BEIJING, China — Luckin Coffee Inc. (“Luckin Coffee” or the “Company”) (OTC: LKNCY) yesterday announced its restated unaudited financial results for the second and third quarters ended June 30, 2019 and September 30, 2019, as well as the unaudited results for the fourth quarter ended December 31, 2019. The company issue the following press release:

Explanatory Note

This Amendment No. 1 to our Quarterly Reports on Form 6-K for the quarterly periods ended June 30 and September 30, 2019 (this “Quarterly Report on Form 6-K/A”) is being filed to amend and restate certain items presented in our Quarterly Reports on Form 6-K for the quarterly periods ended June 30 and September 30, 2019, which were initially filed with the Securities and Exchange Commission (the “SEC”) on August 14, 2019 and November 13, 2019, respectively (the “Original Form 6-K”). This Quarterly Report on Form 6-K/A includes: (1) our restated unaudited consolidated statements of comprehensive loss for three months ended June 30, 2019 and September 30, 2019; (2) our consolidated balance sheet as of December 31, 2019 and the related consolidated statements of comprehensive loss for the three months (unaudited) and twelve months ended December 31, 2019; and (3) our management’s discussion and analysis of financial condition and results of operations as of and for the three months (unaudited) ended December 31, 2019.

See below “Restatement of Previously Issued Condensed Consolidated Financial Statements” in the notes to the unaudited condensed consolidated financial statements included in this Quarterly Report on Form 6-K/A for a detailed discussion of the effect of the restatement.

Immediately following the filing of this Quarterly Report on Form 6-K/A, Luckin Coffee expects to file its Annual Report on Form 20-F for the fiscal year ended December 31, 2019 (the “2019 Annual Report”) with expanded financial and other disclosures. The following discussion and analysis of the financial condition and results of our operations should be read in conjunction with our consolidated financial statements and related footnotes included in the 2019 Annual Report.

The Company continues to work expeditiously with its auditor to file its annual report for the period ended December 31, 2020 as soon as possible.

Background of Restatement

On March 19, 2020, in light of certain issues raised to the Company’s Board of Directors (the “Board”) during the audit of the consolidated financial statements for the fiscal year ended December 31, 2019, the Board formed a special committee (the “Special Committee”) to oversee an internal investigation (the “Internal Investigation”). The Special Committee retained Kirkland & Ellis as its independent advisor, which was assisted by FTI Consulting as an independent forensic accounting expert, in connection with the Internal Investigation.

On July 1, 2020, the Company announced that the Special Committee has substantially completed the Internal Investigation. Based on its work, the Special Committee found that the fabrication of transactions (the “Fabricated Transactions”) began in April 2019 and that, as a result, the Company’s net revenue in 2019 was inflated by approximately RMB2.12 billion and its costs and expenses were inflated by RMB1.34 billion in 2019. See below “Restatement of Previously Issued Condensed Consolidated Financial Statements”.

Luckin Coffee: Company Statement

“Today’s disclosure represents an important milestone for Luckin Coffee as we execute on our plan to return to normalized financial reporting. We have worked diligently to remediate the accounting issues that have delayed our financial filings and led to the review and correction of our historical financial information,” said Dr. Jinyi Guo, Chairman and Chief Executive Officer of Luckin Coffee. “Today, we have a new leadership team and a viable plan that is driving growth for Luckin Coffee and long-term value creation for our shareholders. Across the Company, our team remains focused on delivering improved financial and operational performance while delivering outstanding products and services for our customers.”

Fourth Quarter 2019 Unaudited Financial Results (numbers discussed below relating to fourth quarter of 2018 were unaudited and unreviewed)

Total net revenues were RMB1,049.9 million (US$150.8 million) in the fourth quarter, representing an increase of 125.6% from RMB465.4 million in the fourth quarter of 2018. Net revenues growth was primarily driven by a significant increase in the number of transacting customers, an increase in effective selling prices and the number of products sold.

- Revenues from product sales were RMB1,034.5 million (US$148.6 million) in the fourth quarter, representing an increase of 122.3% from RMB465.4 million in the fourth quarter of 2018.

- Net revenues from freshly brewed drinks were RMB875.2 million (US$125.7 million), representing 83.4% of total net revenues in the fourth quarter of 2019, compared to RMB346.9 million, or 74.5% of total net revenues, in the fourth quarter of 2018.

- Net revenues from other products were RMB104.2 million (US$15.0 million), representing 9.9% of total net revenues in the fourth quarter of 2019, compared to RMB91.4 million, or 19.6% of total net revenues, in the fourth quarter of 2018.

- Delivery revenue were RMB55.1 million (US$7.9 million), representing 5.2% of total net revenues in the fourth quarter of 2019, compared to RMB27.2 million, or 5.9% of total net revenues, in the fourth quarter of 2018.

- Revenues from partnership stores were RMB15.3 million (US$2.2 million), representing 1.5% of total net revenues in the fourth quarter of 2019. Our retail partnership model initiative was launched in September 2019, and first partnership store was opened in October 2019.

Total operating expenses were RMB2,187.2 million (US$314.2 million), representing an increase of 97.2% from RMB1,109.2 million in the fourth quarter of 2018. The increase in operating expenses was in line with business expansion. Meanwhile, operating expenses as a percentage of net revenues decreased to 208.3% in the fourth quarter of 2019 from 238.4% in the fourth quarter of 2018, mainly driven by increased economies of scale and the Company’s technology-driven operations.

- Cost of materials were RMB533.7 million (US$76.7 million), representing an increase of 80.7% from RMB295.4 million in the fourth quarter of 2018, in line with the increase in sales of products.

- Store rental and other operating costs were RMB503.5 million (US$72.3 million), representing an increase of 77.6% from RMB283.5 million in the fourth quarter of 2018, mainly due to increases in the number of stores and headcount.

- Depreciation expenses were RMB130.9 million (US$18.8 million), representing an increase of 122.3% from RMB58.9 million in the fourth quarter of 2018, mainly due to increases in depreciation of leasehold improvements and purchases of operating equipment.

- Sales and marketing expenses were RMB368.5 million (US$52.9 million), representing an increase of 27.8% from RMB288.3 million in the fourth quarter of 2018, mainly due to increases in advertising expenses and delivery expenses as the Company launched new marketing initiatives and entered into new cities. Furthermore, free product promotion expenses increased in line with the growth of new transacting customers.

- General and administrative expenses were RMB431.1 million (US$61.9 million), representing an increase of 192.3% from RMB147.5 million in the fourth quarter of 2018. The increase in general and administrative expenses was mainly driven by business expansion, increased research and development expenses, allowance for uncollectible receivables and share-based compensation to senior management.

- Store preopening and other expenses were RMB10.3 million (US$1.5 million), representing a decrease of 71.1% from RMB35.6 million in the fourth quarter of 2018, mainly due to decreased rental costs before opening as a result of site selection and improved efficiency for new store openings.

- Impairment losses of long-lived assets were RMB209.2 million (US$30.1 million), mainly due to i) the impairment loss amounted to RMB52.1 million (US$7.5 million) for the asset group related to Luckin Coffee EXPRESS, which is an unmanned machine that prepares a selection of freshly brewed drinks, ii) the impairment loss amounted to RMB151.9 million (US$21.8 million) for the asset group related to underperforming or planned closed self-operated stores, and iii) the impairment loss amounted RMB5.3 million (US$0.8 million) related to the cancellation of the constructing coffee bean roasting factories and return of the land use right to local government in Tongan City, Fujian Province and Tianjin City.

Store level operating loss in this quarter was RMB241.8 million (US$34.7 million), with store level operating loss margin of 24.9%.

Operating loss was RMB1,137.3 million (US$163.4 million) compared to RMB643.8 million in the fourth quarter of 2018. Non-GAAP operating loss was RMB1,096.2 million (US$157.5 million) compared to RMB643.8 million in the fourth quarter of 2018. For more information on non-GAAP financial measures, please see the section of “Use of Non-GAAP Financial Measures” and the table captioned “Reconciliation of Non-GAAP Measures to the Most Directly Comparable GAAP Measures” set forth at the end of this press release.

Net loss was RMB1,128.5 million (US$162.1 million) compared to RMB669.0 million in the fourth quarter of 2018. Non-GAAP net loss was RMB1,087.4 million (US$156.2 million) compared to RMB650.7 million in the fourth quarter of 2018.

Basic and diluted net loss per ADS was RMB4.72 (US$0.64) compared to a loss of RMB10.64 in the fourth quarter of 2018. Non-GAAP basic and diluted net loss per ADS was RMB4.48 (US$0.64) compared to a loss of RMB4.80 in the fourth quarter of 2018.

Net cash used in operating activities was RMB347.8 million (US$50.0 million) compared to RMB271.4 million in the fourth quarter of 2018. The increase was primarily driven by an increase in operating expenses as a result of expansion of the Company’s business operations.

Cash and cash equivalents and short-term investments were RMB5,365.8 million (US$770.8 million) as of December 31, 2019, compared to RMB1,761.0 million as of December 31, 2018. The increase was primarily driven by the net proceeds of US$158.8 million (RMB1,065.9 million) from the issuance of Series B-1 convertible redeemable preferred shares in April 2019 to certain investors, the net proceeds of US$657.2 million (RMB4,533.8 million) from the IPO and the concurrent private placement and net cash inflow of RMB1,316.4 million (US$189.1 million) in relation to Fabricated Transactions; offset by cash used in operating activities of RMB2,167.0 million (US$311.3 million), purchases of property and equipment on RMB1,571.0 million (US$225.7 million).

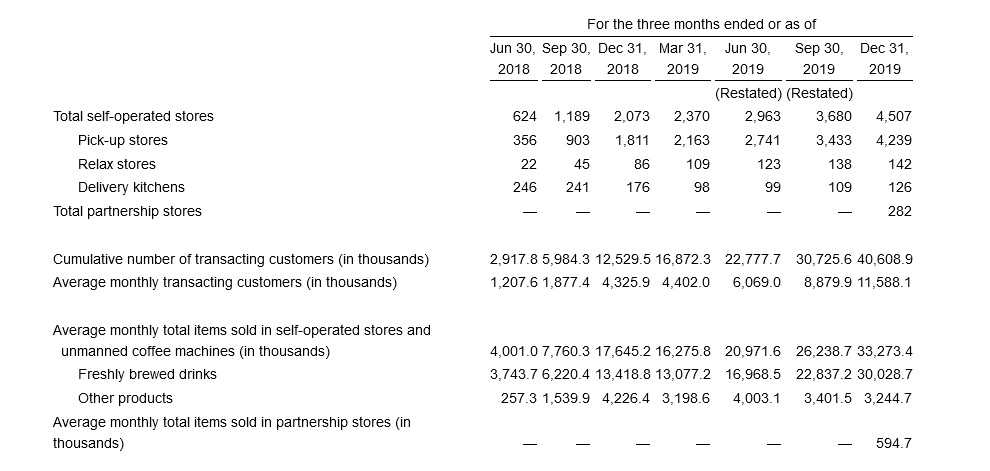

Luckin Coffee: Key Operating Data

Key Definitions

Key Definitions

- Revenues from product sales include net revenues from freshly brewed drinks, net revenues from other products and delivery revenues.

- Revenues from partnership stores mainly consist of material sales to the partnership stores, profit-sharing revenue from the partnership stores for the integrated store operation solution including using the Luckin Coffee or Luckin Tea brand.

- Store level operating profit (loss). Calculated by deducting cost of direct materials (including wastage in stores), cost of delivery packaging materials, storage and logistics expenses, store depreciation expense (including decoration loss for store closure), store rental and other operating costs, net delivery expense, transaction fees, rental deposit of closed stores and rental expense for pre-opening stores from self-operated store revenue. We have changed the way we calculate our store level operating profit (loss) to include all relevant store expenses at the store level (excluding SG&A expenses).

- Store level operating profit (loss) margin. Calculated by dividing store level operating profit (loss) by self-operated store revenue.

- Transacting customers for the period. Refers to a customer who bought at least one item we offer on our mobile apps or through third-party platforms in a given period, regardless of whether the customer paid for the item or merely ordered through our free product marketing initiative. Each unique mobile account is treated as a separate customer for purposes of calculating transacting customer.

- Cumulative number of transacting customers. The total number of transacting customers since our inception.

- Average monthly transacting customers. The number of average monthly transacting customers in the three months during the quarter.

- Average monthly total items sold. Calculated by dividing the total number of items sold during the quarter by three.

- Non-GAAP operating loss. Calculated by adjusting operating loss for non-cash share-based compensation expenses.

- Non-GAAP net loss. Calculated by adjusting net loss for non-cash share-based compensation expenses and change in the fair value of warrant liability.

- Non-GAAP net loss attributable to the Company’s ordinary shareholders and angel shareholders. Calculated by adjusting net loss attributable to the Company’s ordinary shareholders and angel shareholders for non-cash share-based compensation expenses, change in the fair value of warrant liability and accretion to redemption value of convertible redeemable preferred shares.

- Non-GAAP basic and diluted net loss per share. Calculated as non-GAAP net loss attributable to the Company’s ordinary shareholders and angel shareholders divided by weighted average number of basic and diluted share.

- Non-GAAP basic and diluted net loss per ADS. Calculated as non-GAAP net loss attributable to the Company’s ordinary shareholders and angel shareholders divided by weighted average number of basic and diluted ADS.

Use of Non-Gaap Financial Measures

In evaluating the business, the Company considers and uses non-GAAP measures, such as non-GAAP operating loss, non-GAAP net loss, non-GAAP basic and diluted net loss per ADS, as supplemental measures to review and assess operating performance. The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Company defines non-GAAP operating loss as operating loss excluding share-based compensation expenses. The Company defines non-GAAP net loss as net loss excluding share-based compensation expenses and change in fair value of warrant liability. The Company defines non-GAAP basic and diluted net loss per ADS as non-GAAP net loss attributable to the Company’s ordinary shareholders and angel shareholders divided by weighted average number of basic and diluted ADS.

The Company presents these non-GAAP financial measures because they are used by management to evaluate operating performance and formulate business plans. The Company believes that the non-GAAP financial measures help identify underlying trends in its business by excluding change in the fair value of warrant liability and the impact of share-based compensation expenses, both of which are non-cash charge. The Company also believes that the non-GAAP financial measures could provide further information about the Company’s results of operations, enhance the overall understanding of the Company’s past performance and future prospects.

The non-GAAP financial measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. The non-GAAP financial measures have limitations as analytical tools. The Company’s non-GAAP financial measures do not reflect all items of income and expense that affect the Company’s operations and do not represent the residual cash flow available for discretionary expenditures. Further, these non-GAAP measures may differ from the non-GAAP information used by other companies, including peer companies, and therefore their comparability may be limited. The Company compensates for these limitations by reconciling the non-GAAP financial measures to the nearest U.S. GAAP performance measure, all of which should be considered when evaluating performance. The Company encourages you to review the Company’s financial information in its entirety and not rely on a single financial measure.

For more information on the non-GAAP financial measures, please see the table captioned “Reconciliation of Non-GAAP Measures to the Most Directly Comparable GAAP Measures” set forth at the end of this press release.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars (“US$”) at specified rates solely for the convenience of the reader. Other than proceeds from the issuance of Series B-1 convertible redeemable preferred shares, IPO and the concurrent private placement stated, all translations from RMB to US$ were made at the rate of RMB 6.9618 to US$1.00, the exchange rate on December 31, 2019 set forth in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or US$ amounts referred could be converted into US$ or RMB, as the case may be, at any particular rate or at all.