MLAN – Shares of JM Smucker soared yesterday after the company posted better-than-expected quarterly results and raised its outlook on booming sales of its frozen foods and higher coffee prices. Financial results for the second quarter of fiscal year 2025 reflect the divestiture of the Canada condiment business on January 2, 2024, acquisition of Hostess Brands, Inc. (“Hostess Brands”) on November 7, 2023, and divestiture of the Sahale Snacks® business on November 1, 2023.

Net sales was $2.3 billion, an increase of $332.6 million, or 17 percent. Net sales excluding the acquisition, divestitures, and foreign currency exchange increased 2 percent.

Net loss per diluted share was $0.23. Adjusted earnings per share was $2.76, an increase of 7 percent.

Cash provided by operations was $404.2 million compared to $176.9 million in the prior year. Free cash flow was $317.2 million, compared to $28.2 million in the prior year.

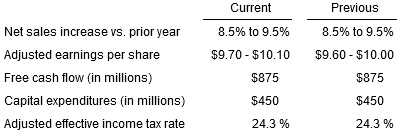

The Company updated its full-year fiscal 2025 financial outlook.

In U.S. Retail Coffee, Net sales increased $18.3 million, or 3%, to $704 miliion. Net price realization increased net sales by 3 percentage points, primarily driven by higher net pricing for mainstream roast and ground and instant coffee. Volume/mix was neutral to net sales, reflecting a decline for the Dunkin’® brand, mostly offset by increases for the Café Bustelo® and Folgers® brands.

Segment profit increased $31.7 million (+19%) to $202.7 million, primarily reflecting lapping the $39.1 million charge in the prior year related to the termination of a supplier agreement and higher net price realization, partially offset by higher commodity costs.

The JM Smucker Co. updated its full-year fiscal 2025 guidance, as summarized below.

Net sales is expected to increase 8.5 to 9.5 percent compared to the prior year. Comparable net sales is expected to increase approximately 1.0 to 2.0 percent, which excludes noncomparable sales in the current year from the acquisition of Hostess Brands and noncomparable sales in the prior year related to the divestitures of the Canada condiment and Sahale Snacks® businesses.

Net sales is expected to increase 8.5 to 9.5 percent compared to the prior year. Comparable net sales is expected to increase approximately 1.0 to 2.0 percent, which excludes noncomparable sales in the current year from the acquisition of Hostess Brands and noncomparable sales in the prior year related to the divestitures of the Canada condiment and Sahale Snacks® businesses.

This guidance also reflects a decline of approximately $100.0 million of contract manufacturing sales related to the divested pet food brands as compared to the prior year.

Adjusted earnings per share is expected to range from $9.70 to $10.10, based on 106.7 million weighted-average common shares outstanding. This guidance assumes an adjusted gross profit margin of approximately 37.5 to 38.0 percent and an increase of SD&A expenses of approximately 9.0 percent as compared to the prior year.

Interest expense is expected to be $400.0 million, and the adjusted effective income tax rate is anticipated to be 24.3 percent. Free cash flow is expected to be approximately $875.0 million with capital expenditures of $450.0 million.