Share your coffee stories with us by writing to info@comunicaffe.com.

BURLINGTON, Mass. and FRISCO, USA – As part of the Company’s strategic refinancing announced on April 7, 2022, Keurig Dr Pepper Inc. (NASDAQ: KDP) today announced the early tender results for its series of tender offers to purchase for cash certain of its outstanding series of senior unsecured notes.

In making the announcement, KDP indicated that it exercised its previously disclosed right to amend such tender offers to increase the maximum amounts initially disclosed, resulting in an increase of approximately $520 million in the total aggregate purchase price, excluding accrued and unpaid interest, for the tender offers.

The tender offer transaction supports KDP’s strategic refinancing objectives to continue to strengthen its liquidity profile and optimize its interest expense.

Details of Tender Offers

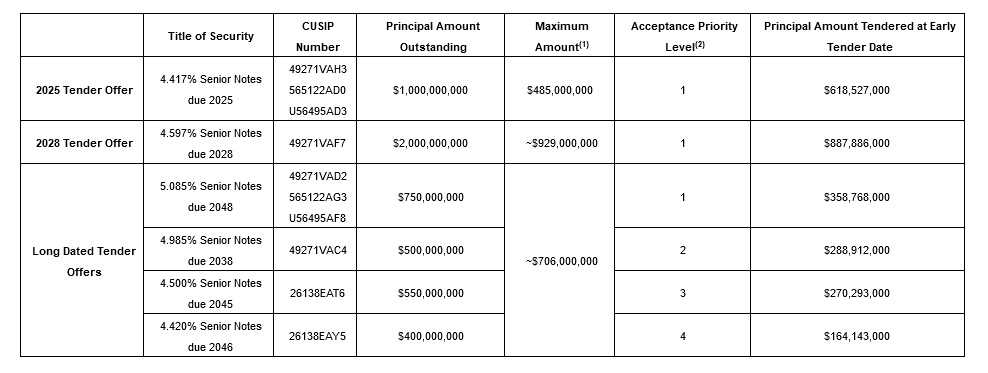

KDP initially offered to purchase for cash: (i) up to $400,000,000 aggregate purchase price, excluding accrued and unpaid interest (the “2025 Maximum Amount”), of its 4.417% Senior Notes due 2025 (the “2025 Notes”), (ii) up to $600,000,000 aggregate purchase price, excluding accrued and unpaid interest (the “2028 Maximum Amount”), of its 4.597% Senior Notes due 2028 (the “2028 Notes”) and (iii) up to $600,000,000 aggregate purchase price, excluding accrued and unpaid interest (the “Long Dated Maximum Amount” and, together with the 2025 Maximum Amount and the 2028 Maximum Amount, the “Maximum Amounts”), of its 5.085% Senior Notes due 2048, its 4.985% Senior Notes due 2038, its 4.500% Senior Notes due 2045 and its 4.420% Senior Notes due 2046 (collectively, the “Long Dated Notes” and, together with the 2025 Notes and the 2028 Notes, the “Notes”), subject to prioritized acceptance levels listed in the table below.

The Company also exercised its previously disclosed right to amend such tender offers to (i) increase the previously announced 2025 Maximum Amount from $400,000,000 to $485,000,000, (ii) increase the previously announced 2028 Maximum Amount from $600,000,000 to a total cash amount sufficient to accept for purchase all 2028 Notes validly tendered and not validly withdrawn prior to or at the Early Tender Date (approximately $929,000,000) and (iii) increase the previously announced Long Dated Maximum Amount from $600,000,000 to a total cash amount sufficient to accept for purchase all 5.085% Senior Notes due 2048 and 4.985% Senior Notes due 2038 validly tendered and not validly withdrawn prior to or at the Early Tender Date (approximately $706,000,000), for a total aggregate purchase price, excluding accrued and unpaid interest, of up to approximately $2.12 billion. All other terms of the tender offers as previously announced in the Offer to Purchase, dated April 7, 2022 (as amended and supplemented hereby, the “Offer to Purchase”) remain unchanged. The Company refers investors to the Offer to Purchase for the complete terms and conditions of the tender offers.

As of the previously announced early tender date and time of 5:00 p.m., New York City time, on April 20, 2022 (the “Early Tender Date”), according to information provided to D.F. King & Co., Inc., the tender and information agent for the tender offers, the aggregate principal amount of each series of Notes listed in the table below had been validly tendered and not validly withdrawn in each tender offer. Withdrawal rights for the Notes expired at 5:00 p.m., New York City time, on the Early Tender Date.

(1)$485,000,000 represents the maximum aggregate purchase price payable, excluding accrued and unpaid interest, in respect of the 2025 Notes that may be purchased in the 2025 Tender Offer. $929,000,000 represents the approximate total cash amount sufficient to accept for purchase all 2028 Notes validly tendered and not validly withdrawn prior to or at the Early Tender Date. $706,000,000 represents the approximate total cash amount sufficient to accept for purchase all 5.085% Senior Notes due 2048 and 4.985% Senior Notes due 2038 validly tendered and not validly withdrawn prior to or at the Early Tender Date.

(1)$485,000,000 represents the maximum aggregate purchase price payable, excluding accrued and unpaid interest, in respect of the 2025 Notes that may be purchased in the 2025 Tender Offer. $929,000,000 represents the approximate total cash amount sufficient to accept for purchase all 2028 Notes validly tendered and not validly withdrawn prior to or at the Early Tender Date. $706,000,000 represents the approximate total cash amount sufficient to accept for purchase all 5.085% Senior Notes due 2048 and 4.985% Senior Notes due 2038 validly tendered and not validly withdrawn prior to or at the Early Tender Date.

(2)Subject to the Maximum Amounts and proration, the principal amount of each series of Notes that is purchased in each tender offer will be determined in accordance with the applicable acceptance priority level (in numerical priority order) specified in this column.

All conditions, including the financing condition, were satisfied or waived by the Company at the Early Tender Date. The Company has elected to exercise its right to make payment for Notes that were validly tendered prior to or at the Early Tender Date and that are accepted for purchase on April 22, 2022 (the “Early Settlement Date”). The Company intends to fund the purchase of validly tendered and accepted Notes on the Early Settlement Date, in part, with the net proceeds from its recent public offering of new senior notes, which was significantly oversubscribed. Nothing contained in this press release shall constitute an offer to sell or a solicitation of an offer to buy any such new senior notes. The offering of the new senior notes is being made only by means of a prospectus and related prospectus supplement, which may be obtained for free by visiting EDGAR on the SEC Web site at www.sec.gov.

As previously disclosed in the Offer to Purchase, because the aggregate principal amount of the 2025 Notes validly tendered and not validly withdrawn prior to or at the Early Tender Date in the 2025 Tender Offer exceeded the applicable Maximum Amount, the Company will accept for purchase the 2025 Notes on a prorated basis. As described further in the Offer to Purchase, Notes tendered and not accepted for purchase will be promptly credited to the tendering holder’s account. Additionally, because the aggregate principal amount of each series of Notes validly tendered and not validly withdrawn prior to the Early Tender Date in each of the tender offers, together with such amount of any series of Notes with a higher prioritized acceptance level, met or exceeded the applicable Maximum Amount, the Company does not expect to accept for purchase any Notes tendered after the Early Tender Date on a subsequent settlement date. The tender offers for the Notes will expire at 11:59 p.m., New York City time, on May 4, 2022, or any other date and time to which the Company extends the applicable tender offer, unless earlier terminated.

The applicable consideration (the “Total Consideration”) offered per $1,000 principal amount of each series of Notes validly tendered and accepted for purchase pursuant to the applicable tender offer on the Early Settlement Date will be determined in the manner described in the Offer to Purchase by reference to the applicable fixed spread for such Notes plus the applicable yield based on the bid-side price of the applicable U.S. Treasury Reference Security at 10:00 a.m., New York City time, on April 21, 2022 (the “Price Determination Date”). Only holders of Notes who validly tendered and did not validly withdraw their Notes prior to or at the Early Tender Date are eligible to receive the applicable Total Consideration, which is inclusive of the applicable early tender payment, for Notes accepted for purchase. Holders will also receive accrued and unpaid interest on Notes validly tendered and accepted for purchase from the applicable last interest payment date up to, but not including, the Early Settlement Date.

Promptly after the Price Determination Date, the Company will issue a press release specifying, among other things, (i) the aggregate principal amount of each series of Notes validly tendered and not validly withdrawn as of the Early Tender Date and accepted for purchase in each tender offer, (ii) the proration factor for the 2025 Notes and (iii) the Total Consideration for each series of Notes.

All Notes accepted for purchase will be retired and cancelled and will no longer remain outstanding obligations of the Company.

Information Relating to the Tender Offers

Morgan Stanley & Co. LLC, BofA Securities and Goldman Sachs & Co. LLC are the dealer managers for the tender offers. Investors with questions regarding the terms and conditions of the tender offers may contact Morgan Stanley & Co. LLC at (800) 624-1808 (toll-free) or (212) 761-1057 (collect), BofA Securities at (888) 292-0070 (toll-free) or (980) 387-3907 (collect) or by email at debt_advisory@bofa.com and Goldman Sachs & Co. LLC at (800) 828-3182 (toll-free) or (212) 902-6351 (collect). D.F. King & Co., Inc. is the tender and information agent for the tender offers. Investors with questions regarding the procedures for tendering Notes may contact the tender and information agent by email at kdp@dfking.com, or by phone at (212) 269-5550 (for banks and brokers only) or (866) 356-7814 (for all others toll-free). Beneficial owners may also contact their broker, dealer, commercial bank, trust company or other nominee for assistance.

The full details of the tender offers, including complete instructions on how to tender Notes, are included in the Offer to Purchase. Holders are strongly encouraged to read carefully the Offer to Purchase, including materials incorporated by reference therein, because they contain important information. The Offer to Purchase may be downloaded from D.F. King & Co., Inc.’s website at www.dfking.com/kdp or obtained from D.F. King & Co., Inc., free of charge, by calling (212) 269-5550 (for banks and brokers only) or (866) 356-7814 (for all others toll-free).

This press release does not constitute an offer to sell or purchase, or a solicitation of an offer to sell or purchase, or the solicitation of tenders with respect to, the Notes or any other securities. No offer, solicitation, purchase or sale will be made in any jurisdiction in which such an offer, solicitation or sale would be unlawful. The tender offers are being made solely pursuant to the Offer to Purchase made available to holders of the Notes. None of the Company or its affiliates, their respective boards of directors, the dealer managers, the tender and information agent or the trustee with respect to any series of Notes is making any recommendation as to whether or not holders should tender or refrain from tendering all or any portion of their Notes in response to the tender offers. Holders are urged to evaluate carefully all information in the Offer to Purchase, consult their own investment and tax advisors and make their own decisions whether to tender Notes in the tender offers, and, if so, the principal amount of notes to tender.