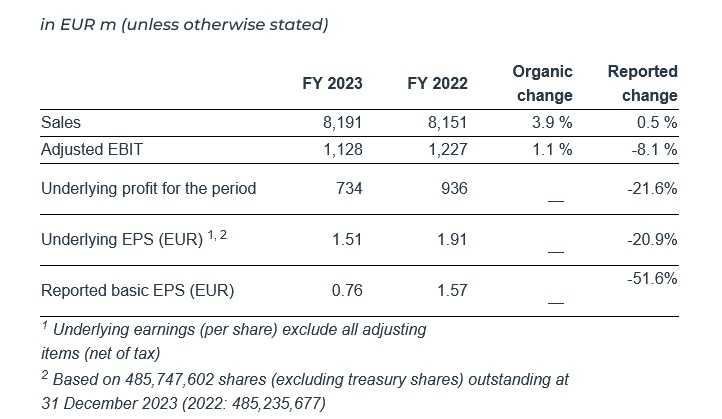

AMSTERDAM, The Netherlands – JDE Peet’s, the world’s leading pure-play coffee and tea company, reported today full-year results 2023. Organic sales were up by 3.9% (H2 23: +4.3%) to €8,191 million. Organic adj. EBIT was up by 1.1% (H2 23: +5.5%) to 1,128 million; up more than 6% FY when excluding Russia’s performance.

Organic adj. gross profit increased +2.9% (H2 23: +4.7%), from premiumisation and efficiencies. Free cash flow of EUR 522 million and leverage of 2.7x, despite currency headwinds.

Underlying EPS of EUR 1.51, with strong operating result offset by fair value changes of derivatives & FX. GHG emissions reduced by 9% in 2023, cumulating to -21% in Scope 1 & 2 and -9% in Scope 3 vs 2020. Proposal to pay a cash dividend of EUR 0.70 per share in two equal instalments

Fabien Simon, CEO of JDE Peet’s stated

“We concluded 2023 with a very strong second semester, marked by an acceleration of JDE Peet’s organic top line and adjusted EBIT growth. We are back to our long-term profitability algorithm, excluding Russia’s performance. While the Coffee industry had been confronted with compounding disruptions over the last 3 years, our 2023 performance is the result of the agility and disciplined execution of the transformation we went through since 2021, to become a more global, more digital, and more sustainable company.

We are rediscovering the power of our brands. While we stepped-up investments, execution and innovation, we have brought back relevance for our consumers and customers. As a result, we have gained market shares globally in 2023 across the premium coffee categories of Single-Serve, Instant and Beans.

In 2023, JDE Peet’s was recognised as an innovation leader (GlobalData), as well as an industry mover in sustainability (S&P Global). We brought industry-first innovation with home-recyclable paper packs for instant coffee, and are leading progress on deforestation by leveraging AI and inclusive ecosystems at origin countries.

We are holding ground in Europe, growing double-digit in China, and are accelerating our globalisation organically, and more recently inorganically in the largest global coffee markets in value (US) and in cups (Brazil).

Strengthening our fundamentals, our brands and our innovation capabilities is elevating our premium growth trajectory and brings confidence in our ability to create sustaining long-term shareholder returns and societal value.”

Sustainability

We continued to achieve meaningful results for each of the three pillars of the Common Grounds programme, that embodies the company’s ambition to positively impact people, our planet, and the future of coffee & tea, and is driven by the purpose “To unleash the possibilities of coffee & tea for a better future”.

“During the year, we made strong progress on our goal towards 100% responsibly sourced green coffee by 2025, reaching 83.8% (2022: 77%)” reports the company. “By year end, we had a portfolio of 63 active projects, through which we have reached more than 108,000 additional smallholder farmers, bringing the total number of smallholder farmers we have reached since 2015, to 700,900. 100% of the palm oil we used in 2023 was responsibly sourced, and we are on track to reach our goal towards 100% responsibly sourced tea in 2025.

We also continued to make strong progress in reducing our footprint with a reduction of -21% in Scope 1 & 2 emissions and -9% in Scope 3 emissions versus base year 2020. We also substantially increased our sustainability ambitions by defining a comprehensive strategic plan to deliver on our long-term targets, including new and stronger SBTi goals to net-zero, and we have built an integrated carbon accounting platform to track and accelerate the delivery of our Sustainability objectives.

In 2023, our pay-equity gap remained below 1%, which is well under the future’s EU directive’s threshold of 5%, and 41% of all leadership positions within JDE Peet’s were held by women.”

JDE Peet’s: Outlook 2024

JDE Peet’s expects the following for 2024:

- Organic sales growth at the lower end of the medium-term range of 3 to 5%

- Mid-single-digit organic adjusted EBIT growth, excluding Russia’s performance;

- Total company: low single-digit growth in H1 and mid-single-digit growth in H2

- Net leverage of around 3x (including Maratá and Caribou transactions) supported by Free Cash Flow above the level of FY 23

- A stable dividend

Dividend

JDE Peet’s’ Board proposes to pay a dividend of EUR 0.70 per share in cash related to FY 23. The dividend will be paid in two instalments of EUR 0.35 each. The first payment date will be on Friday, 12 July 2024, with the ex-dividend date on Monday, 8 July 2024 and the record date on Tuesday, 9 July 2024. The second payment date will be on Friday, 24 January 2025, with the ex-dividend date on Monday, 20 January 2025 and the record date on Tuesday, 21 January 2025. The dividend proposal is subject to approval by the Annual General Meeting of Shareholders to be held on Thursday, 30 May 2024.

Financial Review Full-Year 2023

Total reported sales increased by 0.5% to EUR 8,191 million. Excluding a -3.7% effect related to foreign exchange and 0.3% related to scope and other changes, total sales increased by 3.9% organically. Organic sales growth reflects a price effect of 4.7% and a volume/mix effect of -0.8%. Volume/mix sequentially improved from -3.3% in H1 to 1.8% in H2. In-Home sales increased by 3.3% and sales in Away-from-Home increased by 6.4%.

Total reported sales increased by 0.5% to EUR 8,191 million. Excluding a -3.7% effect related to foreign exchange and 0.3% related to scope and other changes, total sales increased by 3.9% organically. Organic sales growth reflects a price effect of 4.7% and a volume/mix effect of -0.8%. Volume/mix sequentially improved from -3.3% in H1 to 1.8% in H2. In-Home sales increased by 3.3% and sales in Away-from-Home increased by 6.4%.

Adjusted EBIT increased organically by more than 6%, excluding Russia’s performance. Including Russia’s performance, total adjusted EBIT increased organically by 1.1% to EUR 1,128 million supported by an organic increase in adjusted gross profit of 2.9%. In FY 23, the organic adjusted EBIT growth improved sequentially from -3.0% in H1 to 5.5% in H2. Including the effects of foreign exchange and scope/other, the adjusted EBIT decreased by 8.1%.

Underlying profit – excluding all adjusting items net of tax – benefited from stronger core operating performance (+7.8%) which was offset by fair value changes of derivatives & gains and losses in FX (of which the majority in 2023 is non-cash), translational FX results, and scope/other. Including these, the underlying profit decreased by 20.8% to EUR 734 million.

Net leverage was 2.73x (net debt to adjusted EBITDA), despite currency headwinds, with a net debt of EUR 3.9 billion on 31 December 2023.

Our liquidity position remains strong, with total liquidity of EUR 3.5 billion consisting of a cash position of EUR 2.0 billion and available committed RCF facilities of EUR 1.5 billion.