BURLINGTON, Mass. and FRISCO, Texas, USA — Keurig Dr Pepper Inc. yesterday reported strong results for the second quarter ended June 30, 2022 and raised its full-year net sales guidance to low-double-digit growth, from the previous high-single-digit range. The Company also reaffirmed its guidance for full year Adjusted EPS growth in the mid-single-digit range.

Commenting on the announcement, Chairman and CEO Bob Gamgort stated, “Our strong results reflect the flexibility and resilience of our business and the capability of our team to execute with excellence. We successfully recovered from supply chain disruptions in coffee and non-carbonated beverages, implemented additional pricing to offset inflation and continued to accelerate growth across our broad portfolio, leading to another quarter of strong market share performance. We remain confident that our “all-weather” business model will enable us to deliver in the ongoing volatile macro environment.”

Incoming CEO Ozan Dokmecioglu added, “I am pleased with the continued strength of our business and remain confident in our ability to deliver our plans for the second half of this year. I look forward to assuming the role of CEO and partnering with our talented team to drive value creation through the successful execution of our strategic plan.”

Incoming CEO Ozan Dokmecioglu added, “I am pleased with the continued strength of our business and remain confident in our ability to deliver our plans for the second half of this year. I look forward to assuming the role of CEO and partnering with our talented team to drive value creation through the successful execution of our strategic plan.”

Keurig Dr Pepper: Second quarter consolidated results

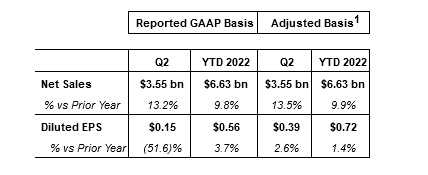

Keurig Dr Pepper net sales for the second quarter of 2022 increased 13.2% to $3.55 billion, compared to $3.14 billion in the year-ago period and, on a constant currency basis, net sales increased 13.5%. This strong performance reflected balanced growth in all segments, with both pricing and volumes up in the quarter. Driving the consolidated net sales growth was favorable net price realization of 10.4% and higher volume/mix of 3.1%, reflecting modest volume elasticity impacts in the quarter.

Keurig Dr Pepper in-market performance in the Liquid Refreshment Beverages (LRB) category remained exceptionally strong in the quarter, with retail dollar consumption² advancing 9.9% and market share growing or holding across 92% of the Company’s cold beverage portfolio, largely reflecting strength in CSDs³, premium unflavored water, coconut water, seltzers, teas, apple juice, vegetable juice and fruit drinks. This performance was driven by Dr Pepper, Sunkist, Canada Dry, A&W and Squirt CSDs, CORE Hydration, Vita Coco, Polar seltzers, Snapple, Hawaiian Punch and Mott’s.

In coffee, retail dollar consumption of single-serve pods manufactured by KDP increased 3.8% in IRi tracked channels, led by higher pricing in both partner and KDP owned and licensed brands, with stronger growth registered in untracked channels. Coffee Systems net sales in the quarter advanced approximately 9%, reflecting the early completion of the Company’s coffee recovery program, which enabled KDP to begin to restore inventory levels to partners and customers. KDP manufactured share in the quarter remained strong at 81.8%.

GAAP operating income in the second quarter of 2022 decreased 22.1% to $572 million, compared to $734 million in the year-ago period, primarily reflecting higher gross profit, driven by the strong and balanced net sales growth and productivity, more than offset by the unfavorable year-over-year impact of items affecting comparability and broad-based inflationary pressures and supply chain disruption.

Adjusted operating income declined slightly in the quarter to $832 million, or 23.4% as a percent of net sales, reflecting Adjusted gross profit growth of 10%, offset by inflationary pressures in transportation, warehousing and retail labor, each of which increased on a rate basis in the quarter.

GAAP net income in the second quarter of 2022 decreased 51.3% to $218 million, or $0.15 per diluted share, compared to $448 million, or $0.31 per diluted share, in the year-ago period. This performance reflected the decline in GAAP operating income and the unfavorable year-over-year impact of items affecting comparability, which more than offset the benefits of a lower effective tax rate and reduced interest expense.

Adjusted net income in the quarter advanced 3.3% to $554 million, driven by the benefits of the lower effective tax rate and reduced interest expense, partially offset by the slight decline in Adjusted operating income. Adjusted diluted EPS in the quarter increased 2.6% to $0.39, compared to $0.38 in the year-ago period.

Operating cash flow in the second quarter of 2022 totaled $676 million and free cash flow totaled $599 million, primarily reflecting the increase in operating cash flow and slightly lower capital expenditures.

During the quarter, the Company repurchased approximately 2.5 million KDP shares for a total cost of $87.6 million, at an average price per share of $34.51. The company has $3.9 billion remaining under its share repurchase authorization expiring on December 31, 2025.

¹ Adjusted financial metrics presented in this release are non-GAAP and on a constant currency basis. See reconciliations of GAAP results to Adjusted results on a constant currency basis in the accompanying tables.

² Retail consumption data based on Keurig Dr Pepper’s custom IRi category definitions for the 13-week period ending 6/26/2022.

³ CSDs refer to “Carbonated Soft Drinks”.

Coffee Systems

Net sales for the second quarter of 2022 increased 8.5% to $1.20 billion, compared to $1.10 billion in the year-ago period and, on a constant currency basis, net sales increased 9.1%. The constant currency net sales growth was driven by a 5.8% increase in net price realization and a 3.3% increase in volume/mix, reflecting the benefits of modest elasticities and the early completion of the Company’s coffee recovery program, which enabled KDP to begin to rebuild retailer and partner inventories and restore customer service levels.

The higher net price realization of 5.8% in the quarter was driven by pod and brewer pricing actions taken late in 2021 and during the second quarter of 2022. The volume/mix increase of 3.3% reflected pod volume growth of 4.7%, partially offset by a brewer volume decline of 4.2%, reflecting comparison to the strong 29% brewer growth in the year-ago period.

GAAP operating income in the second quarter of 2022 decreased 11.3% to $315 million, compared to $355 million in the year-ago period, largely reflecting the lag in timing between higher net price realization and broad-based inflation, continued elevated costs associated with the coffee recovery program, a slight increase in marketing investment and the unfavorable year-over-year impact of items affecting comparability. Partially offsetting these factors was the benefit of productivity. Adjusted operating income decreased 8.4% to $369 million and, on a percent of net sales basis, totaled 30.9%.