BURLINGTON, Mass. and FRISCO, Texas, USA – Keurig Dr Pepper Inc. today reported results for the second quarter ended June 30, 2023, raised its full year constant currency net sales growth outlook to 5% to 6% and reaffirmed its guidance for Adjusted diluted EPS growth of 6% to 7%. Commenting on the announcement, the Chairman and CEO of Keurig Dr Pepper Bob Gamgort stated, “Our second quarter results demonstrated the strength of KDP’s brand portfolio and our high-quality retail execution.

We saw continued momentum in the U.S. Refreshment Beverages and International segments, as well as encouraging intraquarter developments in U.S. Coffee, where we expect a sequential recovery in revenue and a meaningful inflection in margins in the back half.

On a consolidated basis, we continue to drive healthy growth while reinvesting in our business and are increasingly confident in our full year outlook, which now reflects even stronger underlying EPS results.”

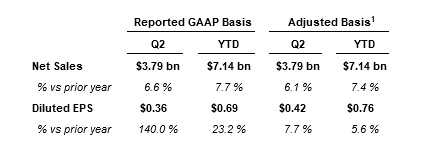

Keurig Dr Pepper: Second Quarter Consolidated Results

Net sales for the second quarter of 2023 increased 6.6% to $3.79 billion, compared to $3.55 billion in the year-ago period. On a constant currency basis, net sales advanced 6.1%, reflecting net price realization of 8.2%, only slightly offset by lower volume/mix of 2.1%. The resilient volume/mix performance reflected the continued strength of the Company’s brand portfolio and in-market execution, as well as continued modest elasticities across most categories.

Keurig Dr Pepper in-market performance in the U.S. Liquid Refreshment Beverages (LRB) category remained strong, with retail dollar consumption² advancing 10.7% and market share gains in categories representing approximately 85% of the Company’s cold beverage retail sales base.

The performance was led by CSDs³, seltzers, coconut waters, energy, apple juice and fruit drinks and was driven by Dr Pepper and Squirt in CSDs, as well as Polar seltzers, Evian, Vita Coco, C4 Energy, Mott’s and Hawaiian Punch.

U.S. retail dollar consumption² of KDP Manufactured K-Cup Pods decreased 2.3% in IRi tracked channels in the quarter, and KDP Manufactured dollar share was approximately 79%.

Total at-home coffee category trends during the second quarter continued to be impacted by greater consumer mobility versus the prior year, though the Company observed sequential improvement in category consumption towards the end of the second quarter, which continued into the third quarter. The single serve segment continued to gain volume share of the at-home coffee category throughout the period.

GAAP operating income increased 34.4% to $769 million, compared to $572 million in the year-ago period, reflecting growth in gross profit, as the strong net sales growth and productivity more than offset continued input cost inflation. Also impacting the comparison was the favorable year-over-year impact of items affecting comparability.

Excluding items affecting comparability, Adjusted operating income increased 4.4% to $873 million, including a strong double-digit increase in marketing investment, reflecting the strong growth in net sales and Adjusted gross profit, which more than offset transportation, warehousing and labor inflation. On a percent of net sales basis, Adjusted operating income was 23.0%.

GAAP net income for the quarter increased 130.7% to $503 million, or $0.36 per diluted share, compared to $218 million, or $0.15 per diluted share, in the year-ago period. This performance reflected a favorable year-over-year impact of items affecting comparability and the increase in Adjusted operating income, partially offset by a higher GAAP effective tax rate. Excluding items affecting comparability, Adjusted net income for the quarter advanced 7.0% to $596 million, and Adjusted diluted EPS increased 7.7% to $0.42.

Free cash flow for the second quarter was $295 million, reflecting lower operating cash flow and higher capital expenditures versus prior year.

During the quarter, the Company repurchased approximately 7 million KDP shares at a weighted average price per share of $32.34, totaling approximately $226 million. The Company has approximately $3.2 billion remaining under its share repurchase authorization expiring on December 31, 2025.

¹ Adjusted financial metrics presented in this release are non-GAAP and with growth rates presented on a constant currency basis.

² Retail consumption data based on Keurig Dr Pepper’s custom IRi category definitions for the 13-week period ending 7/2/2023.

³ CSDs refer to “Carbonated Soft Drinks”.

U.S. Coffee

Net sales for the second quarter decreased 5.7% to $970 million, compared to $1,029 million in the year-ago period, reflecting net price realization of 1.6% and a volume/mix decline of 7.3%.

At-home coffee consumption in the quarter continued to be impacted by year-over-year changes in mobility, with sequential improvement in category volume trends observable each month of the quarter. Pod revenue declined 4.6%, driven by a shipment decline of 7.7% that primarily reflected mobility-driven category softness, the exit of some lower-margin private label contracts and an unfavorable comparison in the prior year during which the Company rebuilt trade inventory levels following supply chain constraints.

On a trailing twelve-month basis versus the pre-pandemic Q2 2019 period, at-home pod shipments grew 16.9%, representing a mid-single digit compound annual growth rate (CAGR).

Brewer shipments totaled 9.9 million for the twelve months ending June 30, 2023, representing an 11.0% decline year-over-year. Compared against pre-pandemic levels represented by the twelve months ending June 30, 2019, brewer shipments grew 17.8%, representing a mid-single digit CAGR.

Brewer shipments in the second quarter continued to be impacted by trade inventory adjustments, which the Company believes are now mostly complete, and slower discretionary spending for small appliances.

GAAP operating income decreased 15.3% to $250 million, compared to $295 million in the year-ago period, reflecting broad-based inflationary pressures, the decline in volume/mix and a significant increase in marketing investment. Partially offsetting these drivers were the benefits of productivity, higher net price realization and a modest year-over-year benefit of items affecting comparability. Excluding these items, Adjusted operating income decreased 14.6% to $292 million and, on a percent of net sales basis, totaled 30.1%.