce players expand their offerings.

The Iri report

FMCG Demand Signals looks at the impact of changing consumer demand on 230 FMCG

categories, 2000+ product segments and over 10 million SKUs across 14 major markets in Europe, the US and Asia Pacific.

The Iri report, which analyses in-store purchases for the year ending July 2022, combined with a consumer survey of 3000 global shoppers, shows that deteriorating disposable income is affecting middle- and low-income consumers across the developed world.

Delivering forensic analysis of value and volume sales trends across food and non-food categories and identifying key category trends, FMCG Demand Signals highlights pockets of growth for FMCG manufacturers and retailers during one of the most challenging times in the last 50 years.

Iri Insight 1: Consumers in crisis – shoppers adapt as inflation fatigue kicks in

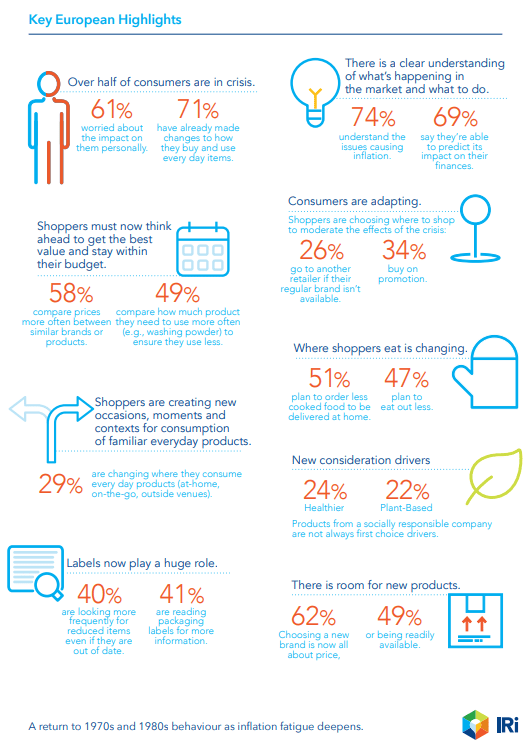

Retailers and manufacturers are witnessing some of the biggest changes in shopper behaviour in the last five decades, affecting their ability to buy and willingness to spend. Consumers, feeling the impact of inflation and, seeing no end in sight, are losing confidence.

Despite this, they are adapting and relying on personal savings to get by – 58% say they have cut down on essentials, such as missing meals and heating, and 35% are relying on personal savings and loans to pay bills. With ‘inflation fatigue’ kicking in, consumers are taking control of their spending, choosing where to shop to moderate the effects of the crisis.

In Europe, 30% of consumers will change where they buy everyday products to get a better deal, 26% go to another shop if their regular brand is not available, 34% go to another shop if a regular brand is not on promotion, and 41% go to another shop if there are no deals.

Shoppers are thinking ahead to get the best value and to stay within budget; planning how often they shop, with 22% making fewer trips, and 21% planning how much they spend. They are also comparing prices more often between similar products (58%), comparing how much product they need so they use and waste less (49%), and looking more often for products that are good for the environment or are socially responsible (29%).

New needs

Shoppers are also looking more often for reduced items even if they are out of date (40%), reading packaging labels (41%) and looking at review of everyday products (27%).

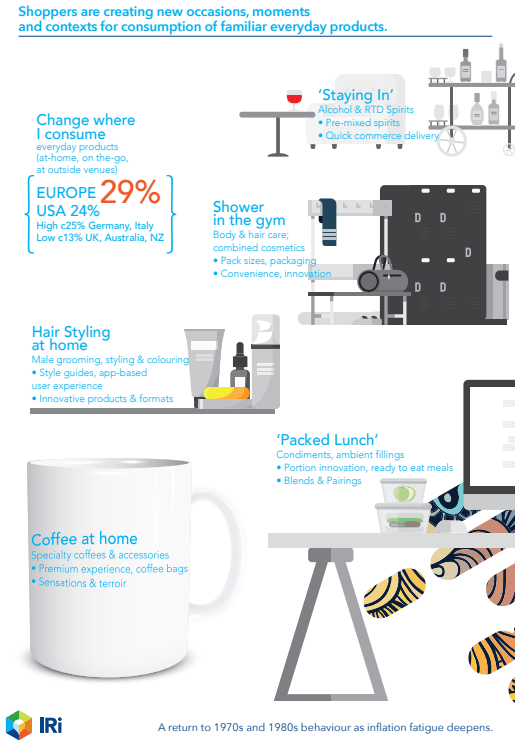

New occasions and moments for familiar everyday products are also important to shoppers, offering FMCG brands and retailers an opportunity to tap into these through new product innovation. Packed lunches at work, specialty coffees, pre-mixed spirits drunk at home, showering at the gym, and home hair styling are becoming popular again, while cooking fresh from home and the use of meal kits are replacing takeaways and eating out.

Choosing a new brand for shoppers is now all about price (62%), availability (49%), and high levels of on-shelf promotion (37%). Less important is whether it is of better quality (15%), innovative (8%) or makes shopping easier (8%), but it is also about tapping into new needs – sandwich fillings for packed lunches, coffee accessories and premium products, and new packaging and pack sizes for personal items used at the gym.

Iri Insight 2: FMCG category in transition as the outlook for 2023 darkens

In 2022, the picture for FMCG looks quite different to how it looked during the pandemic years. Total category growth is +1.5% vs a year ago (YAGO) adding €9Bn and worth €593.4Bn in value sales.

Value sales are predicted to reach +2.6% by the end of 2022, driven largely by inflation and significant price rises, especially in food staples.

A growing slump in volume sales in response to rising inflation may be an early indication of softness in FMCG demand.

Shoppers have little wiggle room due to price rises and are making difficult choices when it comes to their shopping baskets, prioritising essentials, such as milk, butter and pasta, and reducing their spend on discretionary items.

This is being reflected in certain food and non-food categories, with Chilled & Fresh, Ambient, Beverages and Personal Care products all performing well and helping to fuel value sales growth. Even as prices continue to rise in these categories, they will continue to do well.

More selection

Other categories, however, are struggling as consumers become more selective in their choices. Alcohol value sales are down -5.0%, the equivalent of €3.4Bn (MAT 2022), partially offsetting gains in other categories, with Year to Date (YTD) figures showing a further decline of -6.7%.

Germany, Spain, and Italy are responsible for driving FMCG growth across most food and non- food categories, but this is largely down to rising inflation levels in these markets, while the UK and France are helping drive value sales in Beverages, Confectionery, Personal Care, and Baby categories.

In FMCG food categories, growth rates in Europe are accelerating to levels in the US, where shoppers have had to cope with higher inflation for longer.

This applies across all markets for value sales MAT (Moving Annual Total for a full year ended July 2022) and YTD 2022, except for the UK where sales growth is slower.

The opposite is true for non-food categories, which are declining in the US but growing in Europe. The exception is the Netherlands, where declines in the last year and YTD have offset growth in all countries.

Iri Insight 3: Gap closes further – Private Label loyalists now equal those of national brands.

In the current inflationary environment, Private Labels are returning to pre-pandemic levels with value sales growth up +5.4% YTD 2022 (+3.0% MAT 2022). Private Labels now contribute €216Bn or 36.4% of FMCG value sales in 2022 MAT with strong YTD growth in all major European markets.

Retailers are reacting in line with changing consumer behaviours, particularly in terms of controlling price rises. Supermarkets are keen to avoid a return to the 2008-9 financial crisis and another all out price war.

The retailers stopped offering everyday low prices (EDLP) last year and increased promotions to shift stock, particularly in non-food categories. We are now seeing the return of EDLP and a decline in the volume of promotions in YTD 2022. This allows supermarkets to mitigate the impact of food price inflation by maintaining artificially lower prices.

Private Labels typically offer lower prices to shoppers. But the rate of inflation on Private Labels has been higher than on national brands, leading to an increase in value sales, driven by Chilled & Fresh, Frozen and Beverages in food (+5.3%), and by Household and Personal Care in non-food categories.

Throughout the pandemic, national brands outperformed Private Labels, with consumers comforted by buying brands they know and trust and could easily find in challenging times.

But Private Label loyalists now equal those of national brands, having closed the value gap with national brands beyond availability and price.

Private Labels according to Iri

Most shoppers (60%) believe Private Labels are as good as national brands when it comes to quality, innovation, sustainability and delivering on claims. A quarter of consumers believe they are better than national brands.

The risk to smaller and mid-sized manufacturers – the ‘Squeezed Middle’ – is that they will begin to lose volume and value to Private Labels precipitating a price war in early 2023 and affecting value sales of large national brands facing both margin erosion and declining volumes.

The impact of inflation is having a significant impact on the Alcohol category, and this has partially offset growth in other FMCG food and non-food categories, including Chilled & Fresh, Ambient, Beverages, and Personal Care.

Worth €66bn MAT 2022, the category has fallen -5%, the equivalent of €3.4bn. However, YTD 2022 figures show this will drop even further to -6.7%. While the UK is responsible for much of the decline (-13% YTD 2022), particularly in beer and cider sales, France (-4.5% YTD 2022) and Germany (-2.6% YTD 2022) are also contributing to a lesser extent.

Due to travel disruptions and the impact to leisure facilities and venues, this has had a huge impact on the category over the last two years.

Post-pandemic however, the high cost of socialising out of home means consumers in Europe are now changing their habits, with 39% spending less on beers, and 44% spending less on wines and spirits.

Drinks manufacturers and retailers will need to look beyond price to respond to these new consumer behaviours, such as offering new at- home drinking experiences, pairings and sensorial experiences with pre-mixed and ready-to-drink spirits and cocktails.

With the discounters offering low-cost alternatives to help drive footfall, brands should also tap into new opportunities for craft, draft and specialty beers, as well as no alcohol, low alcohol offerings.