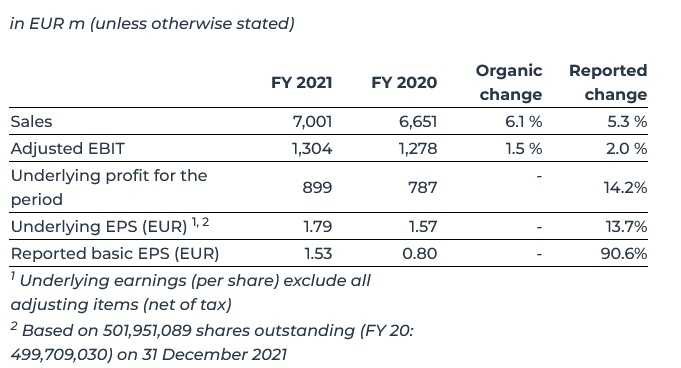

AMSTERDAM, The Netherlands – Jde Peet’s reported today full-year results 2021. Organic sales were 6.1% up to €7,001 million. Organic adjusted EBIT was 1.5% up to EUR 1,304 million. Free cash flow increased to EUR 1,368 million and leverage reduced to below 2.7x. Underlying EPS is 13.7% up to EUR 1.79.

The company proposes to pay a cash dividend of EUR 0.70 per share in two equal instalments.

Fabien Simon, CEO of JDE Peet’s, stated:

“I am very pleased with JDE Peet’s’ performance in 2021. We delivered on all our commitments, in a high-quality way, in another year of unexpected global disruptions. I would like to thank our teams and partners for their resilience and exceptional agility in managing the challenging operating conditions.

2021 marked the year where we refocused on our founding entrepreneurial values. We set out our new strategic framework, re-invested in our powerful portfolio, and reinforced our operational discipline, including taking the lead on pricing in the majority of our markets. As a result, our organic sales growth accelerated, the absolute margin per cup increased, so did the free cash flow generation.

In parallel, we stepped up our commitment to an inclusive growth model, with tracking and tangible progress on sustainability as well as a higher ambition going forward. Finally, we further strengthened our financial position and capital structure.

This year, we became a nimbler global coffee & tea pure player and our brands emerged stronger. This gives me confidence that JDE Peet’s can successfully navigate an unprecedented year of inflation in 2022.”

Jde Peet’s: Advancing on Sustainability

JDE Peet’s’ sustainability strategy is built on three pillars: Common Grounds, to contribute to thriving agricultural supply chains; Minimised Footprint, to reduce its environmental impact; and Connected People, to engage the company’s employees and its communities.

Under its Common Grounds programme, the company increased the number of smallholder farmers that were reached since 2015 to more than 470,000 through more than 50 collaborative projects across 18 countries, despite the pandemic. This also supported the increase in the share of coffee, tea and palm oil that were responsibly sourced in 2021. As such, the company is well on its way to have 100% of the company’s coffee, tea and palm oil responsibly sourced by 2025.

JDE Peet’s also made good progress in reducing its footprint. The company increased the share of packaging designed to be reusable, recyclable or compostable to 88% and achieved 40% recycled content in packaging, reaching its target ahead of time. In addition, its entire European manufacturing network plus five other manufacturing sites reached zero-waste-to-landfill status and overall manufacturing waste reduced by 15%.

Commitment to SBTi-approved targets to reduce GHG emissions

JDE Peet’s has set SBTi-approved targets to reduce GHG emissions in its own operations and across its value chain, in line with the Paris Agreement commitment to limit warming to well-below 2°C. JDE Peet’s has committed to reduce absolute GHG emissions for scope 1 & 2 by 25% and for scope 3 by 12.5% by 2030, from its 2020 base year. In 2021, GHG emissions across scope 1, 2 and 3 reduced by 5%.

Outlook 2022

JDE Peet’s expects the business environment in 2022 to remain volatile as input cost inflation and some effects of COVID-19 might persist. Within this context, the company expects to deliver double-digit organic sales growth, with disciplined pricing for inflation, while aiming for a stable level of gross profit compared to last year. The company will continue to invest in its people and strategic growth opportunities, while keeping a tight focus on other cost items, and expects to deliver Free Cash Flow of at least EUR 1 bn.

Medium- to Long-Term Targets

For the medium- to long-term, JDE Peet’s continues to target organic sales growth of 3 to 5% and mid-single-digit organic adjusted EBIT growth with quality margins, and a free cash flow conversion of approximately 70%.

Dividend

JDE Peet’s’ Board proposes to pay a dividend of EUR 0.70 per share in cash related to FY 21. The dividend will be paid in two instalments of EUR 0.35 each. The first payment date will be on Friday 15 July 2022, with the ex-dividend date on Monday 11 July 2022 and the record date on Tuesday 12 July 2022. The second payment date will be on Friday 27 January 2023, with the ex-dividend date on Monday 23 January 2023 and the record date on Tuesday 24 January 2023. The dividend proposal is subject to approval by the Annual General Meeting of Shareholders to be held on Wednesday 11 May 2022.

Jde Peet’s: Financial Review Full-Year 2021

In FY 21, total sales increased by 6.1% on an organic basis. The In-Home business continued to deliver strong organic sales growth of 5.0% while sales in Away-from-Home increased by 11.5% as the positive effects of (partial) re-openings in most regions more than offset the negative effects of new waves of lockdown measures, most notably in the second half of the year.

Total organic sales growth reflects a volume/mix effect of 3.5% and 2.5% in price. Changes in scope and other changes increased sales by 0.2% while foreign exchange had a negative impact of 1.0%. Total reported sales increased by 5.3% to EUR 7,001 million.

Adjusted EBIT increased organically by 1.5% to EUR 1,304 million driven by a 5.4% organic increase in adjusted gross profit which was partially offset by reinvestments in marketing, innovations and other strategic growth capabilities which included an organic increase in marketing spend of 27%, or EUR 87 million. Including the effects of foreign exchange and scope changes, adjusted EBIT increased by 2.0%.

Underlying profit – excluding all adjusting items net of tax – increased by 14.2% to EUR 899 million. It includes an underlying tax rate of 25% and was supported by lower interest expenses as a result of deleveraging and lower average cost of debt, as well as a reduction of other finance expenses.

Net leverage improved to 2.67x net debt to adjusted EBITDA from 3.23x at the end of FY 20.

The liquidity position remains strong, with total liquidity of EUR 2.1 billion consisting of a cash position of EUR 0.6 billion and available committed RCF facilities of EUR 1.5 billion.