MILAN, Italy – The Board of Directors of Italmobiliare S.p.A. today approved the quarterly financial results for the nine months ending on September 30, 2019. During the first nine months, also thanks to a positive performance in the third quarter, all the portfolio companies reported an improvement in Ebitda compared to the same period of the previous year.

Performance was particularly positive – exceeding forecasts – at Caffè Borbone and Tecnica Group, which both raised their own Ebitda by around 45%. At the same time, Ebitda growth between 15% and 20% was reported by the other portfolio companies, with the sole exception of Sirap, which nevertheless achieved moderate progress.

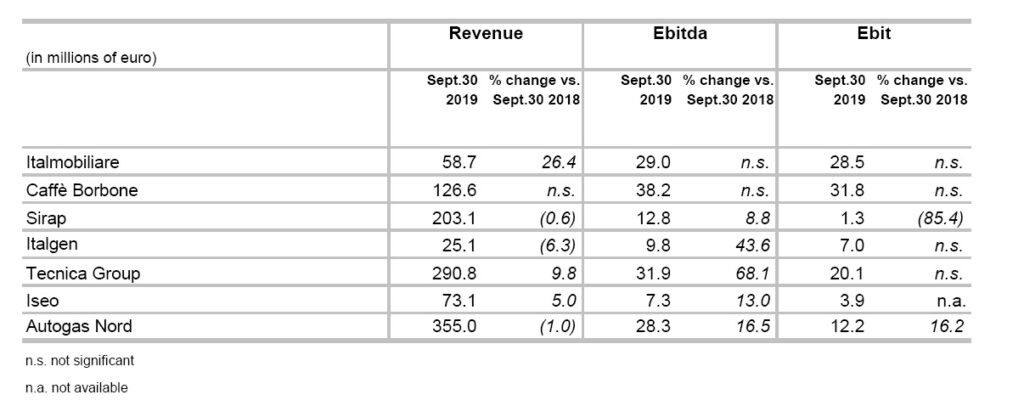

Overall, on the basis of the aggregated performances of the single companies for the first nine months, the Portfolio Companies boosted revenue by 5% to 1.1 billion euro and Ebitda by over 27% to approximately 130 million euro.

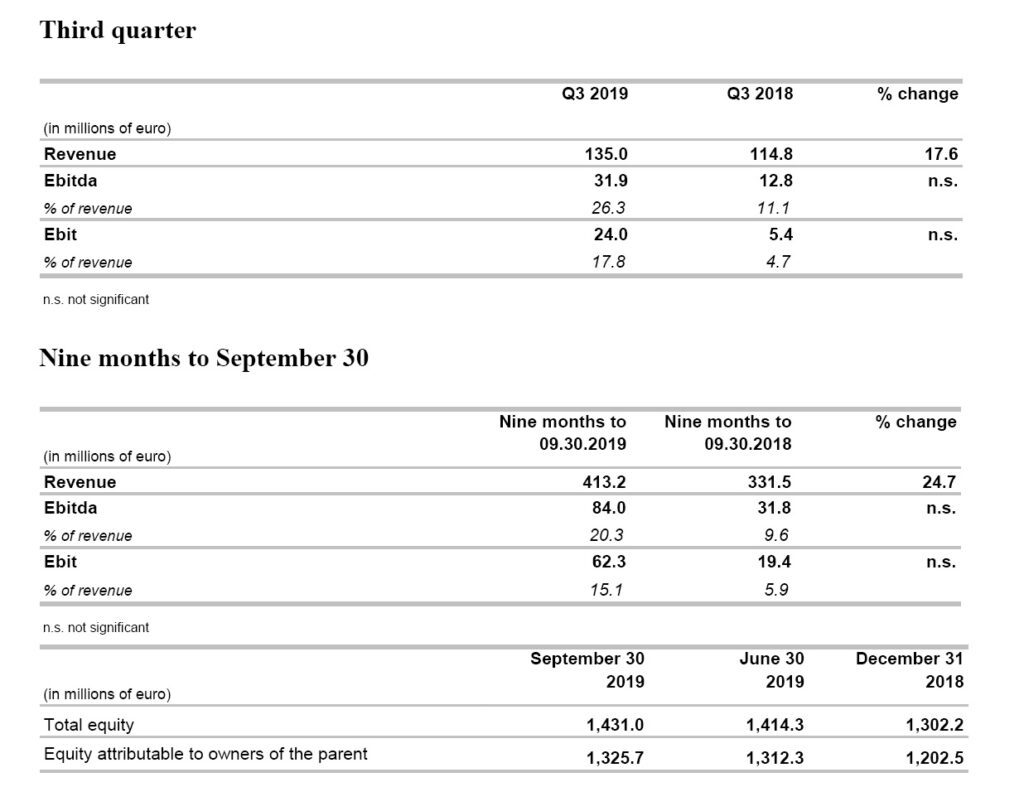

Given the results of the portfolio companies, and considering the different period of consolidation (Caffè Borbone has been consolidated starting from May 2018) and the positive performance of Italmobiliare S.p.A. (a rise of 25.3 million euro in Ebitda to 29 million euro, mainly due to fair value increases of the private equity funds and trading securities), at September 30, 2019, Group consolidated revenue amounted to 413.2 million euro (+81.7 million euro) and Ebitda to 84 million euro, an increase of 52.2 million euro.

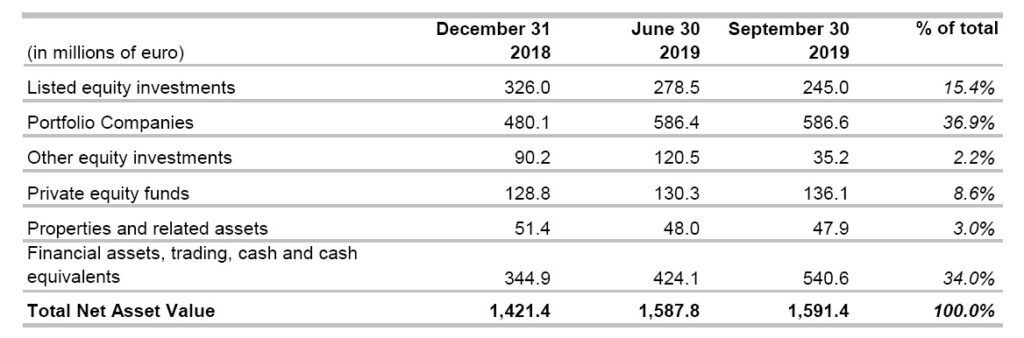

At September 30, 2019, Italmobiliare Net Asset Value was 1,591.4 million euro, with an increase of 170 million euro from December 31, 2018 and of 3.6 million euro from the situation at June 30, 2018; the overall increase in listed securities was the only material change in the third quarter.

NAV per share was 37.9 euro (33.9 euro at December 31, 2018).

The net financial position of Italmobiliare S.p.A. at September 30, 2019 reflected cash of 540.6 million euro, an additional increase (+195.7 million euro) from 344.9 million euro at December 31, 2018.

The main contribution in the first nine months came from divestiture of HeidelbergCement and Mediobanca shares (+167 million euro), the disposal of the shareholding in Jaggaer (+91.2 million euro), and the acquisition of Autogas Nord S.p.A. (-60.1 million euro), where, in accordance with the adjustments envisaged by the investment agreement, the equity interest was recently increased from 27% to 30%. During the third quarter, Italmobiliare also disinvested its interest in the Aksìa IV fund for 21.6 million euro, generating a money-on-money return over 2x in the investment period started with the commitment in 2015.

On September 24, Italmobiliare shares were included in the Borsa Italiana STAR segment. The share price rose by 15.5% over the first nine months of the year, and its current performance reflects an improvement of 30%. Based on current stock market prices, the NAV discount decreased significantly to approximately 36%, from 46.3% at the end of 2018.

Significant events in the quarter

During the third quarter, Italmobiliare completed the sale to Cinven of its 9.5% shareholding in Jaggaer, a company active in e-procurement and spend management software platforms, for an amount of 91.2 million euro. At the end of 2017, Italmobiliare sold its equity investment in BravoSolution to Jaggaer; as part of the agreement, it invested approximately 35 million euro in the US company, acquiring a shareholding of approximately 9.5%.

Italmobiliare also completed the sale on the secondary market of its share in the Aksìa IV fund for an amount of 21.6 million euro, generating a money-on-money return of about 2.2x on its investment commitment in 2015.

In the quarter, Italmobiliare applied for and was granted admission to the STAR segment of Borsa Italiana S.p.A.; trading began on September 24, 2019.

Net Asset Value

Excluding treasury shares, Italmobiliare S.p.A. Net Asset Value at September 30, 2019 was 1,591.4 million euro, steady with the figure at June 30, 2019 (1,587.8 million euro) and up 170 million euro from December 31, 2018 (1,421.4 million euro), on capitalization of 880.9 million euro, for a discount of 44.6%.

Compared with December 31, 2018, the main changes in the composition and value of NAV arose chiefly from:

- a positive effect of 34.4 million euro on reserves from the sale of HeidelbergCement AG and Mediobanca S.p.A. shares for 167.0 million euro. An increase in the fair value of the remaining shares (51.5 million euro). After these disinvestments and changes in fair value, the portion of NAV invested in listed equity investments decreased by 81.0 million euro;

- an increase in the NAV of the portfolio companies (+106.5 million euro overall), largely as a result of the acquisition of Autogas Nord (+60.0 million euro) and an increase in the fair value of Caffè Borbone and Tecnica Group, offset in part by a decrease in the fair value of Sirap (for an overall effect of +48.4 million euro);

- the change in other equity investments was chiefly due to the sale of Jaggaer in the third quarter for 91.2 million euro (with a positive effect of 34.8 million euro on reserves).

The increase in financial assets, trading, cash and cash equivalents (+195.7 million euro) is analyzed in the comments on the results of Italmobiliare S.p.A.

At September 30, 2019, Italmobiliare S.p.A. NAV per share, excluding treasury shares, was 37.94 euro, an increase of 11.98% compared with NAV per share at December 31, 2018.

NAV was computed considering:

- the market price at September 30, 2019 of the equity investments in listed companies;

- the value of the non-listed companies determined by an independent expert at June 30, 2019 as indicated by the company guidelines for the computation of NAV, under which the portfolio companies are valued twice a year, for the annual and half-year reports;

- the market value of real estate assets;

- the deferred tax effect.

General economic and financial scenario

Global economic conditions reflect a synchronized slowdown in the various geographical regions concentrated in the manufacturing sector, while the overall situation in the tertiary sector remains steady. The climate of political uncertainty (trade war, Brexit, Middle East) is having repercussions for business confidence and investment spending, while the direct effects of tariffs on GDP (USA) are neutralized in part in the short term by the effects of the substitution of imported goods with domestic goods. Some signs of stabilization in forward-looking macro-indicators in concomitance with an easing in the tone of the US-China trade negotiations and a possible non-traumatic solution to Brexit increase the probability of a slow upturn in the economic cycle in the first half of 2020, although uncertainties remain.

The latest IMF estimates forecast a fall in world growth to 3% this year, from 3.6% in 2018, and a recovery to 3.4% next year.

Given the weakening economic cycle, the global inflation rate has decelerated. In the advanced nations in particular, the central banks continue to pursue non-conventional monetary policies: however, their effectiveness is beginning to be questioned and their possible adverse effects with regard to financial and economic stability are being analyzed. Looking forward, the chances of greater support for the cycle depend on greater impetus from fiscal policies, especially in the Eurozone (Germany). In Italy, the 2019 GDP growth forecast is practically zero, while expectations for 2020 are around half of one percentage point, below the consensus forecast for the Eurozone (1.4%).

Key consolidated figures at September 30, 2019

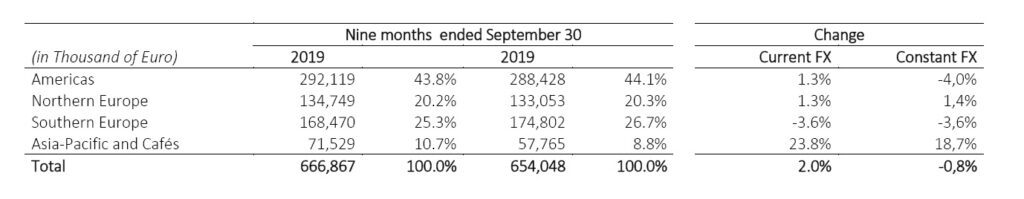

Italmobiliare Group consolidated revenue in the first nine months of 2019 increased by 81.7 million euro (+24.7% on the year-earlier period). A significant factor in the revenue improvement was the rise in turnover at Caffè Borbone (+74.3 million euro, in part as a result of the different consolidation period, given that the company was acquired in May 2018).

Italmobiliare Group consolidated revenue in the first nine months of 2019 increased by 81.7 million euro (+24.7% on the year-earlier period). A significant factor in the revenue improvement was the rise in turnover at Caffè Borbone (+74.3 million euro, in part as a result of the different consolidation period, given that the company was acquired in May 2018).

Ebitda rose by 52.2 million euro, driven mainly by Caffè Borbone (+22.7 million euro) and Italmobiliare (+25.3 million euro). Ebit reflected the impact of net impairment losses of 1.1 million euro attributable to the Sirap Group (fair value gains of 6.0 million euro at September 30, 2018), net of an increase of 5.2 million euro in amortization and depreciation.

Consolidated equity at September 30, 2019, was 1,431.0 million euro, up by 128.8 million euro from December 31, 2018 (1,302.2 million euro).

The increase arose largely as a result of the change in the fair value reserve on assets classified at fair value through other comprehensive income (FVOCI), relating specifically to HeidelbergCement, Mediobanca and Jaggaer shares (+119.8 million euro).

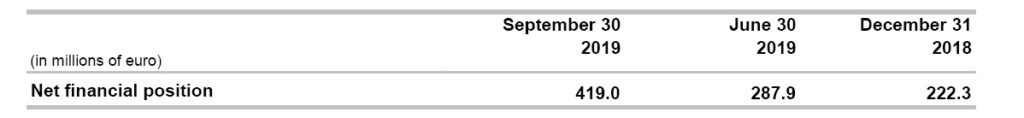

Net financial position

The positive Group net financial position of 419.0 million euro showed an increase of 196.7 million euro from December 31, 2018, largely as a result of the improvement in the net financial position of Italmobiliare S.p.A. (+195.7 million euro). Details are provided later in this disclosure.

The positive Group net financial position of 419.0 million euro showed an increase of 196.7 million euro from December 31, 2018, largely as a result of the improvement in the net financial position of Italmobiliare S.p.A. (+195.7 million euro). Details are provided later in this disclosure.

Operating performance of the main Group companies

The main indicators reflecting the operating performance of the Group companies were generally positive or stable, with some exceptions as detailed in the following sections.

The main indicators reflecting the operating performance of the Group companies were generally positive or stable, with some exceptions as detailed in the following sections.

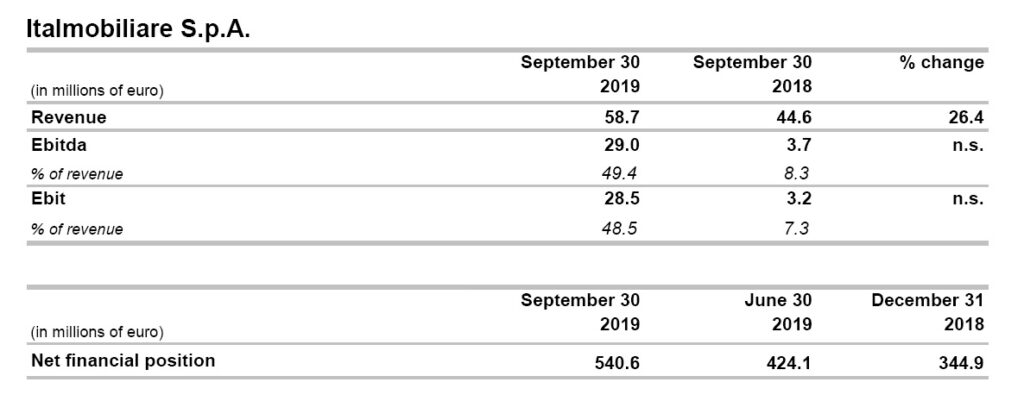

Italmobiliare S.p.A.

Revenue for the first nine months amounted to 58.7 million euro, an increase of 14.1 million euro from the year-earlier period (44.6 million euro), and arose mainly from:

Revenue for the first nine months amounted to 58.7 million euro, an increase of 14.1 million euro from the year-earlier period (44.6 million euro), and arose mainly from:

- dividends declared by subsidiaries, associates and other investees for 20.8 million euro (18.7 million euro in the year-earlier period);

- gains and fair value gains totaling 23.8 million euro, a significant increase from the year-earlier period (9.1 million euro), arising largely from fair value gains on mutual and private equity funds (+21.4 million euro).

- interest income and finance income totaling 13.7 million euro (16.4 million euro in the third quarter of 2018), essentially as a result of the fair value increase of 8.0 million euro on derivatives and the positive exchange-rate effect of 4.2 million euro.

Negative income components amounted to 30.3 million euro (40.9 million euro in the year-earlier period) and reflected:

- substantially stable operating expense of approximately 17.5 million euro;

- a decrease of 11.3 million euro in overall finance costs, largely as a result of smaller fair value reductions on trading securities, which in the year-earlier period had a negative effect of 10.4 million euro.

Equity at September 30, 2019 was 1,330.5 million euro, an increase of 100.4 million euro from December 31, 2018 (1,230.1 million euro) driven largely by: an increase of 51.5 million euro in the fair value of equity investments at FVTOCI (net of the fiscal effect); sales of equity investments at FVTOCI during the period under review (+55.7 million euro net of the fiscal effect).

In the first nine months of 2019, the net financial position of Italmobiliare S.p.A. rose by 195.7 million euro, from 344.9 million euro at December 31, 2018 to 540.6 million euro at September 30, 2019, allocated for approximately 50% in the Vontobel Fund with a conservative risk profile consistent with the company’s investment policies.

The main contribution came from the sale of HeidelbergCement and Mediobanca shares (+167 million euro), the sale of the shareholding in Jaggaer (+91.2 million euro), counterbalanced in part by the acquisition of Autogas (-60.1 million euro).

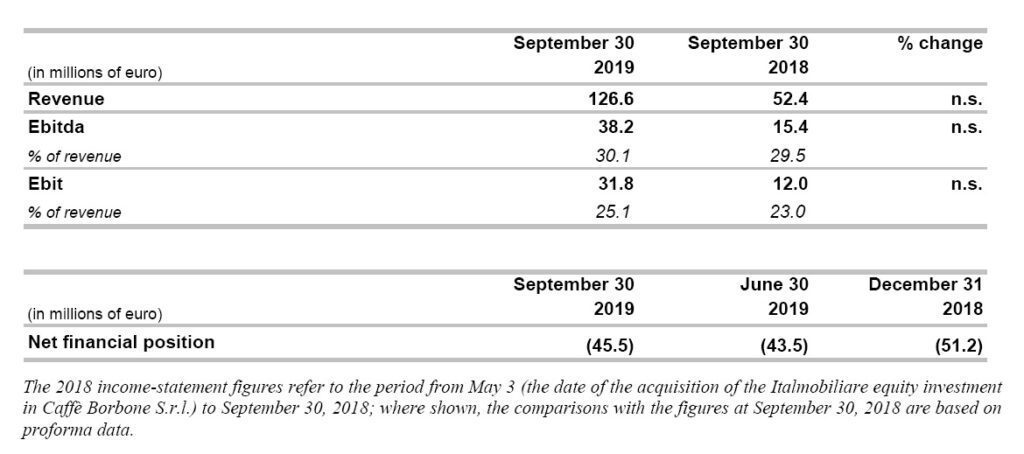

Caffè Borbone

In the third quarter of 2019, Caffè Borbone intensified its growth, with revenue of 40.7 million euro, an improvement of 36% from the third quarter of 2018; revenue for the first nine months was 126.6 million euro, up 31% from the year-earlier period.

In the third quarter of 2019, Caffè Borbone intensified its growth, with revenue of 40.7 million euro, an improvement of 36% from the third quarter of 2018; revenue for the first nine months was 126.6 million euro, up 31% from the year-earlier period.

In terms of distribution channels, sales through the retail channel and on the web continued to grow, at rates substantially in line with average rates; sales in the mass merchandising channel showed a very strong increase of 82% from 2018 on a monodose coffee market that recorded growth of 7.7% over the same period (Nielsen data). In terms of products, capsules showed overall growth of 36%, driven by the excellent performance of the Nespresso and Lavazza A Modo Mio compatible capsules.

Ebitda for the third quarter was 13.1 million euro, up 40% from the year-earlier period. Ebitda for the first nine months was 38.2 million euro, with a margin of 30%; the improvement from the first nine months of 2018 arose from the continuing low purchase price of coffee beans, and the reduction in the ratio of commercial expense to revenue.

Ebit for the first nine months of 2019 was 31.8 million euro (25.1% of revenue), with amortization of the customer list of 4.7 million euro.

The net financial position at September 30, 2019 reflected debt of 45.5 million euro, an improvement of 5.7 million euro from December 31, 2018 after the dividend payout in the second quarter (8.0 million euro); the first nine months generated a positive cash flow of 13.7 million euro, lower than the year-earlier period as a result of the rise in working capital (+15 million euro from the end of 2018) due to higher turnover, seasonality, the change in the channel mix and the increase in stocks of coffee beans.