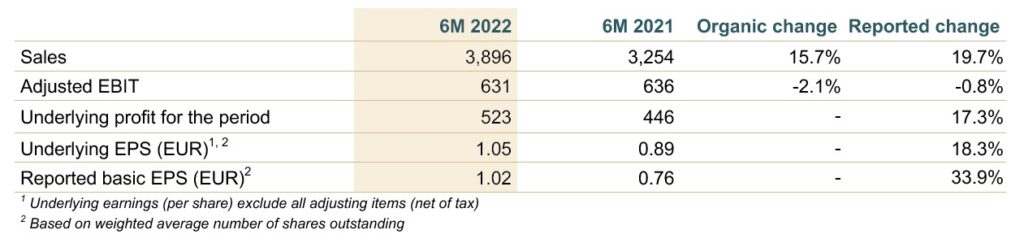

AMSTERDAM, The Netherland – JDE Peet’s, the world’s largest pure-play coffee and tea company by revenue, reported on Tuesday half-year results. Organic sales were 15.7% up (+19.7% reported), driven by +15.9% price and stable volume/mix of -0.2%. Organic gross profit rose by 1.4%, coupled with increasing investments for growth (organic SG&A +4.2%).

Organic adjusted EBIT was 2.1% down to EUR 631 million. Underlying EPS was 18.3% up to EUR 1.05.

The company is amplifying progress on sustainability commitments, with step-change in responsible sourcing. FY 22 outlook is confirmed.

JDE Peet’s: Financial Review Half-Year 2022

Total reported sales increased by 19.7% to EUR 3,896 million. Excluding a positive effect of 3.7% related to foreign exchange and 0.3% related to scope and other changes, total sales increased by 15.7% on an organic basis. Organic sales growth was driven by 15.9% in price and stable volume/mix of -0.2%. In-Home sales increased by 12.0% and sales in Away-from-Home increased by 33.7%, on an organic basis.

Total reported sales increased by 19.7% to EUR 3,896 million. Excluding a positive effect of 3.7% related to foreign exchange and 0.3% related to scope and other changes, total sales increased by 15.7% on an organic basis. Organic sales growth was driven by 15.9% in price and stable volume/mix of -0.2%. In-Home sales increased by 12.0% and sales in Away-from-Home increased by 33.7%, on an organic basis.

Total adjusted EBIT decreased by 0.8% to EUR 631 million on a reported basis. Excluding the effects of foreign exchange and scope and other changes, the Adjusted EBIT decreased organically by 2.1%, as slightly higher gross profit was offset by increased investments in advertising, digital and emerging markets capabilities, which, in turn, was partially offset by lower promotions. The organic increase in gross profit was driven by ongoing cost discipline, simplification, revenue management and pricing to offset inflation.

Underlying profit – excluding all adjusting items net of tax – increased by 17.3% to EUR 523 million, supported by lower interest expenses as a result of deleveraging and lower average cost of debt, following the company’s refinancing in 2021, as well as by a reduction of other finance expenses, a favourable impact from derivatives, and an increase in financial income.

Net leverage increased slightly from 2.7x at the end of FY 21 to 2.8x net debt to adjusted EBITDA at the end of H1 22, as the company allocated EUR 500 million to buy back shares from its shareholder Mondelez International Holdings Netherlands B.V.

JDE Peet’s liquidity position remains strong, with total liquidity of EUR 2.2 billion consisting of a cash position of EUR 0.7 billion (excluding restricted cash) and available committed RCF facilities of EUR 1.5 billion.

Fabien Simon, CEO of JDE Peet’s, stated

“Half-way through 2022, we delivered very well on our commitments, despite unprecedented economic and geopolitical disruptions, exacerbated by the tragic war in Ukraine. Our strong set of results is a testament to the resilient growth profile of JDE Peet’s, supported by powerful brands, leading market positions and talented teams around the world.

We are successfully navigating through supply chain disruptions, pandemic effects and mounting inflation, while keeping course of our value creation agenda, centred around quality and inclusive revenue growth. E-commerce sales kept growing organically at a double-digit rate, as did revenue in the U.S. and in China in-home, while we are accelerating the store expansion there.

Confronted with an exceptional level of cost inflation, we stepped-up efficiencies, and leveraged portfolio and revenue management. We implemented affordable price increases of less than 1 euro-cent per cup, on average. As a result, the absolute gross profit held up well year-over-year.

Not only did we lead on pricing, delivered double-digit earnings growth per share and further increased our investments for growth, but we also amplified our sustainability agenda, with the ambition to elevate the industry standard, targeting 80% responsibly sourced coffee by the end of 2022.

Based on the progress made in the first half of 2022, we remain confident to reach our full-year outlook, while we continue to navigate, with humility and agility, the unpredictable inflationary environment, geo-political unrest and ongoing effects of the pandemic.”

Advancing on Sustainability

Through its Common Grounds sustainability programme, JDE Peet’s has embarked on a journey built on authenticity, to support inclusive and regenerative behaviours from farm to cup and to embrace circular practices across the entire value chain. The sustainability programme consists of three pillars: Responsible Sourcing, fostering thriving agricultural supply chains; Minimised Footprint, to reduce the company’s environmental impact; and Connected People, to engage the company’s employees and its communities.

Through its responsible sourcing and supplier engagement programme, JDE Peet’s is committed to a sustainable supply of coffee & tea from various origins that supports farming communities’ vision of prosperity and contributes to healthy ecosystems. Under this programme, JDE Peet’s has significantly accelerated its journey towards responsibly sourcing 100% of its coffee by 2025 as the company substantially increased its responsibly sourced coffee target from 30% to 80% by the end of 2022.

JDE Peet’s also made good progress in reducing its carbon footprint. In the first half of 2022, for instance, the company increased the use of renewable electricity in manufacturing to more than 40%. In addition, the company further improved the gender diversity of the Board through the appointments of three female Board members during the 2022 AGM.

Outlook 2022

JDE Peet’s expects the business environment to remain volatile for the remainder of 2022 as input cost inflation, geo-political unrest and certain effects of the pandemic persist. Within this context, the company continues to expect to deliver double-digit organic sales growth, with disciplined pricing for inflation, while aiming for a stable level of gross profit compared to last year. The company will continue to invest in its people and strategic growth opportunities, while keeping a tight focus on other cost items, and expects to deliver free cash flow of at least EUR 1 billion.