MILAN, Italy – The Board of Directors of IVS Group S.A. (Milan: IVS.MI), convened on May 14th, 2024, and chaired by Mr. Paolo Covre, examined and approved the Interim Financial Report at 31 March 2024, as summarised below.

Summary of results at 31 March 2024

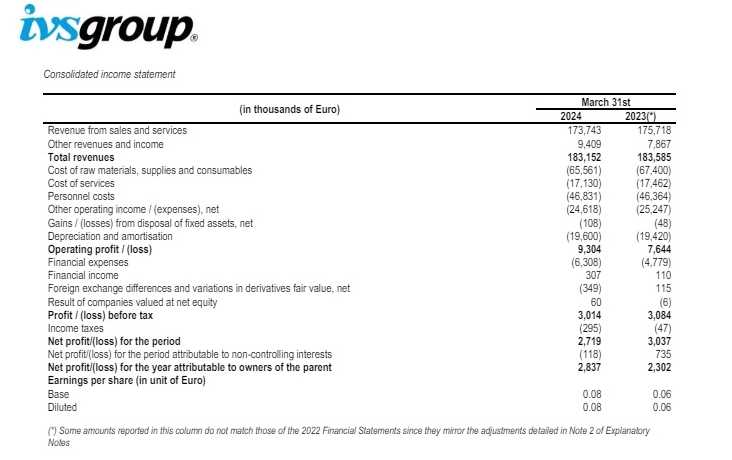

Consolidated Revenues: Euro 183.2 million, almost stable compared to Euro 183.6 million at 31 March 2023.

EBITDA reported: Euro 28.9 million. Adjusted EBITDA: Euro 29.1 million, (+3.6%).

EBIT Adjusted: Euro 9.5 million (+9.2%).

Consolidated Net Profit: Euro 2.7 million. Adjusted Net Profit: Euro 3.4 million.

Net Financial Debt equal to Euro 422.8 million, (including Euro 59.1 million debt related to IFRS 16) from Euro 421.1 million at the end of 2023.

Completed 3 acquisitions in the first quarter 2024 in Itay and Poland, for a value of Euro 1.7 million.

Operating performances

Consolidated revenues in 1st Q 2024 reached Euro 183.1 million, -0.2% compared to Euro 183.6 million in 1st Q 2023.

The operating businesses showed the following turnover performances (before intra group elisions).

1) Vending business (including four areas: Italy, France, Spain and other countries): Euro 144.1 million, +2.7% compared to 140.5 million at 31 March 2023, further divided into the following markets: (i) Italy (Euro 118.7 million, +0,6%), (ii) France (Euro 13.9 million, +13.1%), (iii) Spain (Euro 9.8 million, +8.4%), (iv) other Europe markets (Euro 3.8 million, +27.9%).

2) Resale business: Euro 27.5 million, -22.5% compared to the first quarter 2023 of Euro 35.5 million, that included some extraordinary international sales (to Eastern Europe).

3) hoerca. business: Euro 6.0 million. (+26.7% compared to first quarter 2023).

4) Coinservice business: Euro 10.0 million (+19.4% compared to first quarter 2023)

The three acquisitions completed in Italy and Poland, for a consideration of Euro 1.7 million, generated sales in the first quarter 2023, from the date of the acquisition, of Euro 0.1 million.

The total number of vends at 31 March 2024 was equal to 254.1 million (-2.8% compared to 261.3 million at March 2023).

Average price per vend (net of VAT) was equal to Euro 53.05 cents, +4.0% from Euro 51.03 cents in the same period of 2023. In the average price there are still significant differences amongst the group’s legal entities, different market channels and geographic areas.

EBITDA reported is equal to Euro 28.9 million, increased by 7.0% compared to Euro 27.1 million at March 2023. Adjusted EBITDA is equal to Euro 29.1 million, +3.6% from Euro 28.1 million at March 2023.

Adjusted EBIT increased to Euro 9.5 million, from Euro 8.7 million at March 2023 (+9.2%).

Consolidated Net Profit at March 2024 is equal to Euro 2.7 million (with Euro -0.1 million net result attributable to minorities) compared to Euro 3.0 million of 2023. The Net Profit Adjusted for the exceptional items is equal to Euro 3.4 million, from Euro 3.9 million at March 2023 (with Euro -0.1 million minorities), influenced in the period by around Euro 0,3 million negative FX differences.

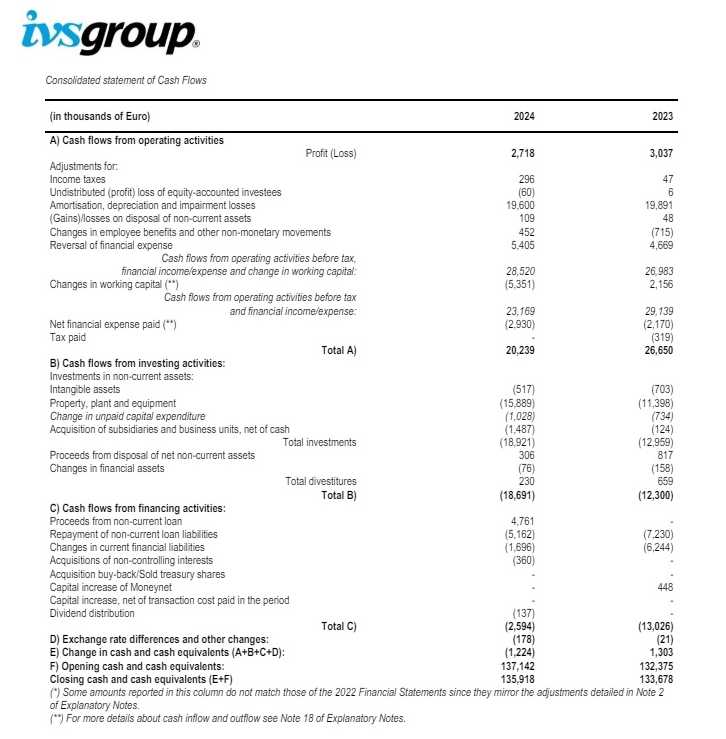

Net Financial Position (“NFP”), is equal to Euro -422.8 million (including Euro 59.1 million debt deriving from rent and leasing contracts according to the definitions of IFRS 16), from Euro -421.1 million (of which Euro 62.4 million of IFRS16 effects) at the end of 2023.

During 1Q 2024 the group generated an operating cash-flow of Euro 20.2 million (Euro 26.7 million in 1Q23). Net Payments for Capex were equal to Euro 17.1 million (Euro 12.0 million in 1Q23) and Euro 1.5 million for acquisitions.

Net financial debt includes Euro 4.3 million of interests accrued, from the last interest payment o October 2023, on the bonds expiring on October 2026. VAT credits (not included in NFP) are Euro 15.5 million.

Other significant events occurred after 31 March 2024 and prospects for the year

On April 22nd, 2024 IVS Partecipazioni S.p.A. (IVSP, the majority shareholder of IVS Group), and E-Coffee Solutions S.r.l. (ECS, controlled by Lavazza group, the Italian leader in the coffee industry) announced the launch of a voluntary totalitarian offer on IVS Group shares, through a newly incorporated company, Grey S.a.r.l., aimed at the delisting of IVS Group.

In the event of a positive outcome of the offer and depending on the percentage of the offer acceptance, IVSP would hold a stake of at least 51% of the share capital of Grey, and ECS would hold a stake between 39% and 49% of Grey.

A reciprocal agreement between IVSP and ECS provides for options to purchase (call options) of ECS, and options to sell (put options) of IVSP, on the shares held by IVSP in Grey. Call and put options will be exercisable after the approval of IVS Group consolidated Annual Report at 31 December 2026 (and therefore starting from 2027 until 2034).

The Board of Director of IVS Group has taken notice of the announced offer and started the procedures applicable in the context of public offers, and specifically, by the committee of independent directors, the selections and appointment of the advisor in charge of preparing a fairness opinion on the offer.

With reference to market scenarios, the well-known international tensions are continuing with a consequent impact on consumption in general, and hence, on volumes – like for like – in the vending business. It is therefore expected that the company will further increase its fucus on actions aimed at optimizing the efficiency profiles, together with the development of new commercial opportunities, also outside Italy, in the vending sector, and in close market segments, to sustain the group’s margins.

Antonio Tartaro and Massimo Paravisi, Co-CEO di IVS Group, comment as follows the results of the first quarter 2024: “In a still complex economic environmentt, IVS Group confirms the solid base of its activities. The extraordinary transactions competed in the past years allowed to obtain a good diversification in different business areas, where, with a continuous and intense work, we can join efficiency, profitability and service quality.

Given the leading position reached in Italy, we started to optimize profitability”.

“So, for example, can be regarded some changes in the vending business in Italy: number of vends: -4%, revenues +1%, positioning fees: -13%, Adjusted EBITDA, +12%. It is confirmed that, a selection and even discntinuing non profitbale contracts and clients, can increase significantly margins”.

“Again, in the resale business, we decided to safeguard the relationship with clients,by freezing the transfer of prices increase of the last six months, as these were above all the effects of speculations on the commodities markets, that are now turning back. It is also clear that, considering this strategic market position in Italy, future growth plans will increasingly look at other European countires and at new markets, potentially complementary to the core vending business. This further strategic phase of IVS Group will certainly require a big commitment, new skills and relevant investments, on a continental scale”.

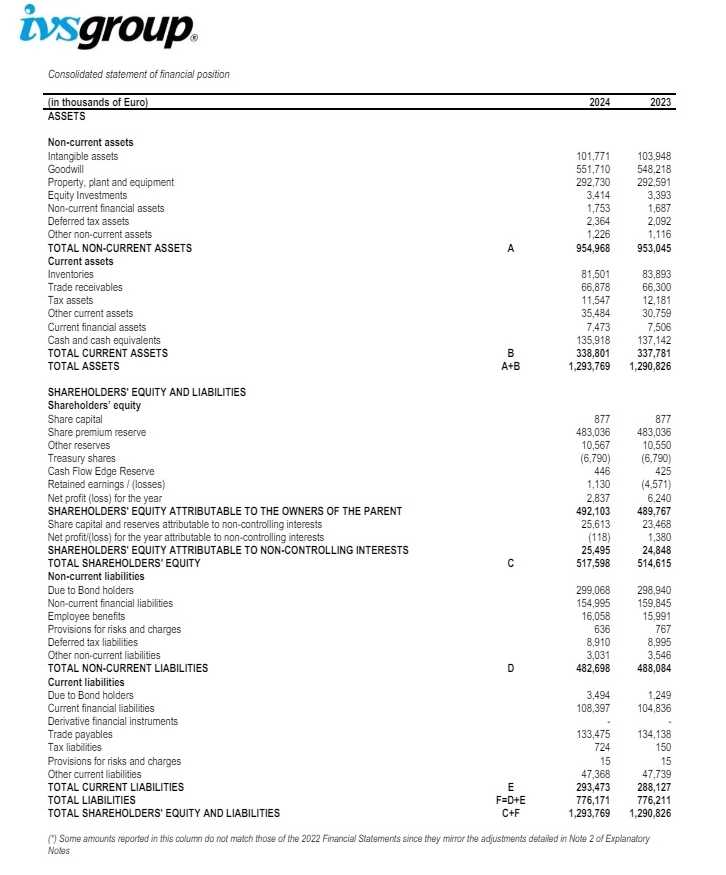

IVS Group balance in detail