ORRVILLE, Ohio, U.S.— The J. M. Smucker Company yesterday announced results for the first quarter ended July 31, 2020, of its 2021 fiscal year. Net sales increased $192.9 million, or 11 percent, with growth across each of the Company’s U.S. and International retail businesses, partially offset by a decline for its Away From Home business.

Net income per diluted share was $2.08. Adjusted earnings per share was $2.37, an increase of 50 percent.

Cash from operations was $409.0 million, an increase of 85 percent. Free cash flow was $332.4 million, compared to $148.5 million in the prior year.

The Company increased its full-year fiscal 2021 net sales, adjusted earnings per share, and free cash flow outlook.

“I am incredibly proud and thankful for our employees, who have adapted quickly to deliver strong results and serve our constituents in an environment marked by the COVID-19 pandemic and social unrest. We continue to ensure employee safety and well-being, support the communities where we do business, and provide a steady, quality supply of food for consumers and their pets,” said Mark Smucker, President and Chief Executive Officer.

“Our first quarter results exceeded our expectations, particularly for the coffee and consumer foods portfolios. Consumers continued to seek out trusted and iconic brands as we achieved strong growth across nearly all our categories. This exceptional performance highlights the strength of our portfolio, the potential of our consumer-centric growth strategy, and our commitment to operate with financial discipline.”

“We expect continued momentum in the second quarter and are pleased to raise our full-year guidance. We remain confident in our ability to deliver on our fiscal year 2021 goals, advance our long-term strategy, and deliver increased shareholder value.”

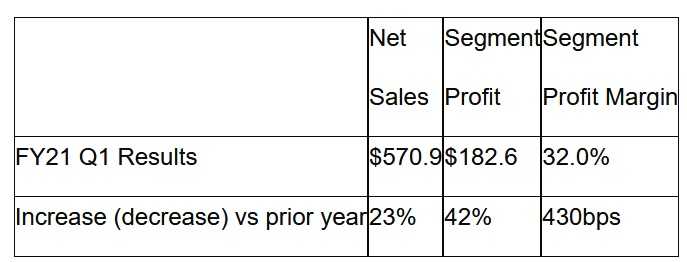

J.M. Smucker: U.S Retail Coffee

Net sales grew $105.2 million, reflecting a 23 percentage point increase from volume/mix. Favorable volume/mix was driven by Dunkin’ Donuts®, Folgers®, and Café Bustelo® coffee, reflecting elevated at-home consumption and re-stocking of retailer inventory following the surge in consumer demand in the fourth quarter of the prior year. Net price realization was neutral.

Net sales grew $105.2 million, reflecting a 23 percentage point increase from volume/mix. Favorable volume/mix was driven by Dunkin’ Donuts®, Folgers®, and Café Bustelo® coffee, reflecting elevated at-home consumption and re-stocking of retailer inventory following the surge in consumer demand in the fourth quarter of the prior year. Net price realization was neutral.

Segment profit increased $53.7 million, primarily due to the favorable volume/mix.