Share your coffee stories with us by writing to info@comunicaffe.com.

ORRVILLE, Ohio, USA – The J.M. Smucker Co. – a leading coffee player in the U.S., with brands of the likes of Folgers and Café Bustelo – yesterday announced results for the third quarter ended January 31, 2023, of its 2023 fiscal year. Financial results for the third quarter of fiscal year 2023 reflect the divestitures of the natural beverage and grains businesses on January 31, 2022, and the private label dry pet food business on December 1, 2021.

Executive Summary

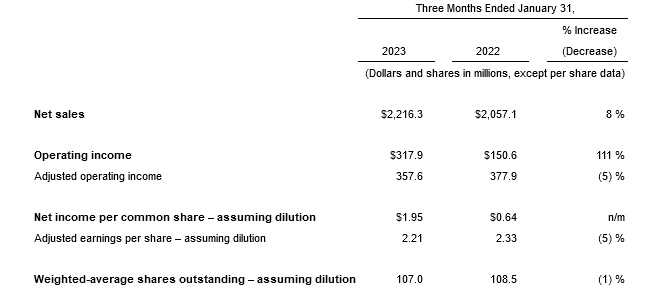

- Net sales increased $159.2 million, or 8 percent. Net sales excluding divestitures and foreign currency exchange increased 11 percent.

- Net income per diluted share was $1.95. Adjusted earnings per share was $2.21, a decrease of 5 percent.

- Cash provided by operations was $584.6 million, an increase of 33 percent. Free cash flow was $442.7 million, compared to $322.4 million in the prior year.

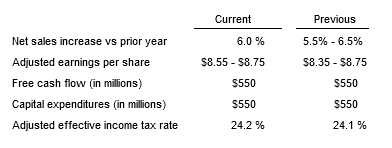

- The Company updated its full-year fiscal 2023 financial outlook for net sales and adjusted earnings per share.

The J.M. Smucker Co.: Third Quarter Consolidated Results

U.S. Retail Coffee

U.S. Retail Coffee

Net sales increased $73.3 million, or 11 percent, to $735.1 million. Higher net price realization increased net sales by 19 percentage points, primarily reflecting list price increases across the portfolio. Volume/mix decreased net sales by 8 percentage points driven by the Folgers and Dunkin’ brands.

Segment profit decreased $9.4 million (-4%) to $204 million, primarily reflecting the decreased contribution from volume/mix, partially offset by a favorable net impact of higher net price realization and increased commodity and manufacturing costs.

International and Away From Home

Net sales increased $22.8 million, or 9 percent, to $288.4 million. Excluding $7.2 million of unfavorable foreign currency exchange and $1.4 million of noncomparable net sales in the prior year related to the divested natural beverage and grains businesses, net sales increased $31.4 million, or 12 percent.

Excluding the impact of foreign currency exchange and the divested businesses, net sales increased 17 percent and 6 percent for the Away from Home and International operating segments, respectively. Net price realization contributed a 15 percentage point increase to net sales for the combined businesses, primarily driven by increases for coffee products and baking mixes and ingredients, partially offset by a decreased contribution from volume/mix of 3 percentage points, primarily driven by baking mixes and ingredients and coffee products.

Segment profit increased $3.4 million to $37.6 million, primarily reflecting a favorable net impact of higher net price realization and increased commodity costs.

The J.M. Smucker Co.: Full-Year Outlook

The J.M. Smucker Co. updated its full-year fiscal 2023 guidance as summarized below:

Ongoing cost inflation, volatility in supply chains and the overall macroeconomic environment continue to impact financial results and cause uncertainty and risk for the fiscal year 2023 outlook. Any manufacturing or supply chain disruption, as well as changes in consumer purchasing behavior, including the potential impact to volume due to recent price increases, retailer inventory levels, and broader macroeconomic conditions, could materially impact actual result

Ongoing cost inflation, volatility in supply chains and the overall macroeconomic environment continue to impact financial results and cause uncertainty and risk for the fiscal year 2023 outlook. Any manufacturing or supply chain disruption, as well as changes in consumer purchasing behavior, including the potential impact to volume due to recent price increases, retailer inventory levels, and broader macroeconomic conditions, could materially impact actual result