ORRVILLE, Ohio, U.S. — The J.M. Smucker Co. has announced results for the third quarter ended January 31, 2021, of its 2021 fiscal year. Financial results for the third quarter and the first nine months of fiscal year 2021 reflect the divestiture of the Crisco® business on December 1, 2020, and the divestiture of the Natural Balance® business on January 29, 2021. All comparisons are to the third quarter of the prior fiscal year, unless otherwise noted.

The J.M. Smucker Co.: Executive Summary

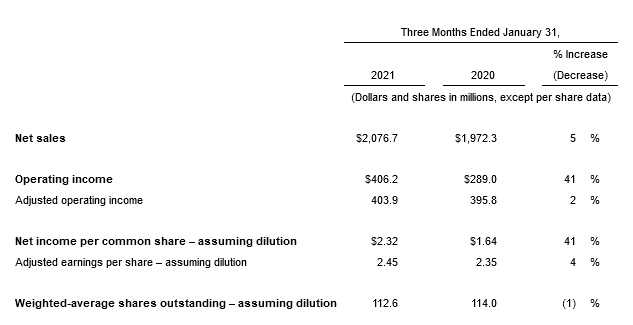

- Net sales increased $104.4 million, or 5 percent. Net sales excluding the noncomparable divested businesses and foreign currency exchange increased 7 percent, reflecting growth across each of the Company’s U.S. and International retail businesses, partially offset by a decline in its Away From Home business.

- Net income per diluted share was $2.32. Adjusted earnings per share was $2.45, an increase of 4 percent.

- Cash from operations was $486.3 million, a decrease of 7 percent. Free cash flow was $416.6 million, compared to $465.1 million in the prior year.

- Return of capital to shareholders was $600.3 million, including cash dividends and share repurchases.

- The Company increased its full-year fiscal 2021 net sales, adjusted earnings per share, and free cash flow outlook.

The J.M. Smucker Co.: Third quarter consolidated results

The J.M. Smucker Co.: Net Sales

Net sales increased 5 percent. Excluding noncomparable sales of $42.1 million for the divested Crisco® and Natural Balance® businesses, as well as $2.4 million of favorable foreign currency exchange, net sales increased $144.1 million, or 7 percent. The increase in comparable net sales was primarily due to favorable volume/mix for each of the Company’s U.S. Retail segments, partially offset by reduced volume/mix for its Away From Home operating segment. Net price realization was neutral, primarily reflecting lower net pricing in the U.S. Retail Pet Food and U.S. Retail Coffee segments, offset by higher net pricing in the U.S. Retail Consumer Foods segment.

Operating Income

Gross profit increased $49.4 million, or 7 percent, primarily due to the increased contribution from volume/mix and a favorable change in unallocated derivative gains and losses as compared to the prior year, partially offset by higher costs and the noncomparable impact of the Crisco® and Natural Balance® divestitures. Operating income increased $117.2 million, or 41 percent, primarily attributable to a $52.4 million intangible asset impairment charge in the prior year, the increase in gross profit, and a $27.2 million net pre-tax gain on divestitures, partially offset by a $12.8 million increase in selling, distribution, and administrative (“SD&A”) expenses.

Adjusted gross profit increased $23.3 million, or 3 percent, with the difference from generally accepted accounting principles (“GAAP”) results being the exclusion of unallocated derivative gains and losses. Adjusted operating income increased $8.1 million, or 2 percent, further reflecting exclusion of the impairment charge in the prior year, the net pre-tax gain on divestitures, amortization, and other special project costs.

Interest Expense and Income Taxes

Net interest expense decreased $1.6 million, primarily as a result of reduced debt outstanding and a decrease in interest rates, partially offset by interest expense related to interest rate contracts terminated in the fourth quarter of the prior year.

The effective income tax rate was 27.7 percent compared to 22.7 percent in the prior year, primarily reflecting the impact of net additional income tax expense related to the divested businesses. On a non-GAAP basis, the adjusted effective income tax rate was 23.1 percent in both the current and prior year, with the primary difference from the GAAP effective income tax rate being the exclusion of the net incremental income tax expense associated with the divested businesses.

Cash Flow and Debt

Cash provided by operating activities was $486.3 million, compared to $521.6 million in the prior year, primarily reflecting an increase in cash required to fund working capital, as compared to the prior year, and a decrease in net income adjusted for noncash items. Free cash flow was $416.6 million, compared to $465.1 million in the prior year, reflecting the decrease in cash provided by operating activities and a $13.2 million increase in capital expenditures. Net debt repayments in the quarter totaled $314.1 million.

During the quarter, the Company received total net proceeds from the divested businesses of $569.3 million, inclusive of the preliminary working capital adjustments and transaction costs paid to date. The Company repurchased 4.5 million common shares for $521.9 million, of which 4.3 million settled in the third quarter for $497.9 million.

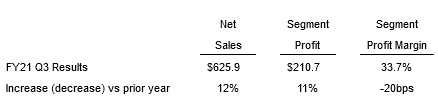

U.S. Retail Coffee

Net sales grew $67.1 million to $625.9 million, reflecting a 13 percentage point increase from volume/mix. Favorable volume/mix was driven by the Dunkin’, Folgers, and Café Bustelo brands, reflecting elevated at-home coffee consumption. Net price realization reduced net sales by 1 percentage point.

Net sales grew $67.1 million to $625.9 million, reflecting a 13 percentage point increase from volume/mix. Favorable volume/mix was driven by the Dunkin’, Folgers, and Café Bustelo brands, reflecting elevated at-home coffee consumption. Net price realization reduced net sales by 1 percentage point.

Segment profit increased $21.2 million to 210.7 $million, primarily reflecting the favorable volume/mix, partially offset by the lower net pricing and increased marketing expense.

The Dunkin brand is licensed to The J.M. Smucker Co. for packaged coffee products sold in retail channels such as grocery stores, mass merchandisers, club stores, e-commerce and drug stores. This information does not pertain to products for sale in Dunkin’™ restaurants.