ORRVILLE, Ohio, USA — The J.M. Smucker Co., maker of Folgers coffee and Café Bustelo, has announced results for the first quarter ended July 31, 2022, of its 2023 fiscal year. Financial results for the first quarter of fiscal year 2023 reflect the divestitures of the natural beverage and grains businesses on January 31, 2022, and the private label dry pet food business on December 1, 2021. All comparisons are to the first quarter of the prior fiscal year, unless otherwise noted.

Executive Summary

- Net sales increased $15.0 million, or 1 percent. Net sales excluding divestitures and foreign currency exchange increased 4 percent. Net sales reflect a 9 percent unfavorable impact related to the Jif® peanut butter product recall.

- Net income per diluted share was $1.03. Adjusted earnings per share was $1.67, a decrease of 12 percent, primarily as a result of the Jif® peanut butter product recall.

- Cash used for operations was $39.0 million, a change of 128 percent. Free cash flow was $(127.3) million, compared to $69.8 million in the prior year.

- The Company increased its full-year fiscal 2023 financial outlook for net sales, adjusted earnings per share and free cash flow.

The J.M. Smucker Co. Chief Executive Officer remarks

“Our first quarter results reflect a strong start to the fiscal year, demonstrating our operational excellence and strength of our strategy. Our teams have done outstanding work to manage headwinds from cost inflation, industry-wide supply chain challenges, and the Jif® peanut butter recall,” said Mark Smucker, Chair of the Board, President and Chief Executive Officer. “We delivered another quarter that exceeded our expectations, as consumers’ demand for our iconic brands continued in a rising cost environment, driving robust organic top-line growth for our key focus platforms of pet, coffee, and snacking.”

“Due to the better-than-expected first quarter results and sustained momentum for our trusted brands, we are raising our net sales, adjusted earnings per share, and free cash flow expectations for this fiscal year. In the months ahead, we will sustain investment in our growth platforms including the Milk-Bone, Dunkin’, and Smucker’s Uncrustables brands. We remain confident in our ability to drive long-term growth and shareholder value creation through the current dynamic operating environment.”

U.S. Retail Coffee

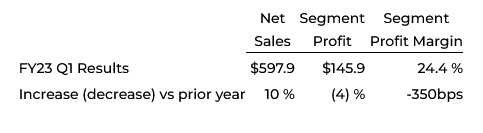

Net sales increased $54.7 million, or 10 percent. Net price realization increased net sales by 24 percentage points, primarily reflecting list price increases across the portfolio. A reduced contribution from volume/mix decreased net sales by 14 percentage points, primarily driven by mainstream roast and ground coffee.

Segment profit decreased $5.4 million, primarily reflecting a decreased contribution from volume/mix and increased marketing investment, partially offset by the favorable net impact of higher net price realization and increased commodity costs.

Segment profit decreased $5.4 million, primarily reflecting a decreased contribution from volume/mix and increased marketing investment, partially offset by the favorable net impact of higher net price realization and increased commodity costs.

The J.M. Smucker Company’s coffee portfolio includes iconic brands like Folgers, Café Bustelo, 1850 and Pilon. Dunkin’ Donuts brand is licensed to The J.M. Smucker Company for packaged coffee products sold in retail channels such as grocery stores, mass merchandisers, club stores, and drug stores..