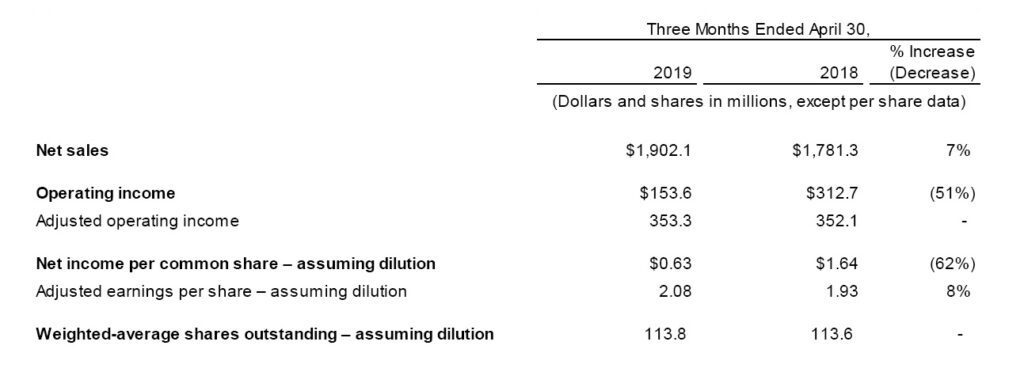

ORRVILLE, Ohio, U.S. – The J. M. Smucker Company announced Thursday results for the fourth quarter ended April 30, 2019, of its 2019 fiscal year. Financial results for the fourth quarter and fiscal year include the contribution from Ainsworth Pet Nutrition, LLC (“Ainsworth”), which was acquired on May 14, 2018, and reflect the divestiture of the Company’s U.S. baking business on August 31, 2018.

Net sales increased $120.8 million, or 7 percent, driven by the addition of Ainsworth and the Company’s growth brands.

Net income per diluted share was $0.63, including a noncash impairment charge related to the Natural Foods business within the U.S. Retail Consumer Foods segment.

Adjusted earnings per share was $2.08, an increase of 8 percent.

For the full year, net income per diluted share was $4.52. Adjusted earnings per share was $8.29, an increase of 4 percent.

Cash provided by operating activities was $274.2 million, compared to $314.4 million in the prior year.

Free cash flow was $181.6 million in the quarter and $781.4 million for the full year.

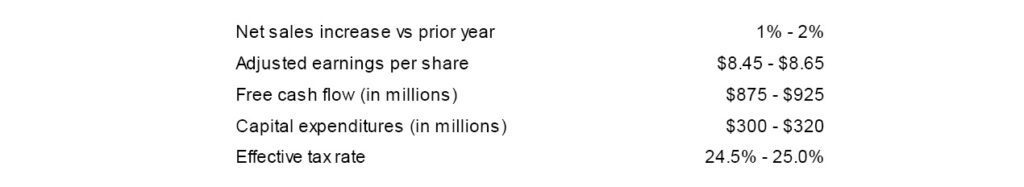

The Company provided its fiscal 2020 outlook, with expected net sales growth of 1 to 2 percent and adjusted earnings per share to range from $8.45 to $8.65.

Fourth Quarter Consolidated Results

Net Sales

Net sales increased 7 percent, reflecting a $200.8 million contribution from the Ainsworth acquisition, partially offset by the impact of $75.0 million of noncomparable net sales in the prior year attributed to the divestiture of the U.S. baking business.

Excluding items impacting comparability, net sales decreased $5.0 million, primarily driven by $4.4 million of unfavorable foreign currency exchange. Lower net price realization, primarily in coffee and peanut butter, impacted net sales by 3 percentage points and was mostly offset by favorable volume/mix, as the lowered price points resulted in volume gains in their respective categories.

Operating Income

Gross profit in the fourth quarter increased $1.9 million, with the addition of Ainsworth being mostly offset by a $44.9 million unfavorable change in derivative gains and losses and a $21.7 million impact from the divested U.S. baking business. In addition, lower net price realization was offset by favorable volume/mix and lower input costs, notably for coffee. Operating income decreased $159.1 million, or 51 percent, primarily reflecting a $97.9 million noncash goodwill impairment charge related to the Natural Foods business within the U.S. Retail Consumer Foods segment and a $45.8 million increase in selling, distribution, and administrative (“SD&A”) expenses primarily related to the acquisition of Ainsworth. The impairment was driven by a reduction in long-term net sales and profitability projections for the beverage and ancient grains categories, reflecting an increased strategic focus on higher growth categories.

On a non-GAAP basis, adjusted gross profit increased $46.8 million, or 7 percent, reflecting the exclusion of the $44.9 million unfavorable change in unallocated derivative gains and losses. Adjusted operating income increased $1.2 million, reflecting the exclusion of the impairment charge, unallocated derivative gains and losses, special project costs, and amortization expense.

Interest Expense, Other Income (Expense), and Income Taxes

As a result of the Ainsworth acquisition and higher interest rates, net interest expense increased $1.7 million over the prior year, which included non-capitalized financing costs related to the acquisition.

The effective income tax rate was 29.8 percent compared to 29.6 percent in the prior year. On a non-GAAP basis, the adjusted effective income tax rate was 21.4 percent compared to 27.6 percent in the prior year. The adjusted effective income tax rate reflects the exclusion of certain discrete tax adjustments related to goodwill impairment charges and income tax reform. The favorable adjusted tax rate compared to the prior year reflects a reduced statutory rate and the integration of Ainsworth. The full-year adjusted effective income tax rate was 25.5 percent compared to 28.0 percent in the prior year, primarily reflecting the full-year benefit of a lower statutory tax rate due to U.S. income tax reform.

Cash Flow and Debt

Cash provided by operating activities was $274.2 million, compared to $314.4 million in the prior year driven primarily by deferred income taxes, partially offset by a benefit from other-net operating activities. Free cash flow was $181.6 million, compared to $202.8 million in the prior year, reflecting the decrease in cash provided by operating activities partially offset by a $19.0 million reduction in capital expenditures. Net debt repayments in the quarter totaled $178.0 million.

Full-Year Outlook

The Company provided its full-year fiscal 2020 guidance as summarized below:

The Company provided its full-year fiscal 2020 guidance as summarized below:

Net sales are expected to increase 1 to 2 percent compared to the prior year, which incorporates the loss of $105.9 million of sales in the first 4 months of fiscal 2019 related to the divested U.S. baking business and incremental noncomparable sales for Ainsworth. On a comparable basis, net sales are expected to increase more than 2 percent.

Adjusted earnings per share is expected to range from $8.45 to $8.65, based on 114.0 million shares outstanding. The anticipated year-over-year increase in earnings reflects the contribution from increased sales, gross profit margin slightly above the prior year, and the benefit of a lower effective tax rate, partially offset by a slight increase in SD&A costs.

U.S. Retail Coffee

Segment net sales increased $19.4 million as volume/mix growth across all brands, including double-digit increases for the Dunkin’ Donuts® and Café Bustelo® brands, contributed 8 percentage points. Favorable volume/mix was partially offset by 4 percentage points from lower net price realization, due to increased trade spend supported by lower green coffee costs.

Segment net sales increased $19.4 million as volume/mix growth across all brands, including double-digit increases for the Dunkin’ Donuts® and Café Bustelo® brands, contributed 8 percentage points. Favorable volume/mix was partially offset by 4 percentage points from lower net price realization, due to increased trade spend supported by lower green coffee costs.

Segment profit increased $15.0 million primarily due to favorable volume/mix and the net benefit of lower input costs and lower net price realization, which more than offset increased marketing expense.