ORRVILLE, Ohio, U.S. — The J. M. Smucker Company announced on Friday results for the second quarter ended October 31, 2019, of its 2020 fiscal year. Financial results reflect the divestiture of the Company’s U.S. baking business on August 31, 2018. All comparisons are to the second quarter of the prior fiscal year, unless otherwise noted.

Executive Summary

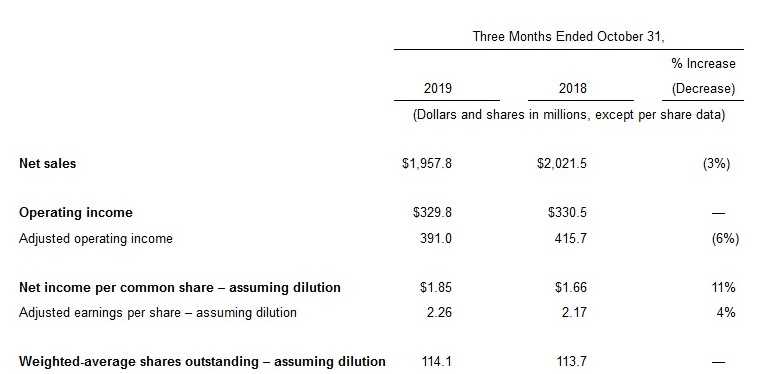

Net sales decreased $63.7 million, or 3 percent. Net sales excluding the noncomparable divested business and foreign currency exchange decreased 1 percent.

Net income per diluted share was $1.85. Adjusted earnings per share was $2.26, an increase of 4 percent.

Cash from operations was $224.0 million, an increase of 10 percent. Free cash flow was $160.6 million in the quarter, compared to $125.1 million in the prior year.

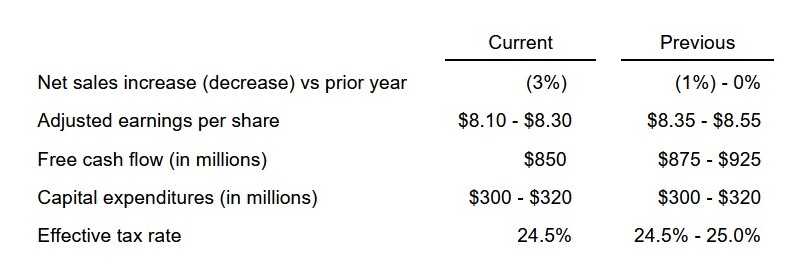

The Company updated its full-year fiscal 2020 net sales, adjusted earnings per share, and free cash flow outlook.

Chief Executive Officer Remarks

“While our second quarter sales performance did not meet our expectations, we delivered EPS growth ahead of our projection, reflecting our commitment to maintain financial discipline and strengthen our bottom line,” said Mark Smucker, President and Chief Executive Officer.

“Despite continuing softness for our premium dog food offerings, we were pleased with the performance for the balance of our portfolio, as the momentum for our cat food and pet snacks businesses continued with year over year sales increases, our high growth coffee brands improved household penetration and market share, and Smucker’s® Uncrustables® grew 19 percent, helping accelerate growth in snacking. Looking ahead, the actions we are taking across the Company, including the recently announced leadership changes, position us well for future long-term growth and shareholder value creation.”

Second Quarter Consolidated Results

Net Sales

Net sales decreased 3 percent, including the impact of $32.8 million of net sales in the prior year attributed to the divested U.S. baking business. Excluding the noncomparable baking results and $1.8 million of unfavorable foreign currency exchange, net sales decreased $29.1 million, or 1 percent. Net price realization reduced net sales by 1 percentage point, primarily driven by lower net pricing for coffee and peanut butter, partially offset by higher pricing for pet food and pet snacks. Volume/mix impact was neutral as decreases for dog food and shortening and oils were mostly offset by increases for coffee and Smucker’s® Uncrustables®.

Operating Income

Gross profit decreased $17.3 million, or 2 percent, primarily driven by the impact of the U.S. baking business divestiture and the net impact of lower prices in excess of lower costs, partially offset by favorable volume/mix. Operating income was comparable to the prior year, as the impact of a $26.6 million pre-tax gain related to the sale of the U.S. baking business in the prior year and the decrease in gross profit were mostly offset by decreases in special project costs and selling, distribution, and administrative (“SD&A”) expenses.

Adjusted gross profit decreased $18.3 million, or 2 percent. Adjusted operating income decreased $24.7 million, or 6 percent, with the primary difference from generally accepted accounting principles (“GAAP”) results being the exclusion of other special project costs, which decreased $22.1 million compared to the prior year.

Interest Expense, Other Income (Expense), and Income Taxes

Net interest expense decreased $4.5 million, reflecting the benefit of reduced debt due to net repayments of $566.9 million during the past twelve months.

Net other expense decreased by $5.9 million, primarily due to legal expenses incurred in the prior year.

The effective income tax rate was 24.3 percent compared to 30.0 percent in the prior year. The effective income tax rate in the prior year included increased income tax expense associated with the sale of the U.S. baking business.

Cash Flow and Debt

Cash provided by operating activities was $224.0 million, compared to $202.9 million in the prior year, primarily reflecting the increase in net income adjusted for noncash items, partially offset by an increase in cash required to fund working capital. Free cash flow was $160.6 million, compared to $125.1 million in the prior year, reflecting the increase in cash provided by operating activities and a $14.4 million reduction in capital expenditures. Net debt repayments in the quarter totaled $72.9 million.

Full-Year Outlook

The Company provided updated full-year fiscal 2020 guidance as summarized below:

Net sales are expected to be down 3 percent compared to the prior year, which included the loss of $105.9 million of sales in the first 4 months of fiscal 2019 related to the divested U.S. baking business and $25.4 million of incremental noncomparable sales for Ainsworth Pet Nutrition, LLC (“Ainsworth”). On a comparable basis, net sales are expected to be down 2 percent. The revision versus previous guidance includes the impact of second quarter sales results and greater than anticipated softness in the back half of the fiscal year, primarily for certain brands within the U.S. Retail Pet Foods segment.

Adjusted earnings per share is expected to range from $8.10 to $8.30, based on 114.0 million shares outstanding. Earnings guidance reflects the reduced contribution from sales, gross profit margin of approximately 38.5 percent, and SD&A expenses declining approximately 2 percent compared to the prior year. Free cash flow is expected to be approximately $850 million.

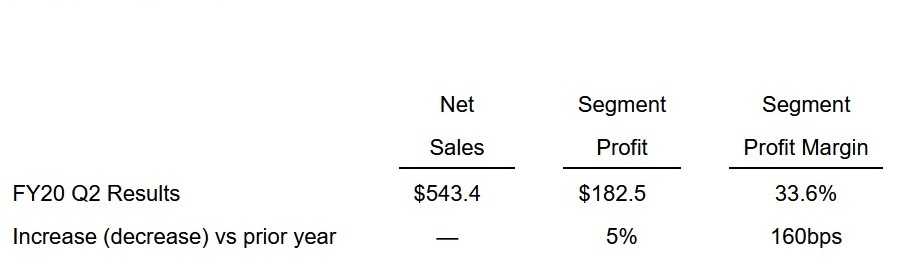

U.S. Retail Coffee

Segment net sales decreased $1.5 million. Lower net price realization on the Folgers® and Dunkin’ Donuts® brands reduced sales by 4 percentage points. The net pricing reflected promotional activity resulting from lower green coffee costs. Volume/mix increased sales by 4 percentage points, primarily due to growth of the Dunkin’ Donuts® and Café Bustelo® brands.

Segment net sales decreased $1.5 million. Lower net price realization on the Folgers® and Dunkin’ Donuts® brands reduced sales by 4 percentage points. The net pricing reflected promotional activity resulting from lower green coffee costs. Volume/mix increased sales by 4 percentage points, primarily due to growth of the Dunkin’ Donuts® and Café Bustelo® brands.

Segment profit increased $8.2 million, primarily due to the favorable volume/mix.