GRAND DUCHY OF LUXEMBOURG – The Board of Directors of IVS Group S.A., convened on March 27th, 2025 and chaired by Mr. Paolo Covre, examined and approved the Annual Report 2024 (statutory and consolidated), the Management Report and related documents and the Sustainability Report.

The Chairman has been mandated by the Board to convene the AGM, in accordance with law and the Company’s statute, on June 26th, 2025, at 12:00 at IVS Group registered office, 18 Rue de l’Eau L – 1449, L-Luxembourg, Grand Duchy of Luxembourg, to vote on the approval of the Annual Report 2024 and related matters, the allocation of the Company’s result and directors’ indemnification. The Board also discussed and approved the reports on Corporate Governance, Remuneration, Risks Control.

With reference to the allocation of the annual result, the Board proposed to carry forward the profit.

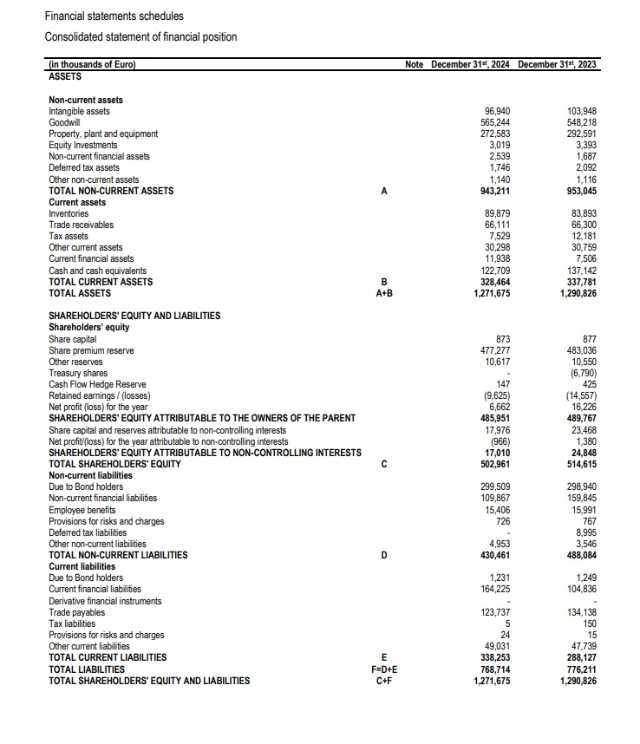

Summary of IVS Group consolidated results at 31 December 2024

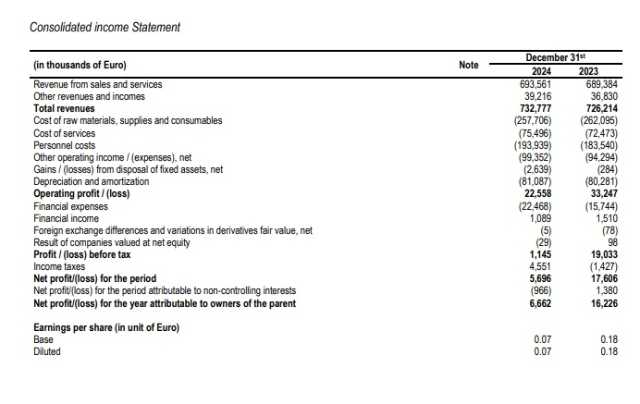

- Consolidated Revenues: Euro 732.8 million, (+0.9%).

- Adjusted EBITDA: Euro 110.0 million, (-5.3%).

- Adjusted EBIT: Euro 29.0 million, (-19.4%).

- Adjusted Net Profit: Euro 11.9 million (-13.9%).

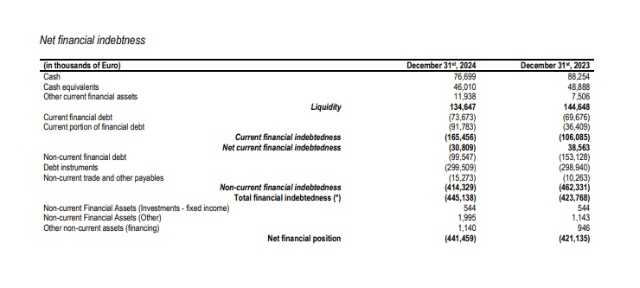

- Net Financial Debt equal to Euro 441.5 million (including Euro 88.8 million debt related to IFRS 16).

- Completed 14 acquisition in Italy and abroad.

IVS Group: operating performances

Consolidated revenues at 31 December 2024 reached Euro 732.8 million, +0.9% from Euro 726.2 million of 2023.

The group’s sectors sales are summarised below (before intra companies elision and pro-rata temporis).

- Vending business (Italy, France, Spain and other countries): Euro 4 million (net of intra group elision of EUR 8 thousand), +3.7% from Euro 556.0 million of 2023, further divided into the following markets: (i) Italy (Euro 469.0 million), (ii) France (Euro 57.9 million), (iii) Spain (Euro 42.4 million), (iv) other Europe markets (Euro 15.2 million).

- Resale business. Euro 103.5, -21.3% compared to Euro 131.6 million of 2023. The strong decrease is due to the sudden increase in product costs (coffee and chocolate) and to significantly reduced/completely stop purchasing of new machines.

- ho.re.ca. business: Euro 28.9 million (+33.2% compared to Euro 21.7 million of 2023).

- Coin division business: Euro 41.4 million (+2.7% compared to Euro 40.3 million of 2023), with a further increase of the payment app CoffeecApp (over 1.8 million registered users and 1.1 million active users).

In the vending business, the total number of vends as of December 31st, 2024 was equal to 982.6 million, from 991.5 million of 2023 (-0.9%). The volumes decrease is not due to the loss of contracts with clients (that on the contrary increased), but to the lower consumptions at like-for-like clients perimeter, caused by the overall reduced number of hours worked and, consequently, lower consumptions at work places. The largest part of the volumes decrease (around -18 million vends, around 1.8% of total volumes) was registered in the Italian market.

The overall yearly acquisition rate of new clients remains higher than the churn rate. The acquisitions of the period contributed pro-rata to 2024 sales for around Euro 5.5 million.

Average price per vend (net of VAT) was equal to Euro 54.77 cents, from 52.5 cents (+4.3%). The increase in the average selling price will continue, rolling, on the whole clients base, and compensates the lower like-for-like volumes. .

Consolidated EBITDA reported is equal to Euro 103.6 million, -8.7% down compared to Euro 113.5 million of 2023.

Consolidated Adjusted EBITDA is equal to Euro 110.0 million, 5.3% down from Euro 116.2 million of 2023. Average Adjusted EBITDA margin to around 15.0% (16.5% net of positioning fees).

Operating margins were especially affected by the strong decrease of turnover in the Resale business, that caused an EBITDA drop of around 38%, and the strong increase of the cost of raw materials in the vending business, especially the coffee cost (that absorbed the slower and gradual increase of average selling prices) and the labour cost, with a significant increase due to contracts renewal.

Consolidated EBIT Adjusted decreased consequently to Euro 29.0 million, from Euro 35.9 million of 2023 (-19.4%). EBIT is influenced by the amortisation of parts of the intangibles emerging from the acquisitions (PPA-Purchase Price Allocation to client’s list, brands, etc.) for around Euro 13.4 million.

Consolidated Net Profit 2024 is equal to Euro 5.7 million (before Euro 1.0 million profits attributable to minorities) compared to Euro 17.6 million of 2023.

Consolidated Net Adjusted Profit (before minorities and net of the exceptional items) is equal to Euro 11.9 million, from Euro

13.8 million of 2023 (-13.9%).

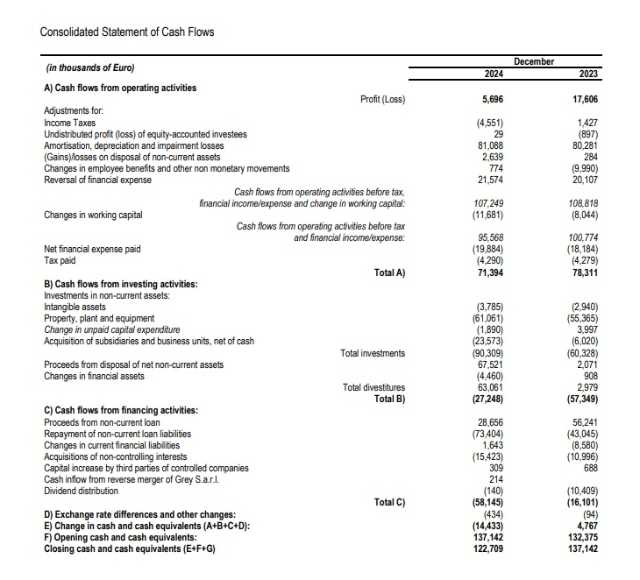

Net Financial Position (“NFP”) is equal to Euro 441.5 million (including Euro 88.8 million related to IFRS 16 effects on rents and leases), comparable to Euro 421.1 at 31 December 2023 (with Euro 62.4 million as a results of IFRS16). The increase of total debt is entirely due to IFRS 16 effects, while the cash component of the debt decreased, despite the significant growth of the investments in the period. During 2024 were made payments related to acquisitions for Euro 23.5 million and Euro 14.1 million of acquisitions of non-controlling interests; payments for net investment in fixed assets were Euro 64.8 million (Euro 58.3 million in 2023). The free cash flow from operations increased significantly to Euro 44.1 million in 2024, from Euro 21.0 million in 2023.

As of December 31st, 2024 the VAT credit, not included in the NFP, was equal to Euro 11.0 million.

Other significant transactions and events occurred after December 31st, 2024 and outlook for 2025

The slowdown of economy that hit Europe during 2024, especially in the second part of the year, seems stabilizing, at least in the first months of 2025. However, there are still uncertainties for the effects of the expected duties between USA and Europe, that could cause further weakness in industrial production and consumption levels.

To compensate these possible decreases, the group is continuing its commercial effort, winning new large clients at international level and with bolt-on acquisitions in specific targeted markets. Rationalisation of some activities and the the development of new promising business areas are also going on.

Comments Paolo Covre, IVS Group chairman. “2024 was another year of small growth at sales level, but very challenging in term of economic results, because of difficult external macro-economic conditions and, specifically for our sector, for the significant increase in the cost of various inputs and raw materials, like coffee. Despite these difficulties, our forecast of further growth at European level, both in size and economic performances, is still valid”.

IVS Group balance