Share your coffee stories with us by writing to info@comunicaffe.com.

ABIDJAN, Côte d’Ivoire – The stock-to-grindings ratio is among the market forces of the cocoa market that determine cocoa price movements. It is obtained by dividing the end-of-season stocks of the previous cocoa year by the estimated grindings for the actual crop year. This indicator is used to measure the relative scarcity or availability of cocoa beans for processing activities during a given cocoa year.

Thus, world cocoa prices and the stocks-to-grindings ratio are inversely related as it is considered that a higher stock-to-grindings ratio will result in lower cocoa prices and vice versa.

The reason for the inverse relationship is that, higher values of the stock-to-grindings ratio suggest relatively abundant cocoa stocks that is available to satisfy the demand for cocoa processing and subsequently is anticipated to pressure down cocoa prices.

On the contrary, lower values for the stock-to-grindings ratio indicate a relative scarcity of cocoa beans in respect to the expected grindings activities and thereby contributes to bolster cocoa futures prices.

However, it is worth noting that, the stock-to-grindings ratio is not self-sufficient to explain the trends of cocoa prices for various reasons. On the one hand, it does not account for parameters like currencies strength, inflation, and other fundamental factors which have a direct impact on price movements.

On the other hand, the calculation depends on the precision and accuracy of statistics on the end of season cocoa stocks and grindings. As such, statistical errors do add up in the derivation of the elasticity of prices to stock-to-grindings ratio.

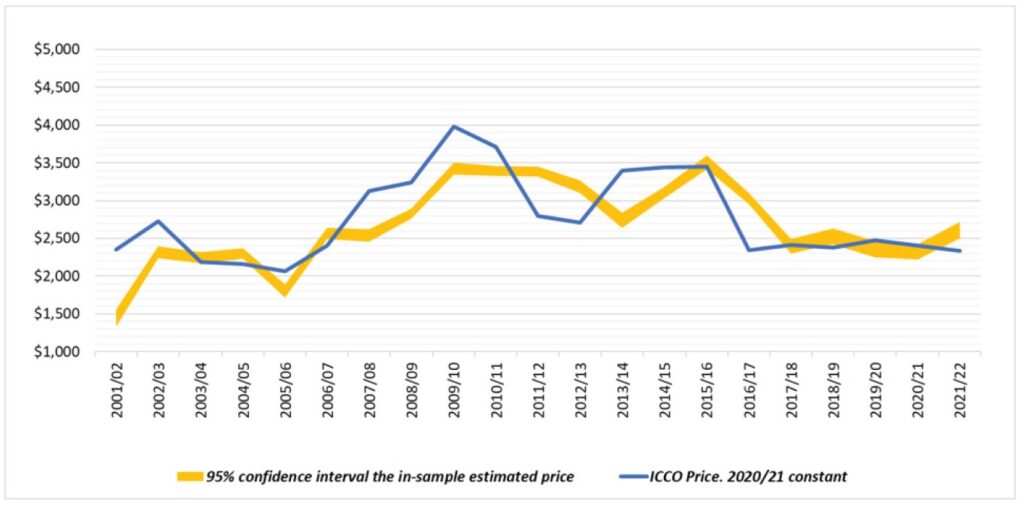

In the light of the aforementioned reasons, as shown in Figure 1, discrepancies between the historical prices – blue line – and the in-sample estimates are indeed expected. The forecast price for 2021/22 is currently under the estimated 95% confidence interval – yellow area -: from US$2,503 to US$2,717 per tonne.

As at June 2022, while a supply deficit is expected for the ongoing 2021/22 season, cocoa futures prices have followed a downward trend which has mainly been triggered by economic uncertainties. A year back i.e. June 2021, prices followed a downward trend as in the midst of the Covid-19 pandemic, the global cocoa market was expected to end the 2020/21 cocoa year with an excess supply.

This situation clearly illustrates that the stock-to-grindings ratio is not robust enough to drive cocoa futures prices as the “severity” of surplus/deficit depends on the volume of grindings for that specific year. Nevertheless, as shown in Figure 1, the observed discrepancy for the ongoing 2021/22 season, is not as big as that of the 2011/12 cocoa year.

The demand for cocoa is expected to overtake supply for 2021/22.

Futures prices developments

The global cocoa market was at half-mast on both sides of the Atlantic in June with prices of the nearby cocoa futures contract averaging US$2,139 per tonne and ranging between US$2,059 and US$2,215 per tonne in London while in New York the JUL-22 contract traded at an average price of US$2,396 per tonne and oscillated between US$2,291 and US$2,522 per tonne.

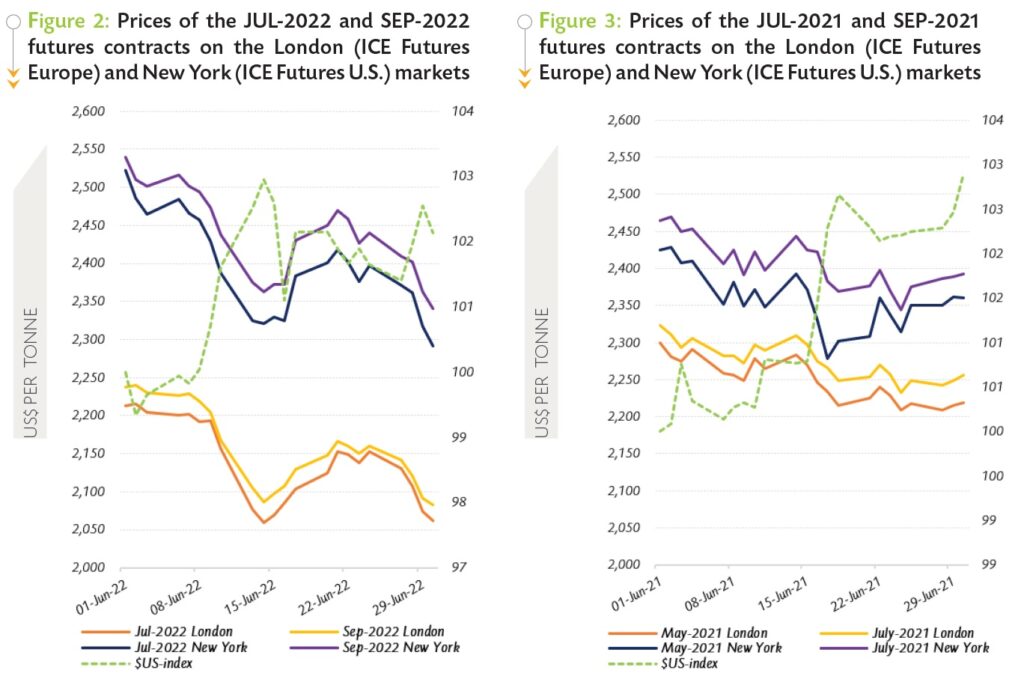

The 2% appreciation of the US dollar during the month under review contributed to curbing cocoa prices. Figure 2 shows price movements of the first and second positions on the London and New York futures markets respectively at the London closing time in June 2022, while Figure 3 presents similar information for the previous year. These two figures include the US dollar index to assess the impact of the strength of the currency on cocoa futures prices.

Although futures prices generally descended during June 2022, their developments followed three distinct sequences (Figure 2). Indeed, during the first half of the month under review, the front-month cocoa futures prices plummeted by 6% from US$2,212 to US$2,069 per tonne in London and by 8% from US$2,522 to US$2,329 per tonne in New York.

This bearish trend in prices was driven by the strengthening of the US dollar, global economic concerns mainly stemming from steady inflation and a high level of inventories in the Exchange monitored stocks of cocoa beans.

Certified stocks of cocoa beans increased from 171,330 tonnes to 176,740 tonnes in Europe and from 352,106 tonnes to 357,894 tonnes in the United States.

Thereafter, information that levels of arrivals in Côte d’Ivoire and purchases in Ghana continued to be lower year-on-year contributed to the short-lived upward trend seen in the JUL-22 prices over the 1-week period 16-22 June. As at 19 June, cocoa arrivals in Côte d’Ivoire were reported at 1.943 million tonnes, down by 5% compared to the level of 2.045 million tonnes seen at the same period of the previous season.

In Ghana, the latest available information indicated that volumes of cocoa purchases were lower by 32% year-on-year from 961,000 tonnes to 651,000 tonnes. During the last week of the month under review, the adequate meteorological conditions that prevailed in West Africa erased concerns regarding cocoa supply. Hence, the JUL-22 contract prices plunged by 4% on both markets moving from US$2,138 to US$2,062 per tonne and from US$2,376 to US$2,291 per tonne in London and New York respectively

Evolution of weather parameters in Côte D’ivoire and Ghana

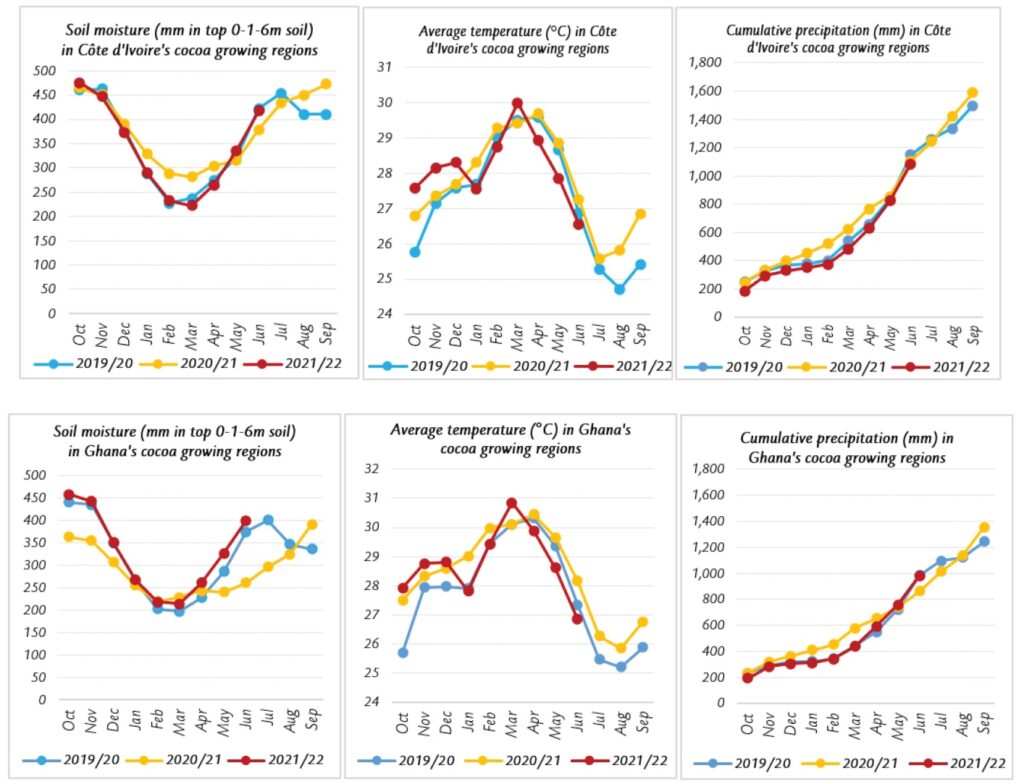

The graphs below present the average temperature (in degree Celsius), the cumulative rainfall (in millimetres), and the average soil moisture (mm in top 0-1-6m soil), compiled from the weather database of Refinitiv for the cocoa growing areas in Côte d’Ivoire and Ghana.

The main observation is that the trend for the current cocoa year and the two previous seasons are nearly similar. This evidence suggests that the current low level of arrivals and purchases in both countries are not necessarily attributable to the weather.

As no bottleneck in the haulage of cocoa upcountry has been reported, other parameters like aging cocoa trees or cocoa-related diseases as well as poor agricultural practices could have contributed to reducing the yield of cocoa farms and subsequently lowering the level of arrivals and purchases in Côte d’Ivoire and Ghana respectively.