BURLINGTON, Mass. and FRISCO, Texas, USA — Keurig Dr Pepper Inc., a leading beverage and coffee company in North America, reported on February, 22, 2024, results for the fourth quarter and full year ended December 31, 2023. The Company also provided guidance for 2024.

Keurig Dr Pepper: 2023 Full Year Consolidated Results

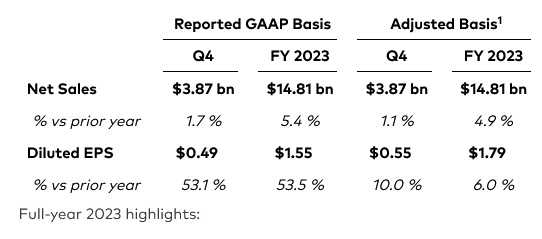

Net sales for the full year increased 5.4% to $14.8 billion. On a constant currency basis, net sales advanced 4.9%, driven by net price realization of 7.0%, partly offset by lower volume/mix of 2.1%. This performance reflected the strength of the Company’s brand portfolio and in-market execution, as well as continued manageable elasticities across most categories.

GAAP operating income increased 22.5% to $3.2 billion. The comparison primarily reflected the favorable year-over-year impact of items affecting comparability, including lapping a $477 million impairment in the prior year period.

Adjusted operating income increased 2.8% to $3.7 billion and totaled 24.7% as a percent of net sales. Adjusted operating income growth was driven by 7.6% Adjusted gross profit growth, translating to 150 basis points of Adjusted gross margin expansion. Adjusted operating income growth reflected higher net price realization and productivity, partly offset by the impact of inflationary pressures, the volume/mix decline, and higher SG&A costs, including increased marketing investment.

GAAP net income for the year increased 51.9% to $2.2 billion, or $1.55 per diluted share. This performance primarily reflected the increase in GAAP operating income and the favorable year-over-year impact of non-operating items affecting comparability.

Adjusted net income for the year advanced 4.4% to $2.5 billion, and Adjusted diluted EPS increased 6.0% to $1.79. The Adjusted net income and EPS growth was driven by the Adjusted operating income growth and a benefit from Nutrabolt equity method earnings, partly offset by higher interest expense.

Operating cash flow for the full year was $1.3 billion and free cash flow totaled $913 million. Operating and free cash flow included a $1.6 billion use of cash from accounts payable and accrued expenses, primarily related to the Company’s decision to strategically reduce its supplier financing program.

Fourth Quarter Consolidated Results

Net sales for the fourth quarter increased 1.7% to $3.9 billion. On a constant currency basis, net sales advanced 1.1%, driven by net price realization of 4.8%, partly offset by lower volume/mix of 3.7%.

GAAP operating income increased 40.1% to $943 million. The comparison primarily reflected the favorable year-over-year impact of items affecting comparability, including lapping a $166 million impairment in the prior year period.

Adjusted operating income increased 6.5% to $1.1 billion and totaled 28.5% as a percent of net sales. Adjusted operating income growth was driven by 9.7% Adjusted gross profit growth, translating to 450 basis points of Adjusted gross margin expansion. Adjusted operating income growth reflected higher net price realization, productivity, and earned performance incentives related to C4 Energy, partly offset by the impact of the volume/mix decline and higher SG&A costs, including increased marketing investment.

GAAP net income for the quarter increased 53.0% to $693 million, or $0.49 per diluted share. This performance primarily reflected the increase in GAAP operating income and the favorable year-over-year impact of non-operating items affecting comparability, partly offset by a higher year-over-year GAAP tax rate.

Adjusted net income for the quarter advanced 7.1% to $770 million, and Adjusted diluted EPS increased 10.0% to $0.55. The Adjusted net income growth was driven by the Adjusted operating income growth and a benefit from Nutrabolt equity method earnings, partly offset by a higher year-over-year tax rate. Adjusted diluted EPS growth also reflected lower diluted shares outstanding.

Operating cash flow for the fourth quarter was $297 million and free cash flow totaled $143 million. Operating and free cash flow included a $463 million use of cash from accounts payable and accrued expenses, primarily related to the Company’s decision to strategically reduce its supplier financing program.

U.S. Coffee

Net sales for the full year decreased 5.4% to $4.1 billion, driven by net price realization of 2.5%, which was more than offset by a volume/mix decline of 7.9%.

Pod revenue decreased 3.6%, driven by a pod shipment decline of 5.1%. Across IRi tracked channels, U.S. retail dollar consumption2 of KDP-Manufactured K-Cup® Pods decreased 4.5%, with stronger performance registered in untracked channels. KDP Manufactured dollar share in the year was approximately 80%.

Brewer shipments totaled 9.7 million for the twelve months ending December 31, 2023, declining 10.3% year-over-year amid a softer discretionary demand environment and due to the impact of retailer inventory shifts during the first half of the year. Compared against pre-pandemic levels represented by the twelve months ending December 31, 2019, brewer shipments grew 13.0% and at a 3% CAGR. Over that same timeframe, Keurig brewing system households increased by 10 million to approximately 40 million.

GAAP operating income decreased 4.7% to $1.2 billion, including a favorable year-over-year impact from items affecting comparability.

Adjusted operating income decreased 4.3% to $1.3 billion and totaled 32.7% as a percent of net sales. Adjusted operating income margin expanded versus prior year, driven by higher net price realization and productivity, partly offset by inflationary pressures and the volume/mix decline.

4Q U.S. Coffee

Net sales for the fourth quarter decreased 9.9% to $1.2 billion, driven by net price realization of 0.8%, which was more than offset by a volume/mix decline of 10.7%.

Pod revenue decreased 6.9%, driven by a shipment decline of 2.7% and unfavorable mix. Across IRi tracked channels, U.S. retail dollar consumption3 of KDP-Manufactured K-Cup® Pods decreased 8.6%, with stronger performance registered in untracked channels. KDP Manufactured dollar share in the quarter was approximately 80%.

GAAP operating income decreased 2.5% to $383 million, despite a favorable year-over-year impact of items affecting comparability.

Adjusted operating income decreased 2.8% to $423 million, primarily due to the decline in volume/mix, and totaled 36.5% as a percent of net sales. Adjusted operating income margin expanded 260 basis points versus the prior year, reflecting a favorable relationship between higher net price realization, productivity, and input costs.

Keurig Dr Pepper: 2024 Guidance

Keurig Dr Pepper expects constant currency net sales growth in a mid-single-digit range and Adjusted diluted EPS growth in a high-single-digit range in 2024. Foreign currency translation is expected to approximate a half of one percentage point headwind to both net sales and EPS growth.

CAPS: the new proprietary system using capsules made of 85% recycled aluminium

CAPS: the new proprietary system using capsules made of 85% recycled aluminium