MILAN – Luckin Coffee Inc. reported better-than-expected results on Wednesday and said it aims to break even next year. The Xiamen, China-based company, in its second set of quarterly results since going public in May, reported wider third-quarter loss but revenue that rose above expectations.

Losses narrowed to 32 cents per share (smaller than the 38 cents analysts had expected) on revenue of $215.7 million, up 540% in local currency. Average monthly total items sold in the quarter shot up 470% to 44.2 million.

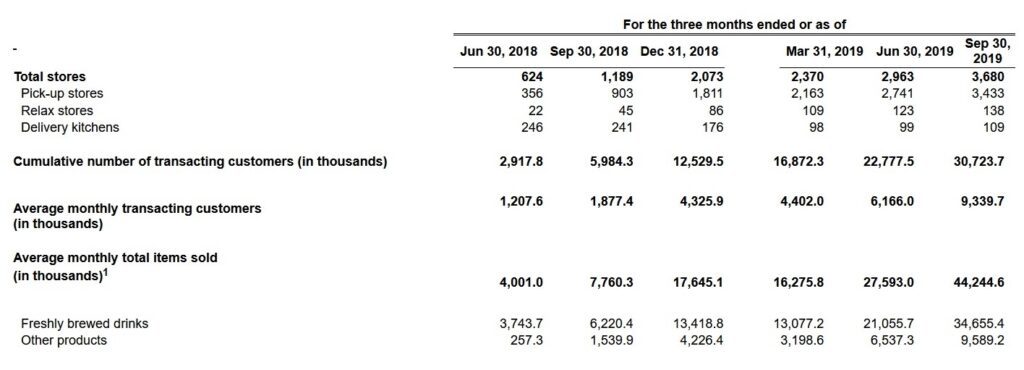

The number of stores at the end of the quarter was 3,680 stores, up from 2,963 at the end of Q2 and more than triple from a year ago. Net revenue per store jumped 79.5% to $62,900.

Luckin has benefited from a growing love for caffeine in China’s major cities such as Beijing and Shanghai, but also from its new range of teas.

The company in July introduced fruit-flavored teas and tea macchiatos at its outlets, and teas constituted 20% of freshly brewed drinks in the third quarter.

Looking to build on the momentum, the company opened its first independently branded “Luckin Tea” store in October.

Luckin Coffee Third Quarter 2019 Highlights

- Total net revenues from products in the quarter were RMB1,493.2 million (US$208.9 million), representing an increase of 557.6% from RMB227.1 million in the same quarter of 2018.

- Average monthly total items sold in the quarter were 44.2 million, representing an increase of 470.1% from 7.8 million in the third quarter of 2018.

- Cumulative number of transacting customers increased to 30.7 million, representing an increase of 413.4% from 6.0 million as of the end of the third quarter of 2018. During the third quarter of 2019, the Company acquired 7.9 million new transacting customers.

Average monthly transacting customers in the quarter were 9.3 million, representing an increase of 397.5% from 1.9 million in the third quarter of 2018.

Total number of stores at the end of the quarter were 3,680 stores, representing an increase of 209.5% from 1,189 stores at the end of the third quarter of 2018.

Average total net revenues from products per store in the quarter were RMB449.6 thousand (US$62.9 thousand), representing an increase of 79.5% from RMB250.5 thousand in the same quarter of 2018.

- Store level operating profit in the quarter was RMB186.3 million (US$26.1 million), or 12.5% of net revenues from products, compared to a loss of RMB126.0 million in the third quarter of 2018.

“We are very pleased with our results in the third quarter. We exceeded the high-end of our guidance range, achieved a store level profit margin of 12.5% and experienced continuous growth across all key operating metrics. These achievements follow a clear trend: an increase in volumes, efficiency and, as a result, profitability. During the quarter, product revenue grew at 557.6%, which was 1.2x, 1.4x and 2.7x the growth rate of average monthly items sold, average monthly transacting customers, and number of stores, respectively,” said Ms. Jenny Zhiya Qian, Chief Executive Officer of Luckin Coffee.

“During the third quarter, sales from freshly-brewed coffee drinks continued to maintain very strong growth, and we believe we will reach our goal to become the largest coffee player in China by the end of this year. With our distinguished value proposition of high quality, high affordability and high convenience we believe that Luckin Coffee has become part of more and more Chinese consumers’ daily lives. China’s coffee market remains highly underpenetrated so we are very excited about the growth potential ahead of us,” said Ms. Qian.

Ms. Qian added, “At the same time, we continued to enrich our product offerings during the quarter. We launched Luckin Tea products nationwide in July 2019 and experienced strong incremental demand during the quarter, contributing to an increase in per store revenue and higher customer retention rate. We also started selling cups and other merchandise products and entered into a joint venture agreement with Louis Dreyfus Company to produce and sell co-branded Not From Concentrate juice products.”

Ms. Qian continued, “We also strategically launched Luckin Tea as an independent brand and developed our new retail partnership model. In addition, we are engaged in ongoing discussions with potential strategic partners to set up joint ventures in markets outside of China. We consider these initiatives as an evolution of our current business model and are part of our strategy to serve more customers.”

“With our disruptive technology-driven new retail model and our newly-launched retail partnership model, we believe we can rapidly expand into adjacent markets with limited capital expenditures while maintaining a high degree of operational control and efficiency. We are pleased to have taken meaningful steps accomplishing our goals this quarter and remain extremely excited about the future of our business,” concluded Ms. Qian.

Third Quarter 2019 Unaudited Financial Results

Total net revenues were RMB1,541.6 million (US$215.7 million) in the third quarter, representing an increase of 540.2% from RMB240.8 million in the third quarter of 2018. Total net revenues from products were RMB1,493.2 million (US$208.9 million) in the third quarter, representing an increase of 557.6% from RMB227.1 million in the third quarter of 2018. Net revenues from products growth was primarily driven by a significant increase in the number of transacting customers, an increase in effective selling price, and an increase in the number of products sold per transacting customer.

- Net revenues from freshly brewed drinks were RMB1,145.4 million (US$160.2 million), representing 74.3% of total net revenues in the third quarter of 2019, compared to RMB192.7 million, or 80.0% of total net revenues, in the third quarter of 2018.

- Net revenues from other products were RMB347.8 million (US$48.7 million), representing 22.6% of total net revenues in the third quarter of 2019, compared to RMB34.4 million, or 14.3% of total net revenues, in the third quarter of 2018.

- Other revenues, which mainly include delivery fees, were RMB48.4 million (US$6.8 million), representing 3.1% of total net revenues in the third quarter of 2019, compared to RMB13.7 million, or 5.7% of total net revenues, in the third quarter of 2018.

Total operating expenses were RMB2,132.5 million (US$298.3 million), representing an increase of 193.6% from RMB726.4 million in the third quarter of 2018. The increase in operating expenses was the result of business expansion. Meanwhile, operating expenses as a percentage of net revenues decreased to 138.3% in the third quarter of 2019 from 301.7% in the third quarter of 2018, mainly driven by increased economies of scale and the Company’s technology-driven operations.

- Cost of materials were RMB721.1 million (US$100.9 million), representing an increase of 375.5% from RMB151.6 million in the third quarter of 2018, as a result of the increase in sales of products. Cost of materials decreased to 48.3% as a percentage of net revenues from products in the third quarter of 2019 from 66.8% in the third quarter of 2018.

- Store rental and other operating costs were RMB477.3 million (US$66.8 million), representing an increase of 176.6% from RMB172.5 million in the third quarter of 2018, mainly due to increases in the number of stores and headcount. Store rental and other operating costs decreased to 32.0% as a percentage of net revenues from products in the third quarter of 2019 from 76.0% in the third quarter of 2018.

- Depreciation expenses were RMB108.5 million (US$15.2 million), representing an increase of 275.8% from RMB28.9 million in the third quarter of 2018, mainly as the result of increases in depreciation of leasehold improvements and the increase in the purchases of equipment for operation due to the increased number of stores. Depreciation expenses decreased to 7.3% as a percentage of net revenues from products in the third quarter of 2019 from 12.7% in the third quarter of 2018.

- Sales and marketing expenses were RMB557.7 million (US$78.0 million), representing an increase of 147.6% from RMB225.3 million in the third quarter of 2018, mainly due to increases in advertising expenses as the Company launched new marketing initiatives, entered into new cities and launched Luckin Tea as an independent brand. The increase in sales and marketing expenses reflect strategic investments in branding which, management believes, will bring long-term benefits to the Company. All promotions and coupons provided to customers, other than free product promotion expenses, are reflected in net revenues from products and therefore not included in sales and marketing expenses. Sales and marketing expenses decreased to 36.2% as a percentage of net revenues in the third quarter of 2019 from 93.5% in the third quarter of 2018.

- General and administrative expenses were RMB246.1 million (US$34.4 million), representing an increase of 108.0% from RMB118.3 million in the third quarter of 2018. The increase in general and administrative expenses was mainly driven by business expansion and share-based compensation to senior management. General and administrative expenses decreased to 16.0% as a percentage of net revenues in the third quarter of 2019 from 49.1% in the third quarter of 2018.

- Store preopening and other expenses were RMB21.8 million (US$3.0 million), representing a decrease of 26.9% from RMB29.8 million in the third quarter of 2018, mainly due to decreased rental costs before opening as a result of improved efficiency for new store openings. Store preopening and other expenses decreased to 1.4% as a percentage of net revenues in the third quarter of 2019 from 12.4% in the third quarter of 2018.

Operating loss was RMB590.9 million (US$82.7 million) compared to RMB485.6 million in the third quarter of 2018. Non-GAAP operating loss was RMB550.1 million (US$77.0 million), representing 35.7% of total net revenues, in the third quarter of 2019, compared to RMB485.6 million, or 201.7% of total net revenues, in the third quarter of 2018. For more information on non-GAAP financial measures, please see the section of “Use of Non-GAAP Financial Measures” and the table captioned “Reconciliation of Non-GAAP Measures to the Most Directly Comparable GAAP Measures” set forth at the end of this press release.

Net loss was RMB531.9 million (US$74.4 million) compared to RMB484.9 million in the third quarter of 2018. Non-GAAP net loss was RMB491.1 million (US$68.7 million), representing 31.9% of total net revenues, in the third quarter of 2019, compared to RMB483.9 million, or 201.0% of total net revenues, in the third quarter of 2018.

Basic and diluted net loss per ADS was RMB2.24 (US$0.32) compared to a loss of RMB3.60 in the third quarter of 2018. Non-GAAP basic and diluted net loss per ADS was RMB2.08 (US$0.32) compared to a loss of RMB3.52 in the third quarter of 2018.

Net cash used in operating activities was RMB122.8 million (US$17.2 million) compared to RMB719.6 million in the third quarter of 2018. The decrease was primarily driven by a reduction of operating loss and a favorable working capital profile.

Cash and cash equivalents and short-term investments were RMB5,543.9 million (US$775.6 million) as of September 30, 2019, compared to RMB1,761.0 million as of December 31, 2018. The increase was primarily driven by the net proceeds of US$158.8 million from the issuance of Series B-1 convertible redeemable preferred shares in April 2019 to certain investors and the net proceeds of US$657.2 million from the IPO and the concurrent private placement.

Key Operating Data