VILLORBA, Treviso, Italy – The Board of Directors of Massimo Zanetti Beverage Group S.p.A. (“MZBG” or the “Company”) approved on November 10th, 2016 the interim report at September 30, 2016.

As announced last August, the Group had to face up to a challenging second half of the year, following the effect linked to recent increases of green coffee prices.

Taken into consideration also Nutricafés acquisition and its positive impact starting from September 1st 2016, the Group has provided an updated outlook for the Full Year 2016.

- Volumes up between 2% -4%

- Gross profit up between 4% -6%

- Adjusted EBITDA up between 4% -6%

- Net financial Indebtedness below Euro 225M

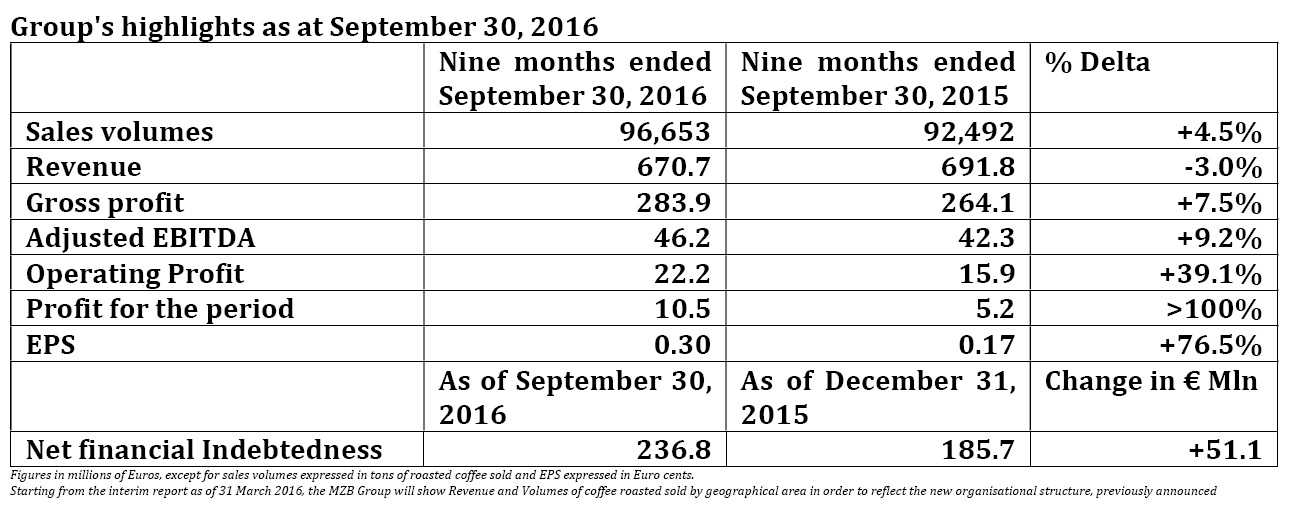

Below Group’s highlights as at September 30, 2016

- Roasted coffee sales volumes grew +4.5% to 96,653 tons in the first 9 months .

- Consolidated turnover of Euro 670.7 million, slightly down (-3.0%) compared to the same period of the previous year.

- Consolidated Gross profit up +7.5% to Euro 283.9 million .

- Consolidated Adjusted EBITDA up +9.2%, to Euro 46.2 million .

- Consolidated Operating profit amounted to Euro 22.2 million, up 39.1% .

- Profit for the period totalling to Euro 10.5 million .

- Net financial indebtedness was Euro 236.8 million, up by Euro 51.1 million compared to December 31, 2015.

Volumes

Volumes

During the first nine months of 2016, MZB Group roasted coffee sales volumes increased 4.5% versus the same period of the last year, totalling 96,653 tons.

The increase occurred across all the MZB Group’s distribution channels. Excluding Nutricafés impact, the sales volumes of roasted coffee rose by 4.1%.

In the first nine months of the year the Mass Market channel grew +4.5%, coming to 39,902 tons, mainly driven by the sustained double digit growth in Northern Europe, led by Finland, the Netherlands, Germany and Poland, as well as by growth in Southern Europe.

Excluding the impact of Nutricafés, the Mass Market channel has grown by 4.3%. The Mass Market channel accounted for 41.3% of the Group’s total volumes. The Food Service channel rose 5.6% to 8,188 tons. The increase was spread homogeneously across all geographical areas.

Excluding the impact of Nutricafés, the Food service has grown by 4.0%. The Food

Service channel accounted 8.5% of the Group’s total volumes.

In the Private Label channel, growth was +4.3% coming to 48,563 tons, thanks to the good results achieved in the Americas, mainly in the USA and in Southern Europe region. Excluding Nutricafés impact, the Private Label segment has grown by 4.0%.

This segment accounted for 50.2% of the Group’s total volumes.

The Single Serve channel grew by 19% in the first nine months of the year, thanks to the positive performance in the Americas, which recorded a 30% growth compared to the same period of the previous year, mainly driven by Segafredo, Hills Bros, Chock full o’Nuts and KAUAI brands. as result of advertising campaigns.

Hill Bros, Kauai and Chock Full O’Nuts brand launched the first capsule 100% compostable thanks to the investment in the Club Coffee technology. Positive performance was also recorded in Southern Europe, which grew by 13.7% on the same period of 2015, also thanks to the acquisition of Nutricafés.

At geographical level, the Americas reached to 59,740 tons in the first nine months of 2016, with a 2.4% growth versus the same period of the previous year.

The greater growth was driven by the Private Label channel, which is the most important one in terms of volumes. Food service recorded a doubledigit growth, mainly led by the global brand Segafredo and by Chock Full O’Nuts and Kauai brands.

The capsules channel grew by 30%. The Americas account for 62% of the Group’s total volumes.

The volumes of Southern Europe totalled 20,038 tons in the first nine months increase of +4.5% involving all distribution channels. Nutricafés has had a positive contributing with 350 tons of Roasted coffee sales volumes. Excluding this impact, Southern Europe rose by 2.6%.

Southern Europe rose across all distribution channels. With reference of this region, on September 16, 2016, the MZB Group finalised the Nutricafés acquisition announced last July 12. The consolidation of Nutricafés took place from September 1, 2016.

The Single Serve segment grew by 14% in the first nine months of 2016 versus the same period of the last year. This growth was positively impacted by the brands Cafè Nicola and Chave d’Ouro.

Southern Europe accounts for 21% of the MZB’s Group total volumes.

Strong growth in Northern Europe where in the first nine months of 2016 volumes grew 13.8% compared to the same period of the previous year, totalling 15,318 tons, mainly driven by the doubledigit growth in the Mass Market channel.

In Finland, Kulta Katriina leads the growth thanks to the relaunch of the brand with new variants and packaging, while in the Netherlands, growth continues following agreements with top customers and promotional activities.

The Private Label, continues to grow despite its small size, as well as Food Service channel. Northern Europe confirms to be the third contributor in terms of volumes, accounting for about 16% of the total.

Roasted coffee sales volumes in the Asia, Pacific and Cafè region came to 1,557 tons in the first nine months of 2016, up 2.6% versus the previous period, with a marked improvement in performance from the previous first half year.

Boncafè confirmed its positive trend with a volume growth of 7%.

Consolidated revenue

The MZB Group consolidated revenue of the first nine months of 2016 totalled Euro 670.7 million, down from the same period of 2015 (3.0%).

The increase in volumes described above has been impacted by the decrease in the average selling prices of roasted coffee, following the decrease of average purchase price of green coffee.

Excluding the contribution of Nutricafés, revenue came to Euro 667.7 million, down 3.5% versus the same period of the previous year.

With respect to distribution channels, the Mass Market contribution to consolidated revenue was 37.4%, Private Label 35.2% and Food Service 21.2% while the Other Products accounted for the remaining 6.2%.

The Americas remain the main geographical area in terms of revenue, accounting for 49% of turnover with the USA confirming their position as the MZB Group’s main market. Southern Europe is the Group’s second geographical area, accounting for 24% with France main market.

Northern Europe accounts for 19% of the Group’s revenues, led by Finland, while Asia, Pacific and Cafes* account for 8%.

Gross profit

Consolidated Gross Profit grew 7.5% in the first nine months of 2016 to Euro 283.9 million versus the same period of last year thanks to Nutricafés contribution of Euro 1.8 million.

Excluding this impact, the gross profit of the period was up by 6.8%.

The trend of Gross Profit was positively impacted by the higher sales volumes and favourable dynamics of the sales and purchase prices of roasted and green coffee, with an improvement of the margin per kg of Euro/kg 2.53 at the current exchange rate.

The Gross Margin was 42.3% versus 38.2% recorded in the first nine months of 2015.

Adjusted EBITDA

Adjusted EBITDA for the period was Euro 46.2 million, up 9.2% on the same period of last year, when it stood at Euro 42.3 million. Excluding Nutricafés contribution of Euro 0,7 million, EBITDA Adjusted rose by 7.6%.

This positive result is mainly attributable to the combined effect of increase in Gross Profit of Euro 18.1 million partially offset by higher operating costs totalling Euro 14.9 million.

These costs are related to the investments in marketing and advertising and to strengthening of the Group’s organisational structure both in terms of resources and systems; moreover costs have also been impacted by the differences in timing allocation of certain variable cost components compared with 2015.

Adj EBITDA Margin came to 6.9% versus 6.1% recorded in the first nine months of 2015.

Operating Profit

Operating profit for the first nine months of 2016 was Euro 22.2 million, up Euro 6.2 million versus the same period of 2015.

This increase is mainly attributable, on top of the factors reported above with regards Adjusted EBITDA, by the non-recurring costs related to the listing incurred in the same period of 2015, amounting to Euro 2.9 million.

Profit for the period

Profit for the period for the first nine months of 2016 amounts to Euro 10.5 million, up versus the same period of 2015 (Euro 5.3 million).

In addition to the factors mentioned above with regard to operating profit, this increase was mainly driven by the combined effect of the reduction in net finance expenses, amounting to Euro 2,620 thousand, mainly thanks to lower Net Financial Indebtedness recorded over most of the first nine months of 2016 compared with 2015 and of the increase in income tax, amounting to Euro 3,545 thousand, mainly linked to the greater taxable income generated by the Group in the first nine months of 2016 compared with the same period of 2015.

Earnings per share increased from Euro cent 0.17 per share to Euro cent 0.30 per share.

Net financial indebtedness – Debt restructuring launched

Net financial indebtedness at September 30, 2016 was Euro 236.8 million, up by Euro 51.1 million from December 31, 2015.

This increase is mainly attributable to the acquisition of Nutricafés partially offset by the positive trend of the Free Cash Flow of Euro 44.8 million, mainly linked to improvement inthe change in working capital.

Starting from the third quarter, Group started a process for the restructuring of its non-current financialindebtedness, in order to extend repayment plans and optimise the cost of debt.

This was done by signing new long-term financing agreements at better conditions than those of some previous ones, for which a gradual early repayment has been scheduled. This process will be completed in the early months of 2017.

Guidance Update

On the basis of the results achieved in the first nine months of 2016 and in consideration of a challenge in the last quarter and Nutricafés positive impact, the Group has provided an update of the outlook for the full year 2016:

- Volumes up between 2% -4%

- Gross profit up between 4% -6%

- Adjusted EBITDA up between 4% -6%

- Net financial Indebtedness below Euro 225M

In terms of volumes growth, excluding Nutricafés, sales volume of roasted coffee has been negativelyaffected by loss of a major customer in the Private Label channel in America. Excluding Nutricafés impact, volumes would have been within a range of +1.0% to +2.0%.

With respect of Gross Profit within the same perimeter, the fourth quarter is expected to be lower compared to the figure recorded in the first three quarters of the year and in the same period of 2015, mainly because of the increase in the green coffee purchase price, which is expected to have its impact in the last part of the year.

Following the increase in raw material price, a revision of price lists has been launched and it has been immediately applied in the Private Label channel, while in both Mass Market and Food Service channels it will be implemented in the first part of 2017.

As a consequence of the combined effect of reduced sales volumes and the rising price of the raw material, without Nutricafés acquisition, Gross Profit by year end would have been expected to be in the range between +2.0% and +4.0%.

EBITDA Adj reflects the dynamics that have impacted volumes and gross profit. Without Nutricafés acquisition, EBITDA growth would have been expected in the range between +1.0% and +2.0%.

Excluding the impact of Nutricafés acquisition, Net financial indebtedness would have been less that Euro 170 million, in line with the previous guidance provided to the market.

********************

The Group’s first nine months of 2016 results will be presented during the conference call to be held today, Thursday, November 10, at 18:30 CET.

To access the call, please use one of the following dial-in numbers: +1 718 7058794 (U.S. e Canada), +39 02 805 88 11 (Italy), +44 1 212818003 (UK) e +33 170918703 (France).

Digital Playback service will be available for 7 days, dialing the following numbers: +1 718 705 8797 (Usa e Canada), +39 02 72495 (Italy), +44 1 212 818 005 (UK) with the following passcode: 902#

The presentation will be available on the corporate website (www.mzb-group.com) and on the storage system (www.emarketstorage.com).

*********************

The Manager in charge of the Company’s financial reports, Massimo Zuffi, pursuant to paragraph 2 of Article 154-bis of Italy’s Consolidated Law on Finance (TUF), declares that the accounting information contained in this press release corresponds to the documented results, books and accounting records.

*This geographic area includes the revenue generated by the international network of cafés.